There’s no mystery why the housing sector is stumbling. Surging mortgage rates are taking a toll: a 30-year fixed rate, for example, is close to 7%, a 20-year high. The question is whether this key slice of the US economy will overwhelm the positive support from a so-far resilient labor market and strong consumer spending?

It’s widely recognized that residential real estate is a crucial factor in the ebb and flow of economic activity. As the Congressional Research Service noted recently, “housing accounts for a significant portion of all economic activity, and changes in the housing market can have broader effects on the economy.”

A widely read research paper a number of years ago went so far as to claim that “Housing IS the Business Cycle.” , explaining: “Of the components of GDP, residential investment offers by far the best early warning sign of an oncoming recession.”

That’s a worrisome point in the current climate. The Bureau of Economic Analysis reports in its quarterly GDP numbers that gross private domestic residential investment has fallen in each of the five quarters through this year’s Q2, accelerating to a sharp 17.8% decline during the April-through-June period.

More recently, the Federal Reserve’s ongoing hikes in interest rates are taking a toll on housing demand. Notably, new applications for mortgages last week fell to a 25-year low. “Mortgage applications are now into their fourth month of declines, dropping to the lowest level since 1997,” says Joel Kan, vice president and deputy chief economist at Mortgage Bankers Association. “The speed and level to which rates have climbed this year have greatly reduced refinance activity and exacerbated existing affordability challenges in the purchase market.”

The headwinds are taking a bite in the demand for purchases, reports Redfin. US home sales fell 25% in September, the real estate firm’s data shows. That’s the biggest drop on record other than the collapse during the pandemic.

“The U.S. housing market is at another standstill, but the driving forces are completely different from those that triggered the standstill at the start of the pandemic,” says Redfin Economics Research Lead Chen Zhao. “This time, demand is slumping due to surging mortgage rates, but prices are being propped up by inflation and a drop in the number of people putting their homes up for sale. Many Americans are staying put because they already relocated and scored a rock-bottom mortgage rate during the pandemic, so they have little incentive to move today.”

He adds: “The housing market is going to get worse before it gets better. With inflation still rampant, the Federal Reserve will likely continue hiking interest rates. That means we may not see high mortgage rates—the primary killer of housing demand—decline until early to mid-2023.”

Warning signs of trouble are emerging from other housing market indicators, including the deeply negative sentiment among homebuilders. “Builder sentiment fell for the 10th straight month in October and traffic of prospective buyers fell to its lowest level since 2012 (excluding the two-month period in the spring of 2020 at the beginning of the pandemic),” reports the National Association of Homebuilders.

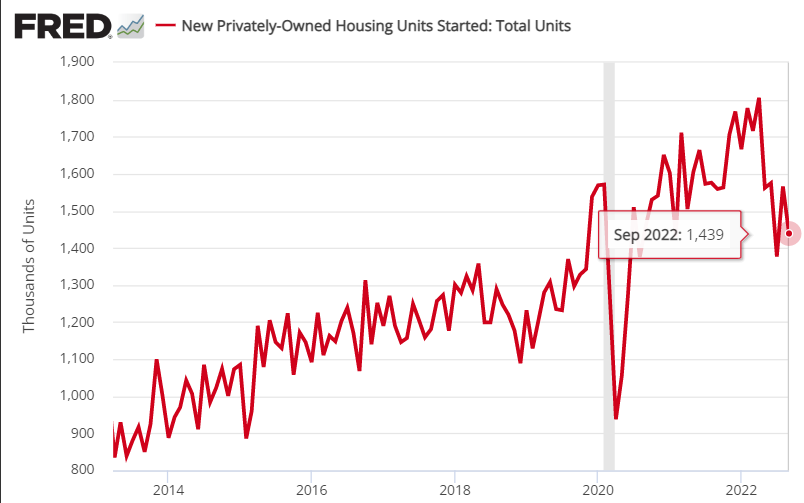

Not surprisingly, housing construction has peaked and is now trending down. US housing starts fell more than expected in September, dropping close to a level that’s near the low since the recovery from the pandemic started.

Optimists counter that the consumer spending and a robust labor market are keeping the economic expansion humming. That’s certainly been true so far. But as I noted on Oct. 5, economic activity looks set to turn mildly negative in November, based on analytics published in The US Business Cycle Risk Report.

In the edition sent to subscribers on Oct. 2 I advised that the Economic Trend Index (ETI) and Economic Momentum Index (EMI), a pair of multi-factor benchmarks tracking US economic activity, slipped below their respective tipping points that indicate contraction for estimates through November. If correct, the decline will mark the start of a new NBER-defined recession.

In this week’s update of the newsletter (published Oct. 16) I noted that the recession call for November remains intact for a third straight week. The weak housing market isn’t helping. Incoming numbers for real estate activity are arguably the critical factor for determining the near-term outlook for the economy. Unfortunately, the trend on this front remains negative.

“The downturn in housing starts has much further to run,” advises Ian Shepherdson, chief economist at Pantheon Macroeconomics.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report