The day after the Federal Reserve lifted interest rates, the benchmark 10-year Treasury vaulted to a new two-year-plus high of 2.60% on Thursday (Dec. 15), based on daily data from Treasury.gov. The latest surge widens the gap between the current yield and the record low of 1.37% that was touched just five months earlier, on July 8.

Yesterday’s economic data provided support for selling bonds (and thereby raising yields). The preliminary estimate for IHS Markit’s US Manufacturing PMI ticked up to a 21-month high for December. “US manufacturing is enjoying a strong end to 2016, showing further signs of pulling out of the soft-patch seen earlier in the year and putting the sector on the starting blocks ready for a further upturn as we move into 2017,” the group’s chief business economist, Chris Williamson, said in a release.

Regional manufacturing indexes via the New York and Philadelphia Fed banks also increased in December, signaling a firmer trend for the sector in the final month of the year.

Meantime, jobless claims fell last week, sticking close to a multi-decade low, as sentiment in the home building industry surged in the December reading to an 11-year high. “This notable rise in builder sentiment is largely attributable to a post-election bounce, as builders are hopeful that President-elect Trump will follow through on his pledge to cut burdensome regulations that are harming small businesses and housing affordability,” said Ed Brady, chairman of the National Association of Home Builders.

But with much of the revival in optimism linked closely to expectations for policy decisions by the incoming Trump administration, there’s political risk to consider. As Yuval Rosenberg at the Fiscal Times reminds:

So much depends on the Trump stimulus. If Congress passes major tax cuts early in 2017, the stimulus could be considerable and drive economic growth higher. If the stimulus comes in smaller than expected or gets hung up for political reasons, we’ll probably find ourselves about where we are now: in a not too hot, not too cold economy that’s just puttering along.

Meantime, the economic outlook has brightened, although this week’s data has been mixed. In contrast to yesterday’s upbeat releases, Wednesday’s data for industrial production and retail sales in November were surprisingly soft, although the year-over-year trend in both cases continues to look encouraging.

Although recent data continues to reflect low recession risk, estimates for fourth-quarter GDP growth point to a slowdown in growth after Q3’s 3.2% advance, the strongest increase in output in two years. By contrast, the Atlanta Fed’s Dec. 14 nowcast points to softer Q4 growth of 2.4%.

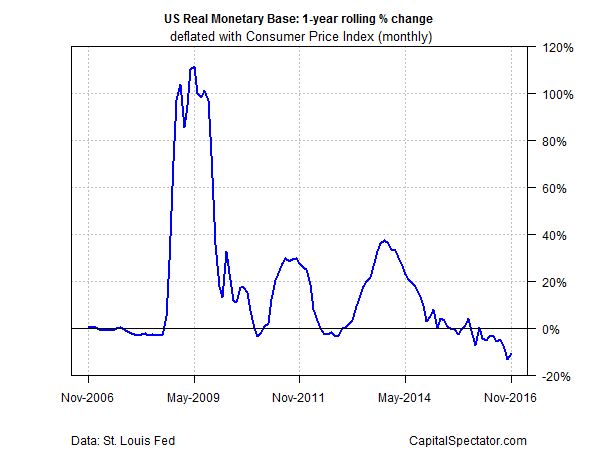

Nonetheless, the Fed is forging ahead with tightening monetary policy, by lifting its target rate and squeezing the money supply. Indeed, real (inflation-adjusted) M0 (also known as the monetary base and high-powered money) continued to contract last month, sliding 10.9% in November vs. the year-earlier level. The decline marks the ninth straight month of red ink.

Rising interest rates and a contracting trend in the money supply may not be a headwind for the economy if growth is picking up. Politically motivated projections certainly paint a bright picture on this front, supported, to a degree, by recent economic releases. But the jury’s still out for deciding if the hype will be matched with hard data.

“We can’t recall a time when a change in leadership in Washington had the potential for such large and diverging effects on the US economy,” analysts at Bank of America Merrill Lynch analysts observed in a recent note to clients.

Pingback: Quiet Pre-Holiday Period - TradingGods.net