It’s the number-one economic question these days, but the answer will remain elusive for several weeks at least, perhaps several months. What we do know is that output has slowed recently and appears to be dipping further. Determining when, exactly, the economy begins to contract can only be known with certainty in hindsight. For now, it’s clear that the risk of a new downturn has increased, but the slow-growth scenario remains the likely path until further notice. What might push the trend over to the dark side? Let’s consider a short list of indicators for perspective.

Employment: Today’s September update on US payrolls could be a decisive factor in adjusting the outlook for the economy, for good or ill. Using Econoday.com’s consensus point forecast as a guide suggests the odds are low that we’ll find a smoking gun in today’s release. Economists are looking for a moderately stronger gain in private payrolls: 135,000, up from a weak 96,000 rise in August. Translating the projected monthly increase to a year-over-year trend implies that the moderate 1.6% annual pace in August will hold steady in September. In that case, today’s results will offer support for thinking that the labor market’s recent slowdown may be stabilizing. By contrast, a hefty downside surprise in today’s update will raise more doubts about the economy’s near-term capacity for sidestepping recession.

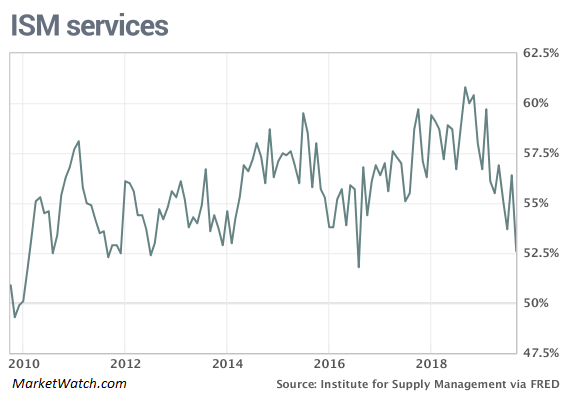

Services Sector: Yesterday’s September update of the ISM Non-Manufacturing Index was considerably softer than expected. Although this survey based measure of business activity continued to indicate modest growth, the dip to 52.6 marks a three-year low and is close to the neutral 50 mark that separates growth from contraction. Because the US economy is dominated by the services sector, this indicator is a critical measure of the macro trend. It’s obvious that slow growth generally is now baked into the near-term outlook. If this benchmark slips further in next month’s update, the recession-alarm bells will ring louder.

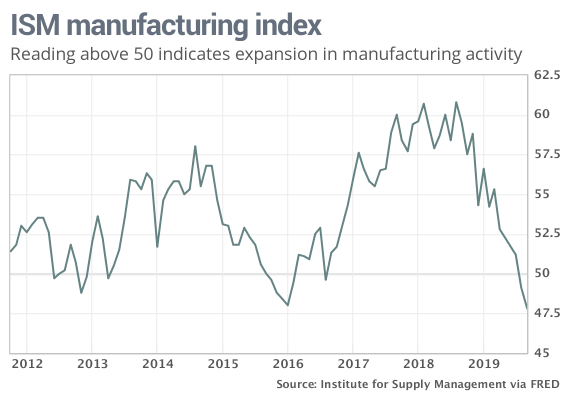

Manufacturing: In contrast with the modest growth for the services sector, manufacturing is already contracting, according to the ISM Manufacturing Index for September. As MarketWatch.com reported earlier this week:

American manufacturers posted the biggest contraction in September since the end of the 2007-2009 recession, reflecting a slowdown in the U.S. and global economies made worse by a tense trade war with China.

The Institute for Supply Management said its manufacturing index fell to 47.8% last month from 49.1%, marking the lowest level since June 2009.

The good news: manufacturing is a relatively small share of the US economy and so a recession in this corner doesn’t guarantee that the broader trend will contract. To be sure, manufacturing’s weakness is a risk factor and to the extent that this slice of the economy is contracting it raises the potential for trouble generally. Nonetheless, it’s worthwhile to remember that the ISM Manufacturing Index fell into negative terrain in 2015-2016 without triggering a broader US recession, although the slide did contribute to softer growth overall. In any case, it’s fair to say that when manufacturing activity is weak, the potential for blowback is higher for the wider economy.

Consumer Spending: The single biggest input for US economic activity by far is personal consumption expenditures and so the trend on this front is, in some respects, fate for the business cycle. Accordingly, the August data suggests that the headwinds are strengthening. Notably, the one-year trend continued to ease, slipping to a 3.7% gain. That’s still enough to keep the economy moving forward, but the downward bias of late is worrisome. If the September trend falls further, recession risk will increase.

For now, the numbers published to date continue to support the case for expecting slow growth rather than recession, as outlined here in late-September, for instance. Business-cycle analysis is never easy, at least in real time. In fact, it’s a lot tougher these days generally, largely because political risk is unusually high, raising uncertainty above and beyond the “normal” degree of fog that inhabits nowcasting and forecasting challenges.

Is Recession Risk Rising? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Caveats aside, using published figures in hand suggests that the immediate outlook will likely bring more of the same: slow growth. The Atlanta Fed’s GDPNow model, for instance, is currently nowcasting that the upcoming third-quarter GDP report (due on Oct. 30) will show that output edged down to a 1.8% gain (Oct. 1 estimate) — slightly below Q2’s 2.0% increase. That’s a sluggish pace, but it’s enough to keep the US out of NBER-defined recession territory.

What’s beyond debate is that the economy has run out of road for another leg down in growth. We are, in short, at a critical juncture. The current state of affairs raises many questions, including: What, if anything, can monetary policy do to keep the expansion alive? Will the Trump administration soften its growth-killing trade-war policy?

The answers, as always, arrive one headline at a time, starting with the jobs report due later this morning.

“The economy is slowing, but it is not in recession and there is no reason to believe it will go into the red this year,” advises Joel Naroff, chief economist at Naroff Economic Advisors. “The jobs report will likely confirm that situation as moderate job growth is expected.”

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Pingback: Risk of a New Downturn Has Increased - TradingGods.net

Pingback: Weighing the Week Ahead: Investment Effects of the Changing Political Landscape | Dash of Insight

Pingback: JOLTS and Inflation Data Reports Coming Out This Week - TradingGods.net