In mid-September, the bond market looked set to coast to a second year of recovery after a bruising run of back-to-back losses in 2021 and 2023. Since then, the market has lost altitude. Although a modest year-to-date gain is holding for the moment, the headwinds may be strengthening for fixed-income securities as the market grapples with a changing outlook for inflation.

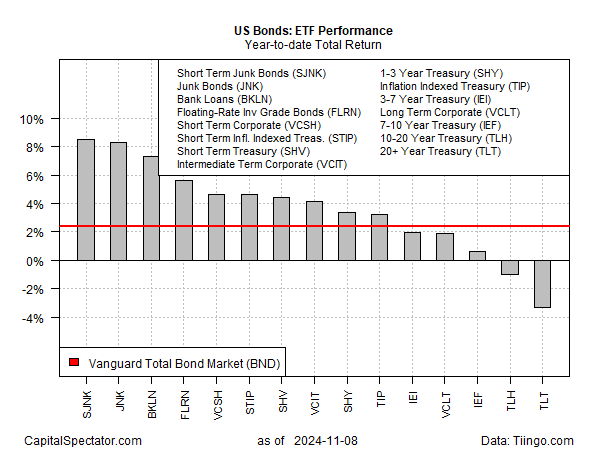

As of Friday’s close (Nov. 8), most of the primary bond market sectors are posting gains for 2024, based on a set of ETFs. Junk bonds are leading the way with 8%-plus total returns. The investment-grade benchmark (BND), however, is up a modest 2.4%, or roughly half the year-to-date gain as of mid-September.

The source of the bond market’s renewed discomfort: reflation risk. The macro cocktail that’s shaken the outlook is a mix of positive economic results and concerns that Donald Trump’s election victory will strengthen inflation. The catalysts for this attitude adjustment centers on the uncertainty surrounding how and when Trump will pursue his campaign pledges — tariffs, tax cuts and promises to deport millions of immigrant workers. This trio of policy changes will almost certainly strengthen pricing pressure. How much and how long depends on how deep and how far a Trump administration pursues his policy platform.

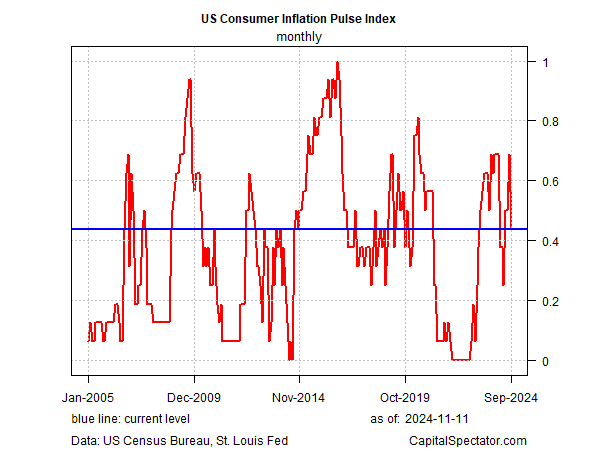

To be fair, the disinflation trend had been fading well before the election, according to CapitalSpectator.com’s US Consumer Inflation Pulse Index. This benchmark of short-term inflation momentum (higher values = stronger inflation pressure), based on analytics of the 32 components of the consumer price index, rebounded sharply during the May-through-August period before pulling back in September.

Deciding what’s in store is especially tricky at the moment because details are still evolving on what could be a radical change in US economic policy starting in 2025 and beyond. As a result, the bond market is demanding a higher risk premium. The 10-year Treasury yield has risen 70 basis points to 4.31% through Friday’s close. That’s still a middling level relative to this year’s range, but the crowd is clearly anxious about what could be brewing for 2025 and so it’s not obvious the rebound in yields has peaked.

This week’s consumer inflation data for October will be closer read for updating the outlook. According to the consensus forecast, the 1-year trend for headline CPI will edge up to 2.6% from 2.4% in September while core CPI will hold steady at a 3.3% pace. In both cases, the Fed’s 2% inflation target remains elusive.

The main event, of course, is how inflation fares once the Trump administration’s policies take effect, which implies lots of uncertainty until we’re deep into 2025.

Meanwhile, the bond market will struggle in pricing in a renewed run of reflation uncertainty.

“We don’t just look for a very shortlived overshoot on inflation [due to Trump’s policies], this could be more structural and protracted,” says Mark Dowding, chief investment officer at RBC BlueBay Asset Management.