The selling that roiled global markets late last week looks set to continue on Monday. Triggered by weaker-than-expected news for the US labor market, the surge in risk-off sentiment took a bite out of the high-flying market for American shares. But even after last week’s hit, US equities are still leading the major asset classes by a wide margin. In the current climate, however, that premium suggests US shares are still vulnerable to a period of “normalizing” performance comparisons.

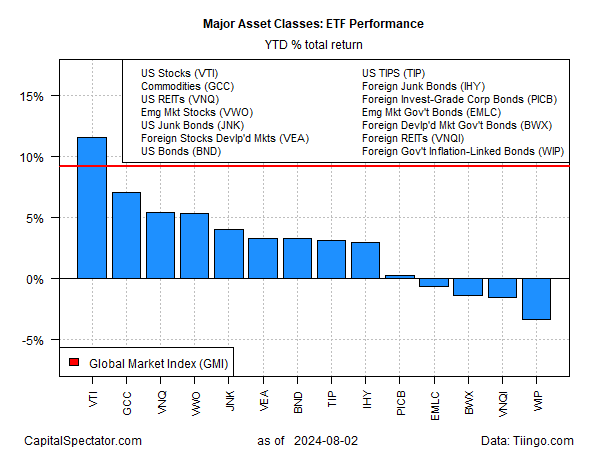

As of Friday’s close (Aug. 2), US stocks were still far and away the global leader, based on a set of ETF proxies. Vanguard Total US Stock Market ETF (VTI) was up 11.6% in 2024. Although that’s well below the year-to-date rise posted just days or weeks earlier, the advance continues to reflect a sizable premium over the rest of the field.

The gap between US stocks and other asset classes, however, is closing. As recently as early July, for example, US shares were outperforming US bonds (BND) by roughly 18 percentage points year to date. As of Friday, the hefty gap has narrowed sharply to around 8 percentage points.

The closing spread is a byproduct of sliding equity prices and surging bonds. The US 10-year Treasury yield fell dramatically last week, closing on Friday at 3.79%, the lowest since December, which accompanied a dramatic rise in fixed-income prices.

The shift in market sentiment now sees larger interest rate cuts as a near certainty. Fed funds futures this morning are pricing in a 99.5% probability of a 50 basis point cut for the Sep. 18 FOMC meeting.

The unusually wide premium in US stocks vs. US bonds in recent years was always susceptible to normalizing, but for a variety of reasons a high premium persisted. The question is whether we’re looking at a new period of market rebalancing? No one knows for sure, but looking at history offers some perspective for managing expectations.

For example, VTI’s trailing 15-year annualized total return is currently 13.8% vs. 2.6% for BND – an 11-percentage point premium. That compares with with a lesser 8 percentage point premium as of Friday. Could it go lower? Yes, of course.

The challenge for looking beyond the near term is estimating the “fair value” of the equity risk premium vs. bonds for the long run, a process that provides context for managing asset allocation. There are many estimates, some that are all over the map, depending on the model and time horizon. By some accounts a “normal” risk premium is somewhere in the 3%-8% range, although debates rage about exact numbers. The current estimate via a particular flavor of modeling highlighted on CapitalSpectator.com each month is 5%-plus.

The risk premium has looked excessive in recent years. Meanwhile, Mr. Market, it seems, never gets it exactly right in real time, leaving wide swings as the only constant through time. That implies that the unsustainably high risk premium of recent vintage may give way to its counterpart.

In future posts I’ll review how various estimates for the risk premium have evolved through time. History is an imperfect guide to the future on such matters, although it beats a kick in the head.