Public statements by Federal Reserve officials in recent days remains unified in forecasting that the recent deceleration in a key measure of core inflation is “transitory.” The first reality check on that outlook via hard data is scheduled for this Friday’s April report for the Consumer Price Index (CPI).

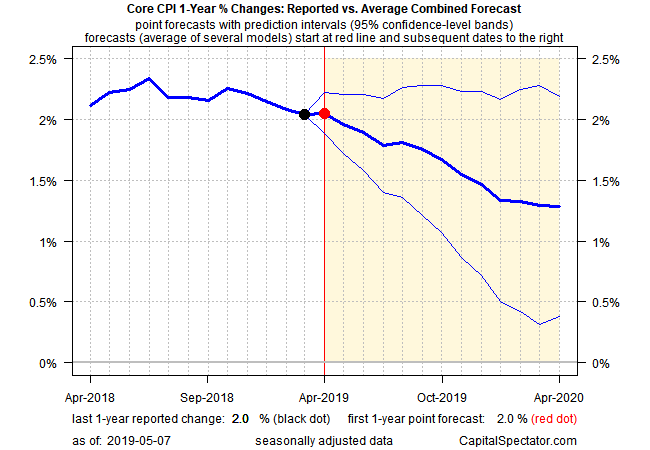

Economists are expecting that core reading of pricing pressure (CPI less the volatile food and energy components) will tick up to a 2.1% annual pace, based on Econoday.com’s consensus forecast. The Capital Spectator’s average point forecast via a combination-forecasting model is a touch lower at 2.0% for the annual pace through April, but both estimates reflect a low probability that disinflation will dominate this Friday’s CPI update.

The inflation profile looked quite different in last week’s core reading for inflation for March via the Personal Consumption Expenditures price index (PCE), which reportedly is the Fed’s preferred inflation metric. By this measure, the pricing trend appears to be weakening. Core PCE inflation slipped to an annual 1.6% increase, the softest rise since Sep. 2017 and moderately below the Fed’s 2.0% inflation target. If core PCE (along with other inflation metrics) slip further, the downshift would be widely seen as a warning sign on the outlook for economic growth.

The central bank, however, isn’t worried, or so we’ve been told. Fed Chairman Jerome Powell recently described the deceleration in core inflation as temporary. “We suspect transitory factors may be at work,” he said at the FOMC meeting on May 1. “If we did see inflation running persistently below, that is something the committee would be concerned about and something we would take into account when setting policy.”

Patrick Harker, president of the Federal Reserve Bank of Philadelphia, on Monday reaffirmed the central bank’s view that inflation may be “transitory.”

This Friday’s CPI data appears on track to provide fresh support for thinking that a worrisome round of persistent disinflation is unlikely in the near term. The CPI and PCE inflation series reflect different methodologies, but a relatively stable update in pricing pressure for this Friday’s release will provide a degree of comfort for the Fed and suggest that the next PCE update will show that inflation is stabilizing.

Nonetheless, the market will be watching closely and a downside surprise in CPI would likely raise expectations that the Fed will be forced to cut interest rates later in the year. At the moment, Fed funds futures are pricing in a low, gradually rising probability of a rate cut. Note, however, that the probability for a cut doesn’t rise above 50% until the December meeting, based on CME data.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Meantime, the Treasury market’s implied inflation forecast is holding steady after rebounding this year following a late-2018 slide. Although this measure of inflation expectations is volatile and subject to all the usual caveats that come with market-based estimates, it’s mildly encouraging to see a degree of stability in this data. For example, the yield spread between the 5-year nominal Note and its inflation-indexed counterpart (black line in chart below) has been trading around the 1.8% mark lately.

Despite the focus on softer inflation, veteran Fed watcher Tim Duy (a professor at Oregon University) thinks the central bank may have laid a dove trap – a scenario when the Fed errs on the side of lower rates and monetary stimulus only to be forced to raise rates later on.

Inflation “below 2% is by definition transitory. Any outcome at or above 2% is by definition persistent. This probably remains the case as long as the unemployment rate hovers at levels the Fed believes is consistent with above-full employment,” Duy wrote last week. “It’s exactly the dove trap that I began warning about in recent weeks. It just sprung sooner than I anticipated.”

Maybe, but Friday’s CPI report isn’t expected to play along with that forecast. Even so, a key question will linger: Is the weaker core PCE reading a more realistic profile of inflation vs. CPI? Answering that question will take several more weeks, when the April numbers on personal income and spending report are published at the end of this month.

Is Recession Risk Rising? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

James. A technical point. The FOMC’s inflation target is headline inflation PCE not core PCE. This is stated in the 2012 Jan 24 statement onpolicy and goals.

Dr. Robert A Eisenbeis

Cumberland Adviors and former director of research FRB Atlanta

Pingback: Will the Feds Outlook Be Supported Friday's Inflation Report - TradingGods.net

Robert,

Yes, that is correct. Thank you for reminding readers. Nonetheless, quite a bit of academic research (and the empirical record) advise that core inflation metrics offer a better measure of the inflationary trend and arguably a superior estimate of where inflation is headed vs headline data. On that basis, it’s reasonable to consider how core inflation compares with the Fed’s target, even though the Fed is formally targeting headline inflation.

–JP