The Federal Reserve is expected to formally announce the end of QE3 in tomorrow’s FOMC monetary statement. But as quantitative easing (buying assets with newly printed money) fades into the sunset, the trend in inflation expectations is moving in the wrong direction: down.

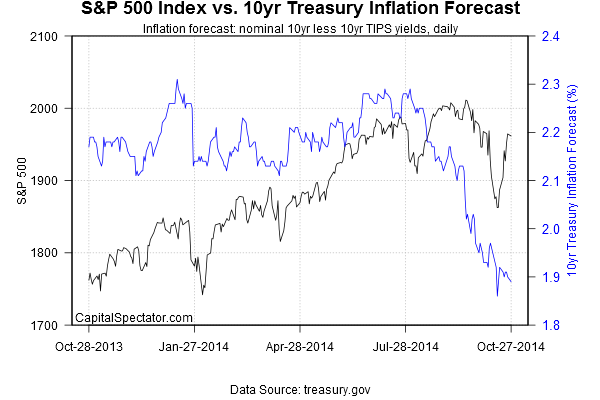

One of the goals of QE is to stabilize inflation, and until recently that objective was successful. For the past year through last month, the Treasury market’s implied inflation forecast—10-year Treasury yield less its inflation-indexed counterpart—remained in the low-2% range, or just slightly above the Fed’s target. Consumer price inflation has been a bit softer lately, but more or less holding steady around the 2% mark in recent months via the annual pace. But the game changed in October, as reflected in a surge in market volatility, which was triggered by renewed fears of deflation and recession in Europe. The blowback for the US has been minimal, at least so far. But the global appetite for safety has soared in recent weeks, driving Treasury yields lower. As a result, the Treasury market’s 10-year inflation outlook has slumped, falling below 1.90% yesterday (Oct. 27) for the first time since late-2011.

The slide is a bit of a conundrum for the US since the economy continues to post moderate growth. If the Treasury market was pricing future inflation based solely on the US macro trend, the prediction would almost surely be higher—probably in the low-2% range. But Treasuries are priced in the world’s reserve currency and so yields aren’t solely a function of local economic conditions, or so it seems. Nonetheless, it would be surprising if the latest dip in the inflation estimate doesn’t influence the Fed’s monetary policy. As economist Millan Mulraine advises in a note to clients in anticipation of tomorrow’s FOMC statement:

The overall tone of the communique should feel dovish as the Fed counters the implied tightening in monetary conditions resulting from the strong dollar and leans against the potential fallout from the current global growth slowdown and disinflationary impulse.

Before you dismiss the recent dip in market-based estimates of future inflation as a byproduct of short-term trading noise, consider that the Cleveland Fed’s Oct. 22 estimate of 10-year inflation with an alternate methodology is projecting a similar outlook: 1.87%. A comparable forecast is reflected in the Atlanta Fed’s recent survey of businesses in the bank’s district for year-ahead assumptions about inflation.

As long as the US macro trend remains upbeat, the softer outlook on inflation may not be as threatening as it appears. Based on the economic profile for September, it’s safe to say that the numbers continue to point to moderate growth at the least. Nonetheless, the latest dip in inflation expectations is one more reason to think that the Fed isn’t in any rush to start raising interest rates. That’s also the thinking via the market for Fed fund futures. Even as far out as the June 2015 contract, the probability of a rate hike is still priced as a low-probability event—just 12%, according to CME data.

Will tomorrow’s Fed statement inspire a more hawkish outlook? Unlikely, or so the recent easing in inflation expectations suggest. But at a time when the battle to minimize deflation risk is priority one in Europe—Sweden’s central bank cut its benchmark rate to zero today—it’s premature to dismiss the Treasury market’s falling inflation prediction. The US may be relatively immune to Europe’s macro problems today, but in a globalized economy that’s an assumption that’s subject to revision, perhaps on a daily basis.

Pingback: The Daily Dose