The new year started a bang with most of the major asset classes posting gains in 2017’s first week of trading, based on a set of ETF proxies. Leading the way higher: foreign real estate investment trusts/real estate.

Vanguard Global ex-US Real Estate ETF (VNQI) scored the biggest gain last week among the major asset classes. The fund’s 3.0% increase during the shortened 4-day trading week through Jan. 6 marks the third weekly increase for VNQI—the longest bull run for the ETF since last summer.

Emerging-market equities were in close pursuit, posting the second-strongest gain last week. Vanguard Emerging Markets (VWO) climbed 2.7%, the fund’s second straight weekly advance.

Last week’s big loser: foreign fixed-income securities. PowerShares International Corporate Bonds (PICB) dipped 0.8% during the first four trading days of the new year, leaving the fund close to its lowest level in a year.

Meantime, last week’s generally upbeat results lifted an ETF-based version of the Global Markets Index (GMI.F). This investable, unmanaged benchmark that holds all the major asset classes in market-value weights jumped 1.2% for the week.

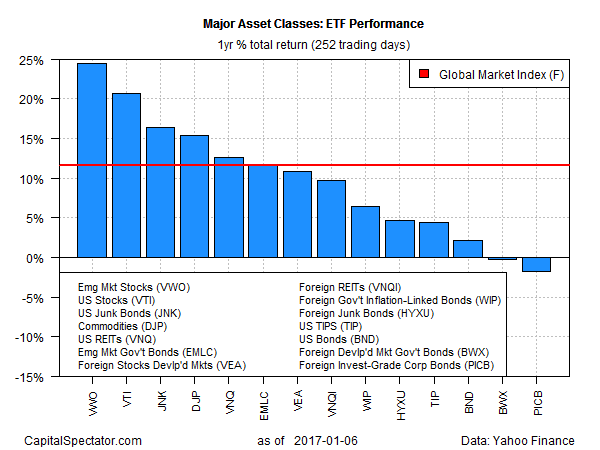

For the one-year column, most of the major asset classes are currently sitting on gains, led by emerging-market stocks. VWO is up 24.4% for the trailing 252-trading-day period.

Foreign corporate bonds, on the other hand, are posting the biggest one-year loss among the major asset classes at the moment. PICB is off 1.7% for the trailing 252-trading-day window through Jan. 6.

The broad trend for markets, however, remains solidly positive via GMI.F, which is currently posting a strong 11.6% total return for the past year.

For some perspective on what to expect from the major asset classes in the long run, take a look at this month’s update of risk premia projections.