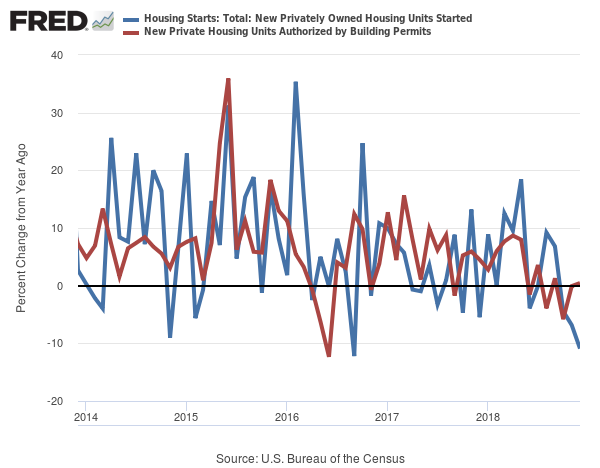

New residential housing construction was surprisingly weak in December, presenting more evidence for assuming that the US economic growth will continue to slow. Housing permits perked up, providing a degree of optimism for expecting that building activity will rebound in the months ahead. But reviewing both indicators on a rolling one-year basis suggests that the housing trend has weakened — a trend that will create headwinds for the US economy in the months ahead.

Housing starts fell 10.9% in December vs. the year-earlier level – the biggest annual decline since September 2016. The annual change in housing permits – a leading indicator for construction activity – is stronger, but the fractional 0.5% rise reflects a flat trend.

Nonetheless, some analysts are encouraged by the stronger permit data in recent months. The pullback in interest rates is a plus, too, notes Daniel Silver, an economist at JP Morgan. “We do expect the housing data to pick up at some point in response to the recent decline in mortgage rates, but it likely will take some time before we start to see firming across many of the relevant figures.”

Perhaps, but the weakness in housing is hardly a new development. Rather, the sector has been reflecting a downside bias for months and the yesterday’s update confirms that the downside bias continues to unfold. Last month, for instance, The Capital Spectator wondered if housing was set to become a headwind for US economy in 2019 – a topic inspired by falling sales of existing homes and a negative annual trend for pending home sales, a leading indicator for sales activity.

Recall, too, that last summer – when the economic growth was considerably stronger – the housing data was looking sufficiently soft to ask: “Is The Housing Market Signaling Trouble Ahead For US Economy?”

Seven months later, economic growth has slowed and tomorrow’s release of gross domestic product for last year’s fourth quarter is expected to show that the downshift rolls on. Econoday.com’s consensus forecast for Q4 GDP calls for a 2.2% increase (seasonally adjusted annual rate). If correct, economic output will post a second straight quarter of softer growth.

Despite the deceleration, recession risk remains low, at least for now. The three-month average of the Chicago Fed National Activity Index for January eased to 0.0, which indicates economic growth that matches the historical trend. But the latest reading for this business-cycle benchmark shows that the macro trend has decelerated – last month’s zero print marks the weakest three-month reading since September 2017.

Later today we’ll see an update of pending home sales data for January and economists are looking for modest rebound. If so, that may mark the start of a spring rebound for housing. By contrast, a downside surprise will strengthen the view that residential real estate will continue to be a drag on the US economy for the near term.

The key question is whether other corners of the economy weaken in the months ahead. A soft real estate market is one thing, but simultaneous deterioration elsewhere represents a bigger problem.

A key update on this front is scheduled for Friday, March 1 with the release of consumer spending data for December and January. The crowd is looking for a mixed bag of results, according to Econoday.com’s consensus outlook: a 0.3% decline in December and a 0.3% rise in January.

On the bright side, yesterday’s February release of the Consumer Confidence Index shows a rebound in sentiment — not a moment too soon after three straight months of decline. An encouraging bit of news, although it’s premature to read too much into one data point. Lynn Franco, senior director of economic indicators at The Conference Board, notes that while “consumers expect the economy to continue expanding,” the consultancy’s outlook for the US economy still projects that “the pace of expansion is expected to moderate in 2019.”

For the moment, the housing data doesn’t offer a reason to argue otherwise. The Capital Spectator’s revised outlook for residential housing construction’s one-year trend (based on a set of combination forecasts) remains negative for the months ahead.

Not surprisingly, Federal Reserve Chairman Powell is expecting softer growth for the economy. Speaking in Congress yesterday, he said that “while we view current economic conditions as healthy and the economic outlook as favorable, over the past few months we have seen some crosscurrents and conflicting signals.”

Financial markets became more volatile toward year-end, and financial conditions are now less supportive of growth than they were earlier last year. Growth has slowed in some major foreign economies, particularly China and Europe. And uncertainty is elevated around several unresolved government policy issues, including Brexit and ongoing trade negotiations.

Is Recession Risk Rising? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Pingback: New Residential Housing Construction Weak in December - TradingGods.net

Pingback: Landmark Links March 1st – Chopped Up