The decline of the US dollar this year has been a bullish force for American investors holding foreign bond funds. The sliding value of the world’s reserve currency is helping offset low and zero yields with capital appreciation.

The US Dollar Index is currently trading near its lowest level since April 2018. Judging by the negative technical profile for this widely followed benchmark, even lower levels for the greenback appear plausible in the weeks and months ahead.

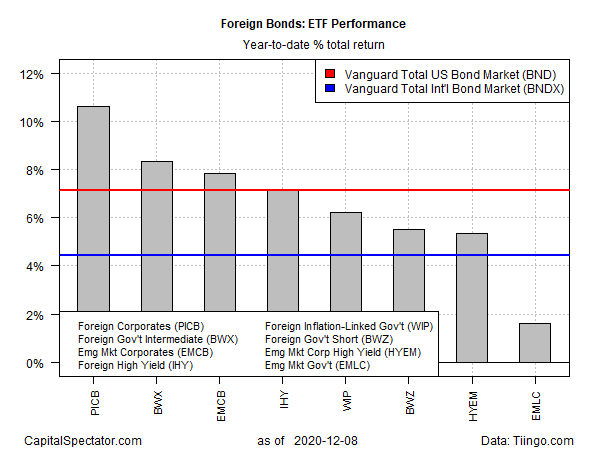

Given the inverse relationship between the dollar and foreign asset prices (in US dollar terms), it’s no surprise that foreign fixed income is posting across-the-board gains for the main components of this asset class, based on a set of US-listed exchange traded funds.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

The leading performer: foreign investment-grade corporates via Invesco International Corporate Bond (PICB), which is up 10.6% year to date through yesterday’s close (Dec. 8). Note that PICB’s performance in 2020 is ahead of an international bond benchmark (ex-US) that dollar hedges, based on Vanguard Total International Bond (BNDX), which is up a relatively modest 4.4% this year. PICB is also beating the US investment-grade benchmark via Vanguard Total US Bond Market (BND), which is ahead by 7.2% in 2020.

The weakest performer on the list: emerging markets government debt, based on VanEck Vectors J.P. Morgan EM Local Currency Bond (EMLC), which is currently posting a 1.6% total return year to date.

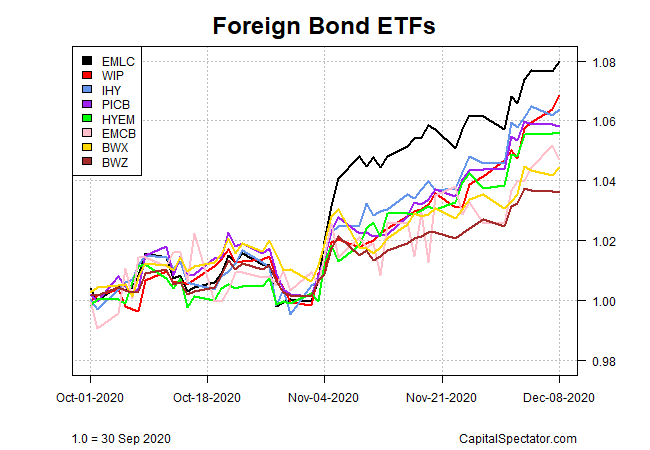

Note, however, that emerging markets debt has turned red hot in recent weeks. Since the end of September, EMLC has decisively outperformed its foreign bond competitors.

After meandering in a range for much of the summer, EMLC began to shoot higher in early November, pulling away from the field.

A key risk to the recent leadership for emerging markets debt is the US dollar. If it the recent weakness in the greenback reverses, EMLC’s rebound could be challenged.

By some accounts, however, the dollar outlook remains bearish. “Low interest rates, increased conversation about stimulus and a ‘flight-to-quality’ unwind with progress on the Covid vaccine should keep the US dollar dropping, which should be a boost to equities,” advises Malcolm Dorson, at Mirae Asset Global Investments.

Emerging markets bonds would likely benefit too. “As economies reopen, vaccines are distributed and risk appetite returns, 2021 could be a break-out year for emerging markets, especially if the US dollar continues to weaken,” says Christopher White, co-manager of an emerging markets fund at Somerset Capital Management. “An unprecedented US peacetime fiscal deficit combined with aggressive monetary stimulus is putting pressure on the dollar, which is very helpful for many emerging economies.”

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Pingback: Decline of US Dollar Has Positively Impacted Foreign Bond Funds for American Investors - TradingGods.net