Yesterday’s update on consumer spending for December looks pretty ugly. Consumption slid 0.3% on a monthly basis in 2014’s final month—the first monthly bout of red ink since the previous January and the deepest retreat in five years. The news prompted some pundits to declare that the sky was falling. But the headline number isn’t as bad as it looks. Why? Because private-sector wages are still rising at a healthy (and slightly faster) pace.

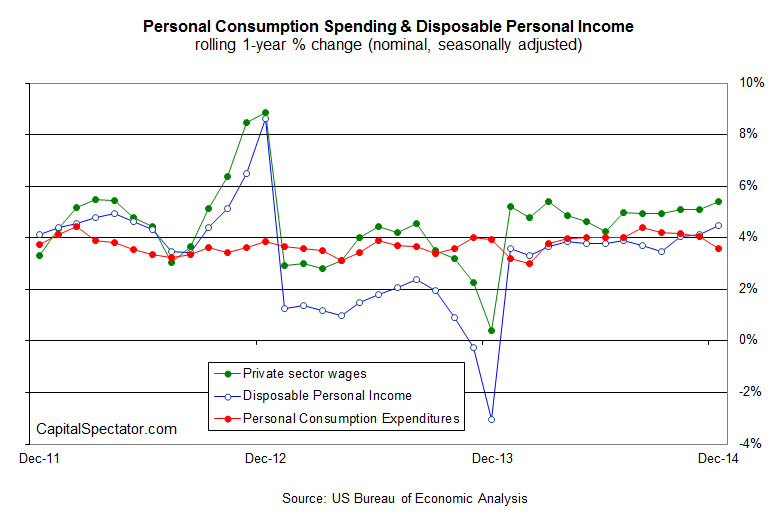

Looking at monthly comparisons in general is subject to a fair amount of distortion; a slightly more reliable approach is to review year-over-year changes, which offers superior signals for monitoring the business cycle. But here too the latest number looks worrisome for personal consumption expenditures (PCE), which decelerated in December to a 3.6% gain, well below the 4.2% rise via my median econometric projection.

One reason for thinking that the slowdown in the annual growth of PCE (red line in chart above) isn’t a sign of deeper trouble ahead: the comparative strength in private-sector wages (green line above), which rose 5.4% for the year through December—the best pace since last March.

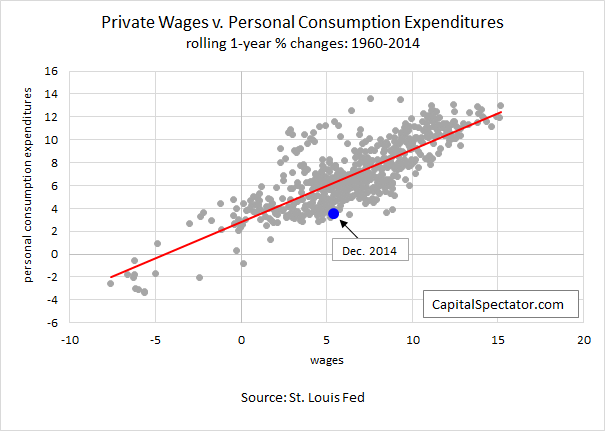

Not surprisingly, the relationship between private wages and consumer spending is quite strong, particularly on a year-over-year basis. Running a simple linear regression for the two data sets over the past half century reveals a positive link (red line) that’s proven to be quite durable through time. It’s not hard to understand why: faster wage growth is the raw material for higher spending.

The relationship is sturdy over time, but it can and does wander in the short run. December is one of those times. Indeed, note the blue dot in the chart above, which reflects the latest data point for wages and spending. Based on the historical trend, the 5.4% annual increase in private wages through December implies consumer spending advancing at roughly 6% a year, well above the 3.6% rise that was reported.

History, in other words, suggests that consumer spending has room for improvement in the months ahead. Why might we question that forecast? Maybe consumers will save more of their income going forward relative to what we’ve seen through history. A darker possibility: wage growth will suffer a dramatic decline.

Yes, anything’s possible. But using private wages—the foundation for spending—as a guide, it’s reasonable to question the last slide in PCE as a warning sign for the near-term future. Okay, but why should we assume that wage growth will continue to rise at the 5%-to-6% rate that we’ve seen recently? Quite a lot of the answer is due to the labor market, which has been expanding at a faster rate lately.

On that note, this Friday’s payrolls report from Washington will provide fresh intelligence for deciding if the latest consumer spending data will perk up in the months ahead. The consensus forecast via Econoday.com sees nonfarm private payrolls increasing by 229,000 for January. That’s moderately below December’s 240,000 rise. But if the crowd’s right, Friday’s release will still reflect job growth that’s accelerated relative to recent history. In that case, we’ll have one more reason to label December’s soft data for consumer spending as noise.