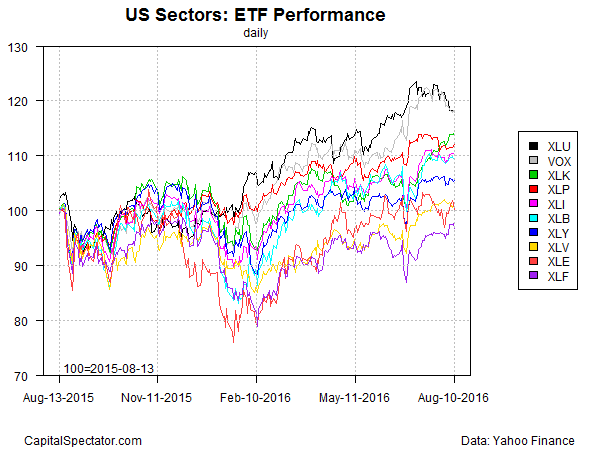

Utility stocks remain the top performer among US sectors for the trailing one-year return window, based on a set of proxy ETFs, but the rally in this corner is starting to look a bit tired. For some analysts, the long-running bull market in utilities looks like a bubble. But for now, the sector’s upside momentum over the last 12 months remains second to none.

The Utilities Select Sector SPDR ETF (XLU) is ahead by nearly 19% on a total-return basis through yesterday (Aug. 10) vs. the year-ago price. That’s still a solid gain, but the sector’s performance edge has been fading a bit lately as the number-two fund—Vanguard Telecommunication Services (VOX)—is in close pursuit with an 18.2% year-over-year increase.

Compared with the US stock market generally, however, the trailing one-year return for utilities remains impressive. Indeed, XLU’s 18.9% advance over the past year is still far above the 5.6% total return for SPDR S&P 500 ETF (SPY).

Meanwhile, financial stocks continue to trail, remaining stuck in last place for the one-year window. The Financial Select SPDR (XLF) has lost 4% over the past 12 months, the worst performance on the US-sector landscape.

But note the contrast in the directional bias of late between utilities (down) and financials (up), as shown in the next chart below. It could be noise, of course—or are we looking at the early stages of a change in leadership?

Ranking the sector ETFs based on 200-day moving averages also reflects a softer trend for utilities lately. Indeed, the degree of upside bias for XLU on this front has turned middling vs. the rest of the pack. Also, XLU is currently trading below its 50-day average at the moment, a mildly negative profile shared only with the energy sector (XLE) as of Aug. 10.

For additional research on the sector ETFs cited above, here are links to the summary pages at Morningstar.com:

Consumer Discretionary (XLY)

Consumer Staples (XLP)

Energy (XLE)

Financial (XLF)

Healthcare (XLV)

Industrial (XLI)

Materials (XLB)

Technology (XLK)

Utilities (XLU)

Telecom (VOX)

Pingback: 08/11/16 – Thursday’s Interest-ing Reads | Compound Interest-ing!

Pingback: Daily Reading: August 12th, 2016 – The Aspirant Investor

Pingback: Dash of Insight| Weighing the Week Ahead: Have Stock and Oil Prices Decoupled?

Pingback: Weighing The Week Ahead: Has The Apparent Oil/Stock Price Relationship Ended? | Energy News Corporation

Pingback: Weighing The Week Ahead: Has The Apparent Oil/Stock Price Relationship Ended? – Seeking Alpha – Daily Stock Advisor

Pingback: Weighing The Week Ahead: Has The Apparent Oil/Stock Price Relationship Ended? – Seeking Alpha – The Liberty Extra

Pingback: Weighing The Week Ahead: Has The Apparent Oil/Stock Price Relationship Ended? | Stock Market News

Pingback: Weighing The Week Ahead: Has The Apparent Oil/Stock Price Relationship Ended? | InvestingLab.com

Pingback: Weighing The Week Ahead: Has The Apparent Oil/Stock Price Relationship Ended? | OptionFN

Pingback: Weighing the Week Ahead: Have Stock and Oil Prices Decoupled? – Minyanville.com – Daily Stock Advisor

Pingback: Weighing the Week Ahead: Have Stock and Oil Prices Decoupled? – Minyanville.com – The Liberty Extra