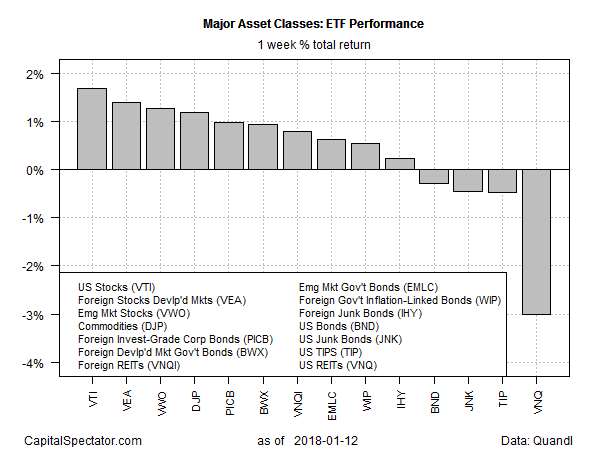

US equities led most markets higher last week, posting the strongest gain among the major asset classes, based on a set of exchange-traded products. Meanwhile, real estate investment trusts (REITs) in the US suffered the biggest weekly loss, extending a slide for this yield-sensitive sector in the wake of rising Treasury yields.

Vanguard Total Stock Market (VTI) was up 1.7% for the five trading days through Jan. 12, closing at yet another record high. The ETF’s upside bias marks an extraordinary run higher in recent months. Indeed, VTI’s latest advance is the 16th weekly increase in the past 18 weeks.

Last week’s biggest loser: Vanguard REIT (VNQ), which slumped a hefty 3.0%. The slide is the fund’s second weekly decline and its deepest since last March. The selling left VNQ’s closing price on Friday at nearly 5% below its 200-day moving average – the biggest downside gap since November.

For the one-year trend, emerging-markets stocks remain firmly in the lead for the major asset classes. Vanguard FTSE Emerging Markets (VWO) is up 33.2% for the year through last week’s close.

The only loss for the one-year change at the moment is in US REITs. VNQ’s posted a small 0.9% decline at last week’s close vs. the year-earlier price.

Overall, positive momentum remains strong for most corners of the major asset classes. Consider how current drawdowns stack up. The majority of markets are posting zero or relatively low peak-to-trough declines as of last week’s close.

The main exception: broadly defined commodities. Although iPath Bloomberg Commodity (DJP) has rallied in recent months, this exchange-traded note remains a conspicuous outlier for drawdowns vs. the rest of the field. At the end of last week’s trading DJP was down 45% from its previous peak.