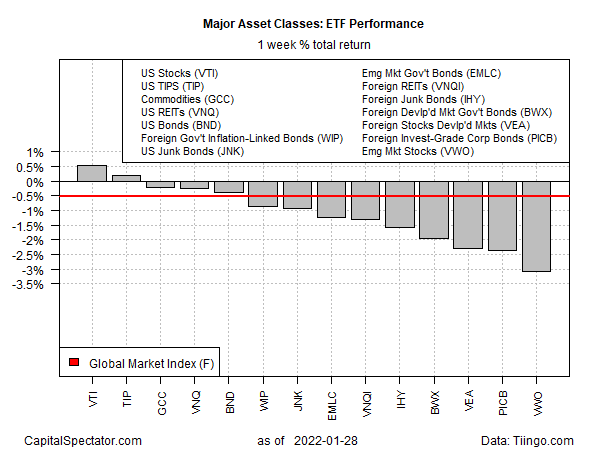

Shares in US companies and inflation-protected Treasuries managed to post gains last week as the rest of the major asset classes lost ground, based on a set of ETFs through Friday’s close (Jan. 28).

The trend for Vanguard Total US Stock Market (VTI) still looks weak, but the ETF posted its first weekly gain of the year with a 0.5% increase.

Strong earnings reports for several key tech companies are probably a factor in the market’s bounce. Notably, Apple and Microsoft delivered strong quarterly numbers and provided optimistic guidance on the future.

Despite upbeat earnings news for several big-tech names, expectations for interest-rate hikes continue to dominate sentiment and inspire caution for the market’s near-term outlook. “The Fed is just starting to get in the way of the market because there’s still a lot of uncertainty about how it will play its hand going forward,” says George Mateyo, chief investment officer at Key Private Bank.

Tim Ghriskey, senior portfolio strategist at Ingalls & Snyder, advises: “The big issue is the Fed, which is clearly in a tightening cycle. Financial market support is not part of the central bank’s agenda. The only question is whether the markets have fully digested [Fed Chair Jerome] Powell’s guidance in his press conference… I would expect the equity and bond markets to find bottoms at some point relatively soon.”

Most of the major asset classes fell last week. Stocks in emerging markets posted the biggest setback. Vanguard Emerging Market (VWO) tumbled 3.1%, leaving the ETF near its lowest close in over a year.

Widespread selling around the world weighed on the Global Market Index (GMI.F). This unmanaged benchmark, which is maintained by CapitalSpectator.com and holds all the major asset classes (except cash) in market-value weights via ETF proxies, fell 0.5% — the fourth straight weekly loss for the benchmark.

For the one-year trend, roughly half of the major asset classes are posting gains while the other half is in the red. The biggest gainer: US real estate investment trusts via Vanguard US Real Estate (VNQ), which is up 25.6% over the past 12 months.

At the opposite extreme: foreign government bonds in developed markets. SPDR Bloomberg Barclays International Treasury Bond ETF (BWX) ended last week with a 10.5% one-year loss.

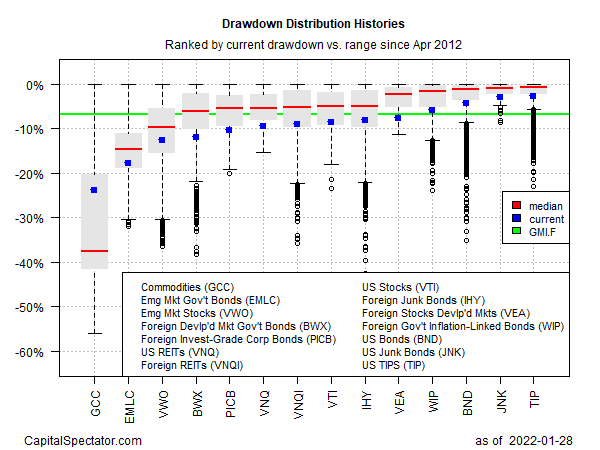

Looking at the ETF proxies through a drawdown prism shows that most markets are posting peak-to-trough declines that are below the GMI.F benchmark’s 6.8% slide from its previous high. That’s a reminder that market trending behavior is broadly weak relative to a proxy for the market portfolio.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno