Although American shares continue to hold on to a strong rally from the year-ago bottom, reclaiming the previous market peak is nowhere on the near-term horizon. The combination of heightened geopolitical risk, uncertainty about inflation and interest rates and the ongoing political dysfunction in Washington provide compelling reasons for investors to adopt a wait-and-see posture.

The rebound off of last year’s low hit a wall in the summer and the market has been drifting down ever since. It’s a slow grind lower, which leaves room for bulls and bears to extol their respective views.

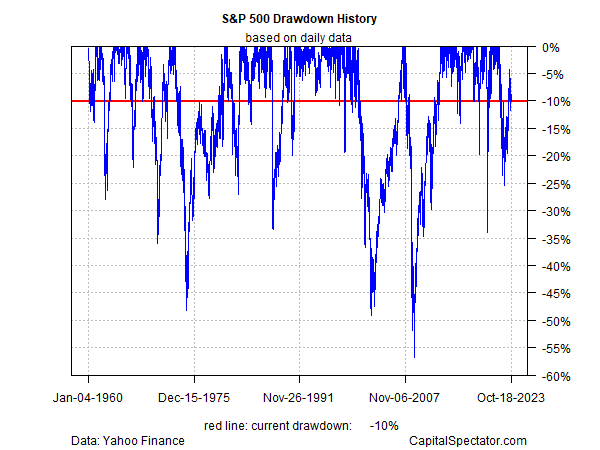

Despite the previous rally, stocks remain in a steep drawdown relative to the market’s January 2022 peak. The current peak-to-trough decline for the S&P 500 Index is -10%. That’s a big improvement from last year’s trough, which at one point touched -25%.

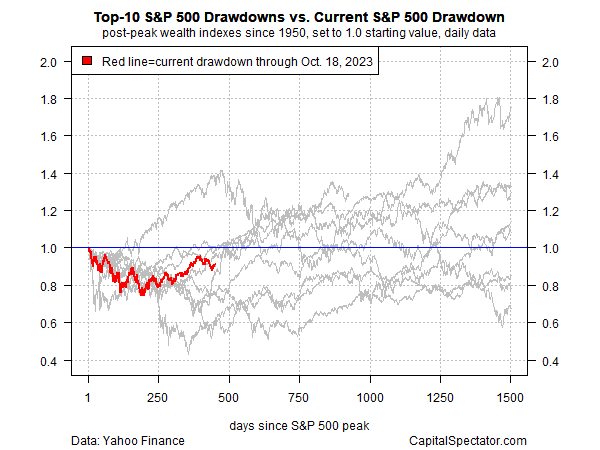

The current drawdown is the ninth-longest on record since 1950. At this point in history several of the steeper drawdowns were on the cusp of regaining their previous peaks. But there’s also precedent for much longer drawdown periods. The three longest ranged from 1,376 trading days (2007-2009) to nearly 1,900 (1973-1974). That’s a reminder that the current 451 days of drawdown could be the opening bid in a extended run of trading below the previous peak.

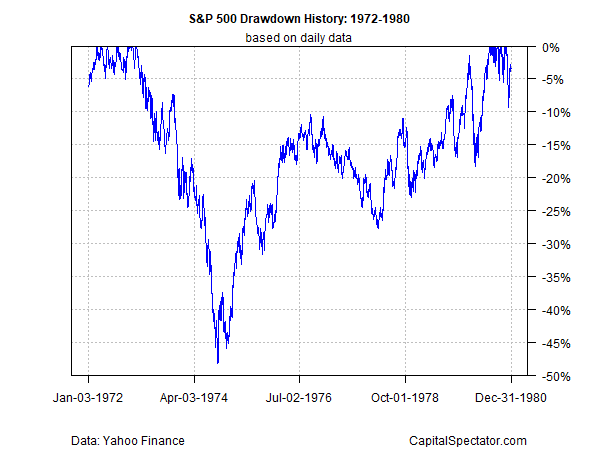

It’s encouraging to recognize that following the steepest drawdowns, recoveries are persistent, albeit vulnerable to temporary setbacks. For perspective on how bad it could get, the 1973-1974 drawdown is a guide. Lasting 1,898 trading days, it’s the longest since 1950. It’s also the poster child in modern history for a flailing recovery. In mid-1975, when the market looked to be well on its way to recovering, the roughly -20% drawdown swooned anew, dropping to more than -30% before regaining its footing.

There was a subsequent setback starting in 1976 that marked the beginning of a nearly 2-year retreat – a hefty drawdown within a drawdown.

The good news is that despite setbacks, the broad trend following the peak drawdown point is recovery, albeit in fits and starts. That suggests the current drawdown will follow the historical pattern and repair and recovery will endure. The mystery is timing.

My guesstimate is that the market will ebb and flow for the foreseeable future, subject to the headlines du jour. At some point, when the news cycle is a bit kinder and gentler, the market will make a clear effort to regain the previous peak. But for now, given the news of the day and the recovery histories, I’m not holding my breath.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno