Retail consumption fell sharply in December, far more than expected, the US Census Bureau reports. Sales slumped 0.9% last month vs. November, well below the consensus view that predicted a relatively mild 0.1% fall (or the modest 0.2% gain anticipated by The Capital Spectator’s median forecast). Today’s surprisingly weak report translates to a 3.2% annual increase, the slowest year-over-year gain in 10 months. In short, today’s numbers for retail spending at last year’s close look discouraging. It may be a warning sign for the US economy, but a closer review of the data suggests that last month’s skid may be noise.

Note that gasoline sales posted an unusually steep decline last month, falling 6.5% on a monthly basis—the biggest dose of red ink in six years. Part of the reason for the dramatic drop in gasoline purchases is linked to the tumble in energy prices in recent months. Indeed, a gallon of gasoline fell by more than 60 cents a gallon in the US last month and is lower by more than a dollar vs. a year ago. The implication: the decline in the dollar value of spending on gas is less about sliding demand vs. a bear market in energy prices.

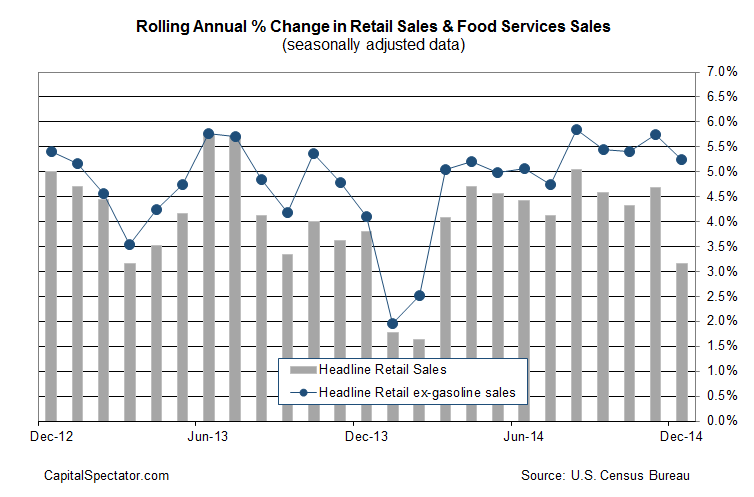

Not surprisingly, when we strip out gasoline sales from the headline number for retail spending the trend looks quite a bit better. Retail sales overall rose by a soft 3.2% last month vs. the year-earlier level. By contrast, retail consumption ex-gasoline was higher on an annual basis by 5.3%, which is only modestly below November’s 5.7% annual gain.

Today’s retail spending numbers would cast a much darker shadow for the US if there were clear warning signs elsewhere in the economy. But with recent data for the labor market posting stronger gains, it’s reasonable to wonder if today’s figures are truly reflective of the apparent improvement in the US economic trend in recent months. The combination of an upbeat trend in job creation plus the de facto tax cut for consumers by way of falling energy costs should keep growth bubbling for the near term. What could go wrong? Troubles abroad come to mind rather easily these days.

With the global economy looking increasingly wobbly, no one can afford to dismiss today’s release entirely. As the World Bank noted in yesterday’s update of the Global Economic Prospects report, “risks to the outlook remain tilted to the downside.” Nonetheless, the bank still expects a moderately stronger year of growth in 2015 for the world economy vs. 2014: “After growing by an estimated 2.6% in 2014, the global economy is projected to expand by 3.0% this year, 3.3% in 2016 and 3.2% in 2017.”

Meantime, the US is still expected to lead the developed world in the year ahead, even if today’s retail sales numbers cast some doubt on what happens next. But at this point, considering a broad array of indicators, the worst you can say about today’s update is that it puts a mild dent in the outlook for US growth, which has been upgraded lately by most economists.

Today’s retail sales comparison for December is “a weak number but it follows some really strong ones and I don’t think it changes my general feeling on how the economy and consumers are doing,” says Guy Berger, US economist at RBS Securities. “Maybe the optimism a month ago got a little too heated.”

Pingback: Retail Sales Fall in December