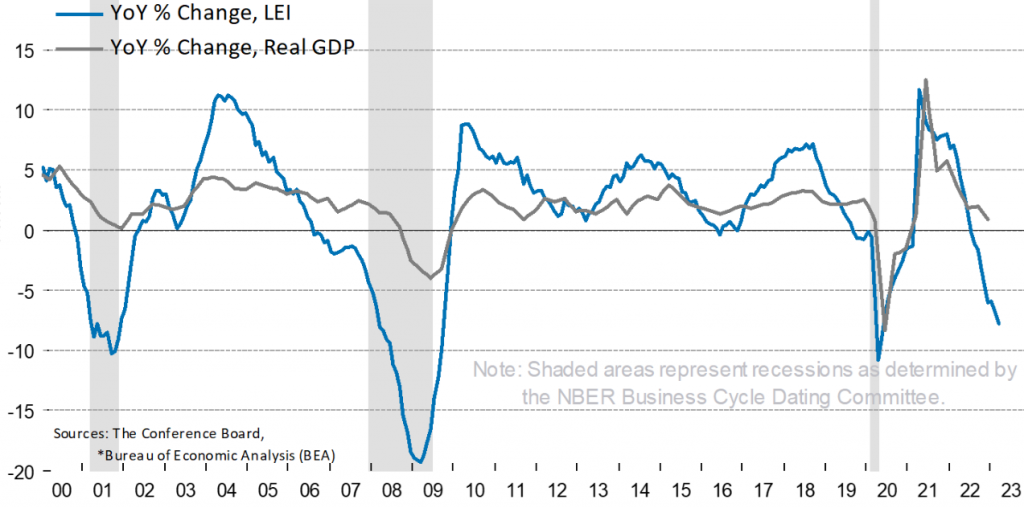

Nowcasting the business cycle isn’t getting any easier. Despite a firehose of data and an expanding list of analytical techniques, benchmarks and related research at researchers’ disposal, debate persists about the state of the US economy. Yesterday’s release of the Leading Economic Index (LEI) from the Conference Board appears to settle the matter in favor of recession, but real-time analysis isn’t as clear-cut as this indicator suggests.

On its face, LEI is signaling that US economic activity is contracting. The year-over-year change for this benchmark is unambigious in signaling a deeply negative bias. “The weaknesses among the index’s components were widespread in March and have been so over the past six months, which pushed the growth rate of the LEI deeper into negative territory,” notes an analyst at the Conference Board. The consultancy forecasts “economic weakness will intensify and spread more widely throughout the US economy over the coming months, leading to a recession starting in mid-2023.”

A number of other metrics align with the recession profile. The Treasury yield curve has been inverted for several months, for example. Numerous studies advise that that when short rates are above long rate, the odds of a downturn spike.

But there’s also hard data that offers a more optimistic picture. It’s premature to dismiss the recession risk that’s been swirling for months, but there’s also a good case for arguing that the economy is still expanding.

Consider, for instance, the first-quarter GDP report that’s scheduled for next week. The Atlanta Fed’s GDPNow model is currently estimating that output increased 2.5%, close to matching the respectable 2.6% rise in Q4.

Meanwhile, the New York Fed’s Weekly Economic Index, after gradually declining for much of the past two years has recently stabilized at a level that implies modest growth, based on data through April 15. The ADS Index, another real-time business-cycle index published by the Philly Fed, also reflects a growth bias through mid-April.

In short, there’s room for debate about whether the economy is in recession right now. Looking at several business-cycle indicators and aggregating the numbers tells me that the expansion is still intact, based on the Composite Recession Probability Index, published in the weekly updates of The US Business Cycle Risk Report.

But while the economy is probably not contracting at the moment, the potential for an NBER-defined downturn in the months ahead is still lurking. Two indicators that are on the short list for monitoring this risk: payrolls and consumer spending. On both fronts, there are early signs that the tide is turning.

Although the labor market still added jobs through March, there are hints that a slowdown is unfolding. Private hiring has slowed while jobless claims on a year-over-year basis are now persistently rising for the first time since the pandemic was raging.

Retail sales also appear to be rolling over: spending fell in four of the past five months through March. The general view is that rising interest rates are working through the economy and starting to pinch consumer spending.

The next round of releases for payrolls and retail sales for the April profile may provide the smoking guns that convince the skeptics that a recession is baked in. If so, clear real-time recession signals will emerge in WEI, ADS and other business-cycle indicators. But we’re not there yet.

Yes, there are several risk factors that are flashing red. The question is whether the labor market and the consumer sector will issue decisive confirmations? Alternatively, is the economy more resilient than generally understood? The answer, presumably, is forthcoming. But that’s been true for months and the debate rolls on. The business cycle hasnt been repealed, but it has evolved.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Could it be that we are seeing the needed moderation from very high nominal GDP numbers, needed to rein inflation in? Wouldn’t it look like a recession based on leading indicators, because of the decline?

https://fred.stlouisfed.org/graph/fredgraph.png?g=12J02

I say this because Copper and Credit spreads have yet to join the pro-recession party. Labor remains strong, however it is very, very co-incident to the overall business cycle.

Interesting times for sure.

Scott,

Possibly. To be fair, I still have more questions than answers these days re: the business cycle. On that note, shortly after I write today’s column the April report for the Composite PMI, a GDP proxy for the US, was released and it shows business activity picking up to an 11-month high: bit.ly/3LmtVAx In short, it looks like next week’s Q1 GDP report will be moderately positive and the early clues for Q2 suggest more of the same. The plot thickens!

–JP