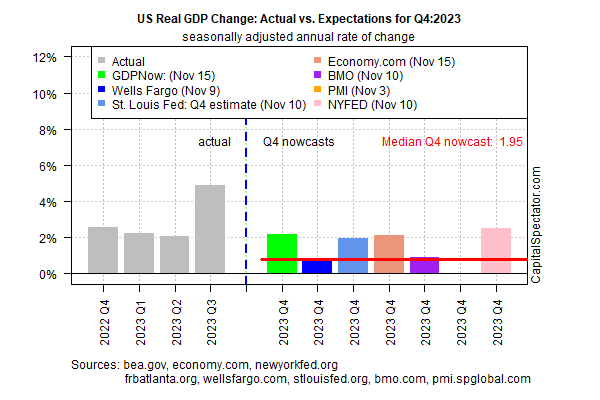

US economic activity in the fourth quarter remains set for a sharp slowdown vs. Q3, but the pace of expected growth has strengthened recently, based on updated nowcasts.

Output for Q4 is estimated at 2.0%, based on the median for a set of estimates compiled by CapitalSpectator.com. That’s still far below the red-hot 4.9% increase reported for Q3. Note, however, that today’s revised Q4 median nowcast has picked up from recent estimates.

The median nowcast published on Nov. 8 was a substantially weaker 1.0% estimate. The latest update is encouraging, but the key question remains: Will the next several nowcast updates for Q4 hold on to the firmer estimates? If they do, the news will boost confidence that the Q4 slowdown will be milder than recently expected and that today’s update is more signal than noise.

Using today’s revised estimate as a guide, the odds appear to be fading that a recession will start in the near term. Goldman Sachs, for example, advised yesterday (Nov. 15) that it “reaffirms its longstanding view that the probability of a US recession is much lower than commonly appreciated — at just 15% over the next 12 months.”

Nancy Vanden Houten, lead U.S. economist at Oxford Economics, agrees. “What we are expecting now is a soft landing,” she says. “We expect the economy to weaken quite a bit, but it does look like we’ll avoid an outright contraction” in GDP.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report