The US economy remains on track to post stronger growth in the second quarter, although the pace of acceleration over Q1 has been revised lower in recent weeks, based on a set of nowcasts.

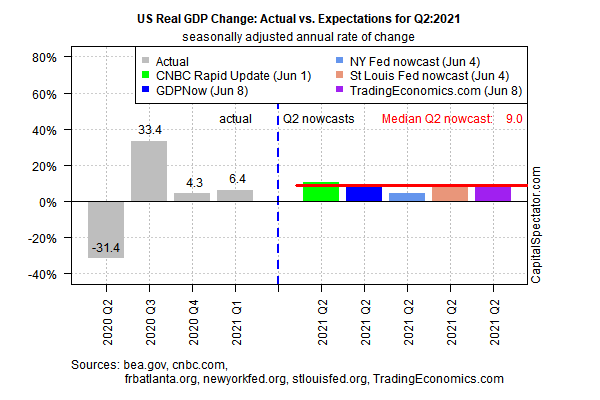

US gross domestic product is projected to increase 9.0% in Q2 (real annual rate) via the median nowcast for several estimates compiled by CapitalSpectator.com. This estimate represents a strong upgrade over the already hefty 6.4% gain reported for Q1. Note, however, that the median Q2 nowcast continues to decline as new data becomes available for the current quarter.

The current 9.0% nowcast for Q2 fell modestly from the 9.9% estimate published on May 21, which slipped from May 6’s 10.5% nowcast. The declines aren’t surprising – unusually high estimates based on preliminary numbers are likely to be revised down. It’s likely that the current 9.0% nowcast will fall further in the weeks ahead of the government’s initial Q2 GDP report scheduled for July 29.

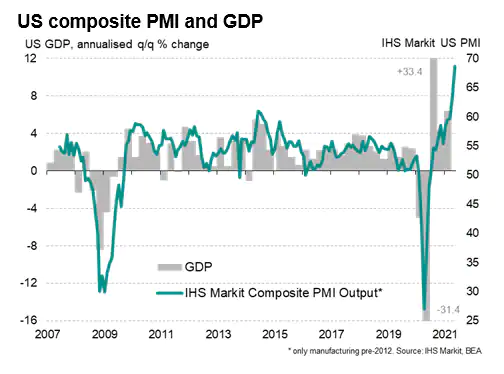

Although Q2 growth estimates are subject to downgrades in the weeks ahead, the outlook for an improvement on Q1 remains intact. Survey data published by IHS Markit last week, for example, continues to indicate a strong rebound in progress through May.

“The US economic recovery shifted up a gear in May, with the PMI covering the combined output of the manufacturing and service sectors surging past all prior peaks by an impressive margin,” advises Chris Williamson, chief business economist at IHS Markit. “The strong correlation between the PMI and GDP means the economy looks set to enjoy impressive – potentially double-digit – growth in the second quarter.”

A headwind that could affect evolving estimates of Q2 growth is the ongoing struggle to hire enough workers as the economy rebounds.

“Things exploded — it was like a light switch,” says Kirby Mallon, president of Elmer Schultz Services, which repairs and maintains kitchen equipment for restaurants and other clients. “The labor market is just out of control. We literally cannot hire technicians … We ramped up so quickly, the supply chain wasn’t ready for it.”

Yesterday’s release of the Labor Department’s estimates of job openings aligns with Mallon’s narrative. The US reported 9.3 million job openings in April, the highest on record (starting in 2000). Meanwhile, workers quitting jobs also reached a record high as layoffs dropped to the lowest since data collection began for the series more than 20 years ago. Meanwhile, almost half of small business report difficulty in hiring workers.

“The rate at which adults are participating in the workforce has been flat since last summer,” observes Michael Strain, director of economic policy studies at the American Enterprise Institute. “This is a significant issue. Workers are not coming back.”

Perhaps, but private nonfarm payrolls grew by a solid 492,000 in May, more than double the gain in the previous month. Economists were expecting a significantly higher increase, but the latest gain still points to a labor market that’s humming and most forecasts see more of the same for the summer.

Production bottlenecks and labor market frictions will remain headwinds for the rebound, but at this point the odds still appear favorable for expecting a strong acceleration in Q2 GDP growth over Q1’s gain.

“The supply constraints are problematic, but it doesn’t mean that’s going to prevent the economy from continuing to recover,” says Ryan Sweet, senior economist at Moody’s Analytics.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno