US economic growth remains on track for substantially slower growth in the second quarter vs. Q1, based on a set of nowcasts. Although the current estimates suggest that the economy will avoid a recession in the immediate future, output for the April-through-June period appears to be at risk of decelerating to the softest pace in more than two years.

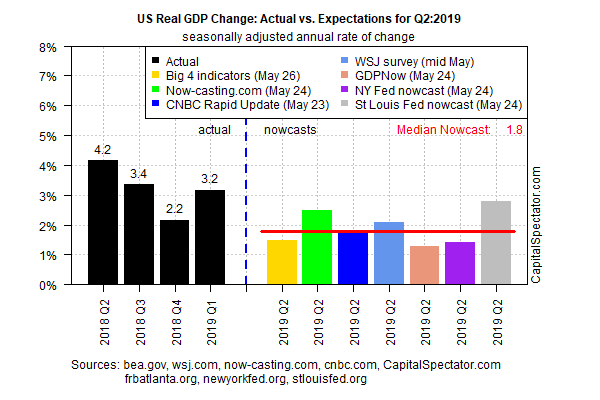

The economy is expected to expand 1.8% in Q2, based on the median for a set of GDP estimates compiled by The Capital Spectator. Today’s outlook reflects a modestly softer estimate from the 2.1% projection for Q2 published two weeks ago. If today’s median Q2 estimate is correct, the expansion will post a sharply softer gain compared with Q1’s strong 3.2% increase.

Aside from GDP estimates, one factor that’s weighing on economic expectations is the deepening inversion of the Treasury yield curve, which is widely viewed as an indicator of elevated recession risk. This spread ticked deeper into negative territory yesterday (May 28), when the 3-month Treasury yield exceeded the 10-year yield by 12 basis points – the deepest negative spread since 2007.

“The drop of the US Treasury yield is an indicator of growing uncertainty,” Lena Komileva, chief economist at G Plus Economics, told Bloomberg. “It’s quite clear now that we are past that cyclical peak for earnings and the cyclical trough in credit spreads.” She added that Treasuries are “going to be very well-supported here.”

Looking beyond the yield curve, however, suggests that US recession risk remains low. Last week’s review of a broad set of indicators reaffirmed that the probability remained virtually nil that an NBER-defined recession has started, based on data published to date. This week’s update of The US Business Cycle Risk Report reaffirmed the analysis, noting that near-term projections of the macro trend through next month continue to show that the expansion will prevail.

At this point, using data published to date, it appears that the US is headed for a period of slower growth. For now, there are no smoking guns that offer a high-confidence forecast that a new recession is imminent. The calculus could change, of course. Perhaps the leading risk factor at the moment is the escalating US-China trade conflict.

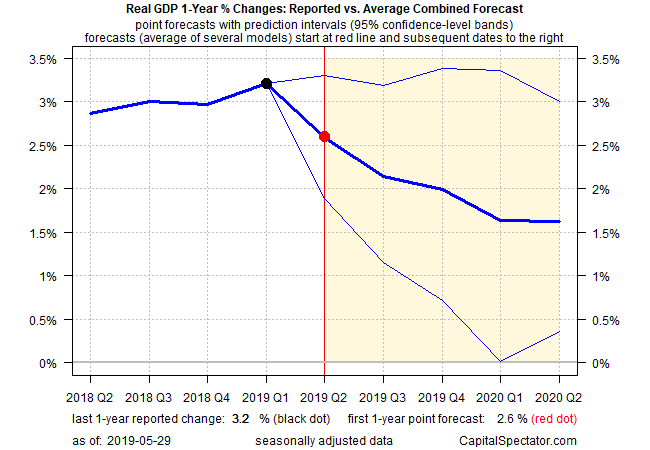

Meantime, The Capital Spectator’s baseline outlook for the near term remains slower growth without a material rise in recession risk. Consider, for instance, the outlook for GDP’s one-year trend, based on The Capital Spectator’s average estimate via a set of combination forecasts. Today’s revised point forecast anticipates that the year-over-year rate of growth will decelerate for several quarters.

The crucial question in the days and weeks ahead: Will incoming data materially change the outlook? First up on the schedule is this Friday’s update on consumer spending and income for April and next week’s May figures on employment. Based on estimates and the rear-view mirror, these updates are expected to show that recession risk remains low. But as growth slows, any downside surprises threaten to unleash larger-than-usual headwinds. The US, in short, appears headed for a challenging second half in 2019.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Pingback: US Economic Growth on Track for Slower Growth for Q2 - TradingGods.net

Pingback: Weighing the Week Ahead: Is there Any Sense in the Conflicting Market Messages? | Dash of Insight

Pingback: Economic Calendar Is Big for this Week - TradingGods.net