US second-quarter growth estimates continue to decline, but the upcoming GDP report is still expected to post a materially higher growth rate over Q1’s gain, based on a set of recent nowcasts.

US gross domestic product is projected to increase 8.8% (real annual rate) in Q2, according to the median nowcast for several estimates compiled by CapitalSpectator.com. This estimate is well above Q1’s strong 6.4% gain via the Bureau of Economic Analysis.

Median estimates for Q2 growth have been continually revised lower in recent weeks. In the previous update in late-June, for example, the median nowcast was a modestly higher 9.3% advance.

Despite the downside revisions, the fact that the current nowcast remains high – this close to the July 29 release of Q2 GDP data – suggests that growth will likely post a material upgrade over the previous quarter’s already robust expansion rate.

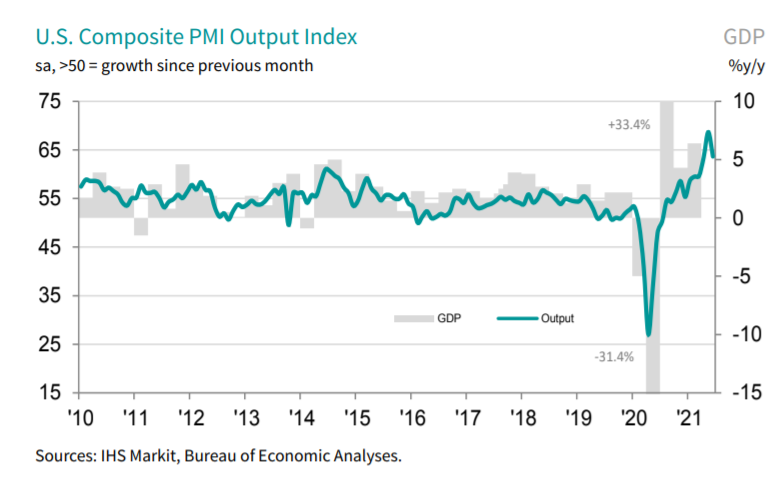

New survey data for June offers a similarly upbeat profile of recent economic activity. The IHS Markit US Composite PMI Output Index slipped to 63.7 in June, down from May’s recent high of 68.7, but the latest print continues to reflect an unusually high rate of growth.

“June saw another month of impressive output growth across the manufacturing and services sectors of the US economy, rounding off the strongest quarterly expansion since data were first available in 2009,” says Chris Williamson, chief business economist at IHS Markit. “The rate of growth cooled compared to May’s record high, however, adding to signs that the economy’s recovery bounce peaked in the second quarter.”

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

The bond market appears to be pricing in higher odds that growth in the second half of the year will continue to decelerate, perhaps faster than expected. The 10-year Treasury yield continued falling yesterday (July 7), dropping to 1.33%, the lowest since February.

Although payrolls posted a solid acceleration in growth for June, some economists see the potential for materially weaker results ahead. Mizuho economist Steven Ricchiuto says that “layoffs have declined to a new all-time low, and the level of hiring and quits have declined and are now closer to their pre-pandemic levels. This is somewhat concerning as it suggests recent net payroll gains are unsustainable.”

MKM Financial Partners strategist Michael Darda sees a darker possibility lurking in the 10-year rate’s decline, noting that the bond market may be anticipating “near recessionary” growth next year.

The good news is that economic growth appears to have plenty of room to cool from a fast pace and still leave a healthy expansion intact. That implies that a lot would have to go wrong for a worrisome rate of deceleration to unfold. That doesn’t preclude trouble ahead, but for now the odds appear favorable for expecting a robust rate of growth for the foreseeable future.

Perhaps the biggest risk is managing expectations. On a relative basis, moderating growth in 2020’s second half will have a tough time in comparison to the first half’s remarkably strong expansion.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Pingback: Second-Quarter Economic Data Is Expected to Show Impressive Acceleration - TradingGods.net