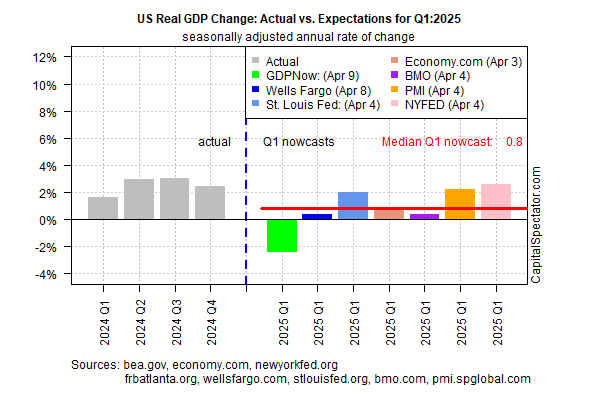

The official first-quarter GDP report from the government that’s scheduled for Apr. 30 is expected to post a sharp slowdown in growth, based on the median estimate from several sources compiled by CapitalSpectator.com.

Output is on track to downshift to a weak increase of 0.8% (annualized real rate) in Q1, according to the median nowcast. If accurate, the growth will mark a substantial slowdown vs. Q4’s solid 2.4% advance.

Today’s revised Q1 nowcast extends the recent slide in estimates. In the previous update (Mar. 28), the nowcast was slightly higher at 1.0%, which was a downgrade from 1.2% (Mar. 18). In mid-February, the nowcast was in the mid-2% range.

The downside bias for recent Q1 nowcasts is worrisome for several reasons. First, a persistent slide in revisions as more data arrives suggests a higher confidence for the directional trend for the upcoming report.

More importantly, the Q1 data will not reflect the turmoil that’s been unleashed in recent days due to dramatic shift in US tariff policy. Although President Trump announced a 90-day pause yesterday on tariffs for most countries, the import fees on China – 125% — will remain in effect, at least for now.

Despite the pause, uncertainty persists, largely due to expectations for Trump’s plans. Meanwhile, huge tariffs on China remain in effect, and so the trade war between the two largest economies looks set to continue.

“China is unlikely to change its strategy: stand firm, absorb pressure, and let Trump overplay his hand,” said Daniel Russel, vice president of international security and diplomacy at the Asia Society Policy Institute. “Beijing believes Trump sees concessions as a weakness, so giving ground only invites more pressure. Other countries will welcome the 90-day stay of execution — if it lasts — but the whiplash from constant zigzags creates more of the uncertainty that businesses and governments hate.”

Paul Ashworth, chief North America economist at Capital Economics, outlines a case for optimism, if only in relative terms. Writing in a note to clients yesterday, he advised:

“Our working assumption now will be that, cowed by the market response, Trump will repeatedly extend the ‘pause’ meaning that this will end up looking a lot like the 10% universal tariff that he campaigned on. In return, other countries will offer minor concessions on their own tariffs and trade practices.”

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report