The upcoming first-quarter report on US economic output is expected to post the softest gain since the recovery from the coronavirus recession began in the second half of 2020.

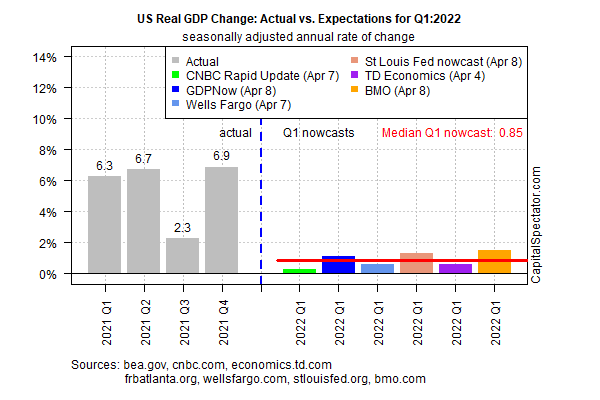

The US Bureau of Economic Analysis is on track to report later this month (Apr. 28) that Q1 GDP rose a sluggish 0.9% (seasonally adjusted annual rate) in the first three months of 2022, based on the median of several estimates compiled by CapitalSpectator.com. The forecast for a weak advance stands in sharp contrast to the red-hot 6.9% surge in the preceding Q4 for 2021.

The combination of blowback from the Ukraine war, high inflation and expectations for an extended run of interest rate hikes by the Federal Reserve are creating stronger headwinds for the US economy. In turn, more analysts are focusing on the rising risk of recession in the months ahead.

“I would say that it’s probably closer to a coin toss that the economy will be moving into recession by the end of the year,” predicts Vince Reinhart, chief economist and macro strategist at Dreyfus and Mellon.

A new survey of economists by The Wall Street Journal estimates that the probability of a US economic contraction at some point in the next 12 months has risen to 28%, up from 18% in January.

Meanwhile, the share of fund managers expecting the global economy to weaken is the highest on record, according to polling this month by Bank of America.

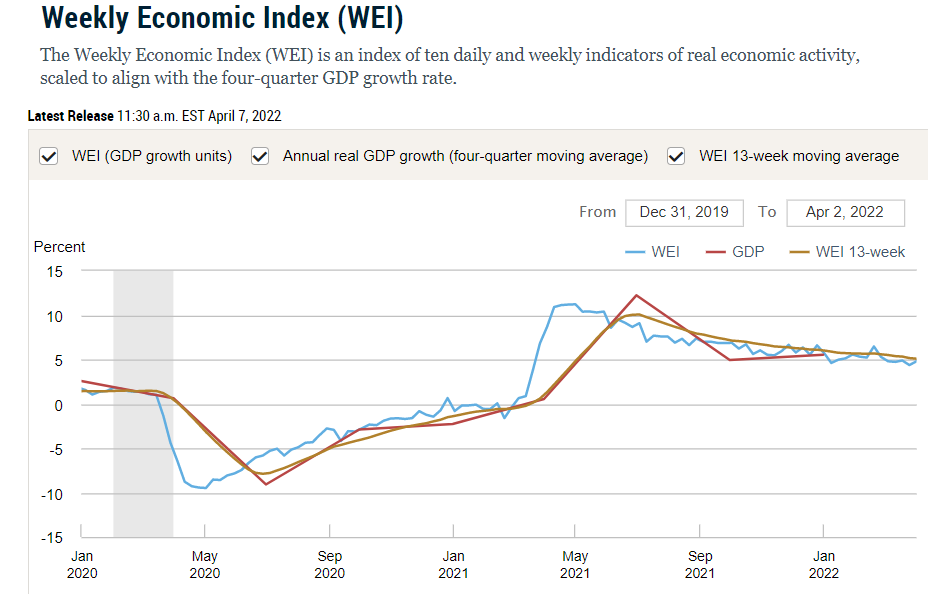

Despite the gloomy outlook, current readings of key business cycle indicators continue to show that US growth remains intact. The New York Fed’s Weekly Economic Index, for example, still estimates a clear bias for economic growth through April 2.

Pairing the low expectations for economic activity in the near-term future with relatively solid current conditions imply that some degree of deterioration in the macro trend will become prominent in upcoming data releases. Incoming numbers to watch start with Thursday’s report (Apr. 14) on US retail sales for March. Note, however, that economists are expecting a relatively robust pickup in spending for the monthly change, according to Econoday.com’s consensus forecast: +0.6% vs. +0.3% in February.

In addition, Thursday’s weekly update on jobless claims (a leading index for the labor market) is expected to show that new filings for unemployment benefits continue to hold near a 50-year low.

Macro risk is surely on the rise, but expecting it to manifest in the immediate future via incoming US economic data may still be a step too far, at least for now.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report