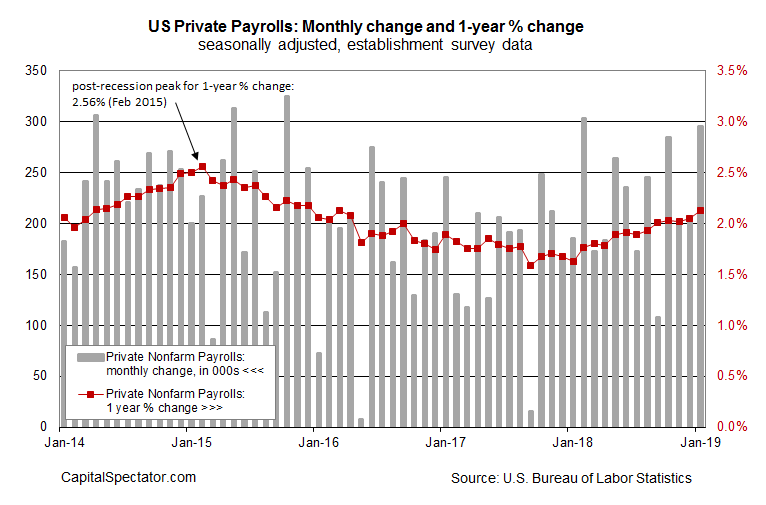

The Labor Department reports that US companies continued to hire workers at a strong pace in January. The 296,000 gain in payrolls last month beat the consensus forecast by a wide margin. Even more impressive, the annual rate of growth for the nonfarm workforce in the private sector ticked up to the strongest pace in nearly three years.

Today’s release follows the upbeat January employment data published by ADP earlier in the week. The two data sets paint a clear picture at the start of the new year: hiring by US companies is strong.

The private-sector workforce increased 2.1% over the 12 months through January, according to government data — a sign that demand for workers is accelerating. Today’s update marks the fifth straight month of year-over-year growth at or above the 2% mark – the longest run of growth by that standard since late-2015/early 2016.

Although there’s been concern that the partial government shutdown that ended last week might skew today’s report, the Labor Department discovered “no discernible impacts” for the data.

Perhaps the most striking aspect of today’s results is that the uptrend in the annual trend for private payrolls remains intact and shows no sign of slow. If anything, the January data suggests the re-acceleration in growth that began in early 2018 appears to be strengthening.

Today’s update reaffirms The Capital Spectator’s business-cycle analysis in recent history, including the Jan. 18 profile that found that a low level of recession risk for the US continued to prevail, based on a broad set of indicators. Although US economic growth appears to be slowing in terms of gross domestic product (GDP), today’s report betrays no sign of deceleration in the labor market.

It’s unclear if the strong data for jobs is an early clue that the GDP trend will soon revive, but the numbers du jour certainly offer a new reason to take a fresh look at the possibility.

Meantime, it’s clear that the case for growth in the near term remains compelling. Exactly what the growth rate will be is open for debate, in part because of the recent weakness in the housing sector. But perhaps that corner of the economy will find some healing in the months ahead via the strong labor market.

“This jobs report is showing no evidence of an economy slowing, certainly not falling into recession,” says Michelle Meyer, chief United States economist for Bank of America Merrill Lynch.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Pingback: US Companies Continued to Hire Workers at a Strong Pace in January - TradingGods.net