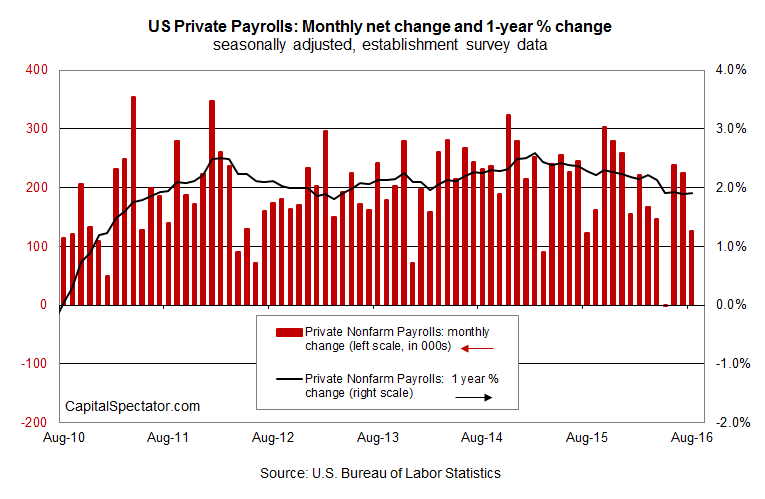

US job growth slowed in August, the Labor Dept. reports, although the year-over-year growth rate remained unchanged at 1.90%. Economists projected that the US companies would add 179,000 jobs last month—the actual increase was considerably lower at 126,000.

The softer gain in August follows two months of solid increases. The average monthly rise for the June-through-August period is a respectable +196,000. The fact that the annual pace of job growth held steady at 1.90% suggests that the downside surprise for last month may be noise.

The main message in today’s update is that the recent slowdown in job growth via the annual trend is likely to endure. The year-over-year advance for private payrolls peaked in February 2015 at 2.58% and has been winding lower ever since. After seven years of economic expansion, one of the longest on record, the forward momentum in the labor market is a bit frayed.

Although the strongest gains are likely behind us for the current cycle, it’s premature to argue that the labor market’s about to suffer a sharp deceleration in the near term. In fact, some economists advise that because the recovery has been comparatively mild and uneven since the recession ended in 2009, the length of the expansion may have a relatively long shelf life.

Nonetheless, some analysts spin today’s number as disappointing. “While it’s still a decent pace of job growth, I think the optics of it is not particularly compelling, to the extent that it reflects a sharp deceleration in the pace of labor-market momentum,” says Millan Mulraine, deputy head of US research and strategy for TD Securities USA.

The danger is that focusing on one monthly number could be leading us astray… again. Recall that payrolls in May collapsed, posting a slight loss for the month. But the apocalypse faded in June and July, courtesy of a dramatic rebound in job growth.

The only solution for cutting through monthly volatility: watching the annual trend. It’s clear that growth momentum is slowing for payrolls, but a 1.90% year-over-year gain is strong enough to keep the economy bubbling for the near term. Still, it’s likely that the annual pace will continue to ease in the months ahead. When should we start worrying in terms of business cycle risk? When the annual rate is moving rapidly toward +1%.

By that standard, there’s still a reasonable case for projecting moderate growth in payrolls and the economy overall for the foreseeable future. If the deceleration in job growth unfolds slowly, as it has over the past year, we could be looking at a year or more of a moderating expansion that keeps recession risk at bay.

“Job growth in August was respectable though not spectacular,” notes Harry Holzer, a former chief economist at the Labor Department and now a professor at Georgetown University

It’s possible, perhaps even likely, that Holzer’s analysis will apply for months to come.

Pingback: US Job Growth Slows in August - TradingGods.net

Pingback: Data Generates Fear that US Economy Is Weakening - TradingGods.net