Rising interest rates may threaten the “soft landing” outlook for the US economy, but the upcoming preliminary estimate of third-quarter GDP from the government still looks set to report that output picked up from Q2.

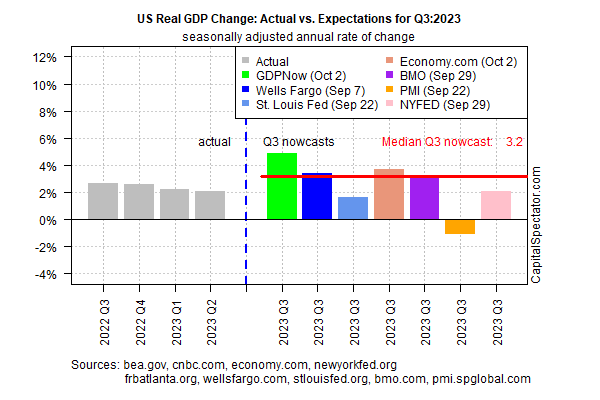

The median nowcast for GDP via several sources compiled by CapitalSpectator.com indicates growth at 3.2% for the July-through-September period (seasonally adjusted annual rate). That’s substantially up from the 2.1% advance in Q2.

But in a sign of what may be brewing, today’s revised Q3 nowcast is fractionally below the previous update. It’s reasonable to assume that more downside revisions are likely ahead of the Oct. 26, when the Bureau of Economic Analysis will publish its Q3 report for GDP. One factor weighing on the outlook for the remaining Q3 nowcasts: rising Treasury yields.

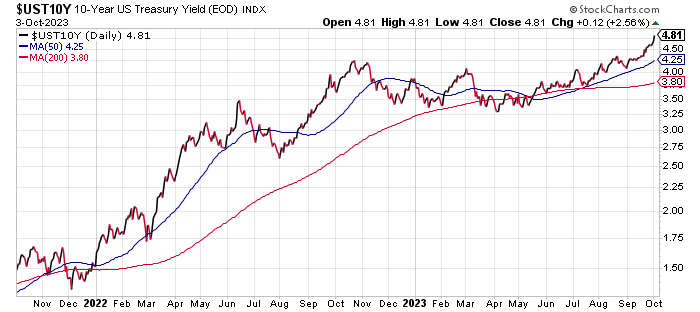

The recent runup in the 10-year yield lifted the benchmark rate to 4.81% on Tuesday (Oct. 3), the highest since 2007. “I think we’re gonna go to five [percent]” for the 10-year yield, predicts former Pimco bond fund manager Bill Gross.

Upside momentum for the 10-year yield is certainly strong lately. The 50-day average for the rate, after briefly falling below its 200-day counterpart in the spring, has recently rebounded, which implies that the market will continue to reprice this yield higher in the near term.

Meanwhile, Fed officials are signaling that interest rate cuts aren’t on the horizon. In fact, it’s premature to rule out another rate hike, advises Cleveland Fed President Loretta Mester. On Monday she said: “At this point, I suspect we may well need to raise the fed funds rate once more this year and then hold it there for some time as we accumulate more information on economic developments and assess the effects of the tightening in financial conditions that has already occurred,”

Jim Bianco, president of Bianco Research, tells CNBC: “I don’t think we’re near the end of this move in the bond market.”

Higher interest rates are a new headwind for the economy in Q4 and beyond. There’s also a risk that today’s 3%-plus nowcast for the upcoming Q3 report will be revised down ahead of the Oct. 26 release. Given the recent persistence in higher nowcasts vs. Q2, however, it’s likely that growth will match or exceed the previous quarter. But the longer that interest rates rise and/or hold on to current levels, the stronger the case for revising current growth estimates down for Q4.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report