The last major economic release for the US in 2015 delivered a cautionary message. Initial jobless claims jumped substantially more than expected, rising to a seasonally adjusted 287,000 for the week through Dec. 26—the highest since July, the Labor Department reports. Claims are still low by historical standards and falling on a year-over-year basis. But putting the latest update into context with recent history hints at the possibility that this leading indicator–after a long and generally consistent decline over the last several years–has run its course in terms of probing ever lower (i.e., bullish) levels. That doesn’t mean that the labor market’s outlook has suddenly switched from positive to negative. Nonetheless, after more than six years of economic growth (in fits and starts), the cycle may be starting to show signs of aging.

Growth momentum still has the upper hand for the macro trend overall, and today’s report certainly doesn’t offer much in the way of arguing otherwise. But as the chart below suggests, new filings for unemployment benefits may have hit a bottom earlier this year and are now meandering higher. In short, the low-hanging fruit has been picked, or so today’s numbers imply.

Perhaps the most-compelling clue for wondering if the best days for claims have passed is the upward-sloping trend in the year-over-year changes, as shown by the gray bars in the upper half of the chart above. Although new filings are still sliding on an annual basis, we’re moving closer to zero and have been for some time. When/if we see claims consistently inching higher vs. year-earlier levels we’ll have a genuine warning signal. It’s anyone’s guess if that’s in store on the other side of tonight’s New Year’s celebrations. But for the moment it’s a topical subject for consideration in the final hours of the year as we ponder what we may find in 2016.

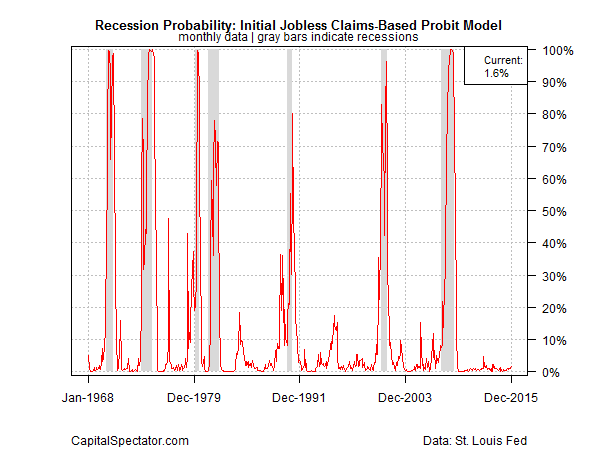

Leaving speculation aside, the good news is that today’s data still point to low recession risk from an econometric perspective, based on running the latest claims figures through a probit model and analyzing the results with the historical record for business-cycle peaks and troughs (via NBER’s data). Jobless claims alone are hardly the last word on monitoring economic risk overall–a more-reliable system is analyzing a diversified mix of numbers, as we do each month (here, for instance). As for the data du jour, new filings are certainly a key input and so today’s report still leaves room for optimism.

Consider too that last week’s data may have been distorted because of the Christmas holiday. The Labor Department, however, advises in today’s release that there were no special factors gumming up the analytics.

“We do have to discount the heightened volatility we have around this time of the year,” said Mike Englund, chief economist at Action Economics, via Bloomberg. “When the dust settles, we’ll see claims drop back down. There will be continued slow improvement in the labor market.”

That’s a good spot for exiting 2015… on an upbeat note. Confirmation may or may not be coming in next week’s monthly payrolls data for December. Meantime, this much is clear: the rest of this year still looks encouraging.

Cheers!