US consumer inflation’s one-year trend eased in August, marking a second month of lesser pricing pressure, the Bureau of Labor Statistics reports. But the pace of inflation remains elevated and a new run of analytics suggest that the pullback from the recent surge will be unfold slowly.

Let’s start with core CPI, which eased to a 4.0% year-over-year rate last month. The softer pace for the one-year change marks the second straight month of lesser inflation following the 4.5% peak in June.

The pullback strengthens, if only modestly, the view that the inflationary surge earlier from earlier in the year is abating. Although the June peak will likely mark the high point for the pandemic-related runup in inflation, the return to the low-2% range that prevailed before the coronavirus hit is currently expected to unfold slowly.

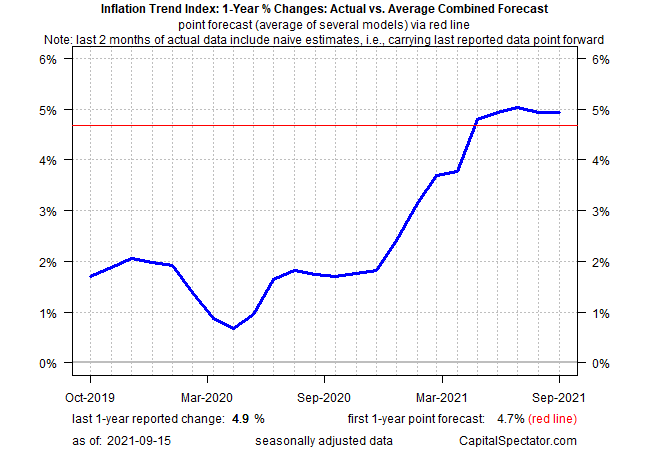

Consider CapitalSpectator.com’s Inflation Trend Index (ITI), which seeks to provide a degree of forward guidance on the directional bias of pricing activity in real time. ITI has been projecting a peak in inflation for several months (see the previous ITI update in late-August, for example). Revising the analytics with new data published through yesterday (Sep. 14) points to the inflation trend holding steady in September and then dipping moderately in October (red line in chart below).

For a clearer look at the evolution in ITI’s direction bias estimates to date, here’s how monthly changes in the index compare. No change in ITI is expected for September.

The key takeaway: inflation has probably peaked, as ITI has been anticipating throughout the summer. But for the moment, the retreat from the peak is expected to proceed slowly. As a result, inflation will remain elevated, with a downside bias, for the foreseeable future.

What factors could alter this outlook? The course of the pandemic is probably the main variable. If Covid-19 cases and fatalities fall substantially in the weeks and months ahead, the shift could be a boost to economic activity and perhaps keep inflation higher for longer than currently expected. Alternatively, if the pandemic worsens due to variants or other factors, economic growth could slow at an accelerated rate, and in turn cut inflationary pressure deeper and faster than ITI’s current outlook anticipates.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Pingback: US Inflation Is Cresting - TradingGods.net