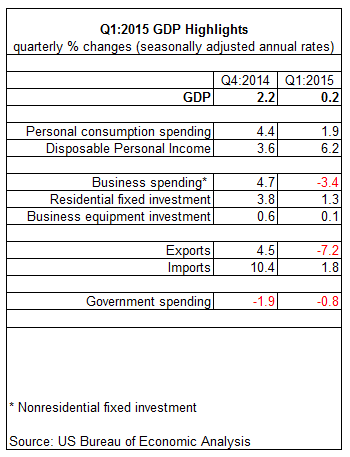

The US economy expanded by a slim 0.2% in this year’s first quarter vs. the previous three-month period (seasonally adjusted real annual rate), the Bureau of Economic Analysis reports. The incremental gain is well below the consensus forecast (and The Capital Spectator’s median estimate). All of the major components in today’s release suffered, with one key exception: disposable personal income (DPI), which posted sharply higher growth in Q1 vs. last year’s Q4.

DPI jumped 6.2% in real terms in the first three months of 2015, the strongest gain in more than two years. The robust advance in income suggests that consumers aren’t financially stressed and maintain the capacity to ramp up spending in the quarters ahead. If so, economic growth may revive in Q2.

Keep in mind, however, that a strong increase in DPI is encouraging, but it’s no silver bullet. In 2008’s Q2, for instance, real DPI surged more than 8%–just as the Great Recession was getting started.

In any case, there was minimal appetite for spending in the quarter that just ended. Personal consumption expenditures rose 1.9% in Q1, less than half the gain in the previous quarter and the slowest advance since 2014’s Q1, when GDP shrank 2.1%.

Overall, the Q1 GDP numbers cast a dark shadow over the economic outlook. There’s still a general view that we’ll see a second-quarter rebound. But optimism requires a bit more faith in the wake of today’s disappointing numbers.

As for the implications on the timing of the first rate hike by the Federal Reserve, the economy’s deceleration to stall speed all but rules out a rate hike in the near term. June is almost certainly off the table as a possible date and there’s quite a bit more doubt that anything will change by the Fed’s September meeting.

Pingback: GDP Data Casts Shadow Over Economic Outlook

Pingback: Wall Street National | Estimating Recession Risk After The Weak Q1 GDP Report - Wall Street National

Pingback: Wall Street National | Is The Market Still Looking For A Fed Rate Hike This Year? - Wall Street National