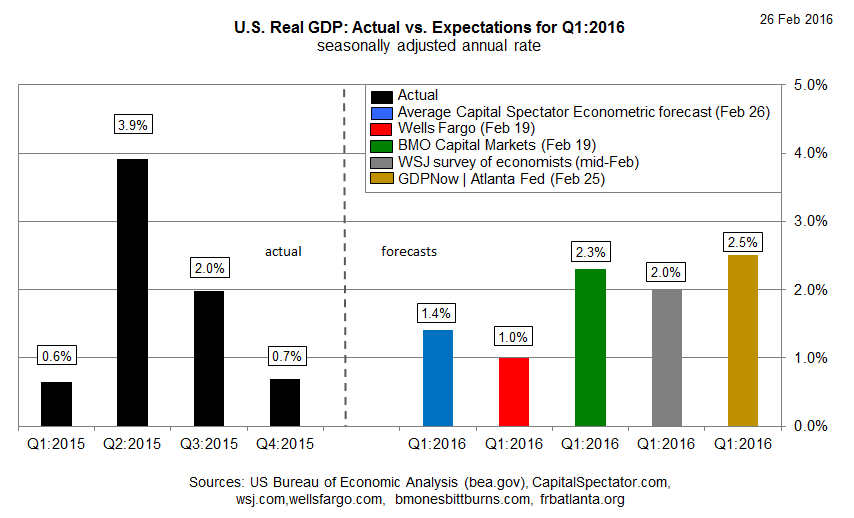

The US economy’s stall speed expansion in last year’s fourth quarter is on track to accelerate in Q1, according to a variety of estimates. There’s disagreement about the strength of the revival, but a diverse set of forecasts are in agreement that Q1 economic activity will strengthen in the “advance” estimate that the Bureau of Economic Analysis will publish on Apr. 29.

Among the stronger forecasts: yesterday’s revised Q1 outlook from the widely followed nowcast via the Atlanta Fed. The bank’s GDPNow model is currently projecting a 2.5% increase (seasonally adjusted annual rate) in output for the first three months of this year, based on the Feb. 25 update. If the forecast holds, the US macro trend will post a solid acceleration in growth over the tepid 0.7% rise in last year’s final quarter.

Even the comparatively pessimistic estimates at the moment see some improvement in the Q1 data, if only on the margins. Wells Fargo’s latest prediction (Feb. 19), for instance, is currently looking for a slightly stronger pace: 1.0%.

Economists overall are expecting a healthy revival in growth. This month’s survey data via The Wall Street Journal points to a 2.0% advance in Q1 GDP, based on the average estimate among analysts polled by the newspaper.

The Capital Spectator’s average econometric estimate is relatively soft in comparison with the crowd’s expectations, although here too the current outlook is pointing to a modestly stronger rate of expansion: 1.4%.

It’s still early for Q1 data, of course, and so there’s a long road ahead between now and the government’s preliminary estimate at the end of April. The path ahead could be bumpy, in part because of ongoing concerns about blowback from a wobbly global economy. “What we’re concerned about is China,” says Charles Collyns, chief economist at the Institute of International Finance. “Could there be a break on China’s currency that could tip the global economy into recession?”

For the moment, any fallout is expected to have a limited impact on the bounce-back forecast for US GDP growth in Q1. Monitoring how, or if, this outlook changes is job one for macro analysis in the weeks ahead. Meantime, here’s a sampling of recent estimates for US economic growth in 2016’s first quarter:

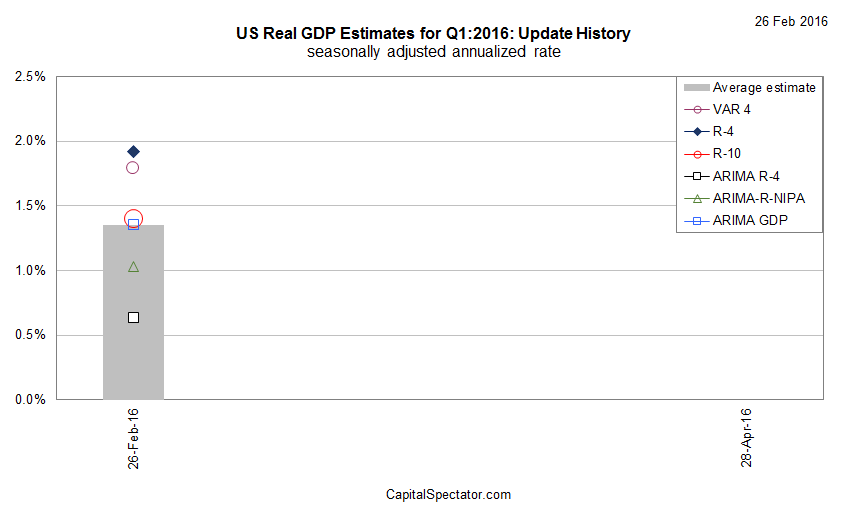

Here are the various forecasts that are used to calculate CapitalSpectator.com’s average estimate:

As updated estimates are published, based on incoming economic data, the chart below tracks the changes in the evolution of The Capital Spectator’s projections.

Finally, here’s a brief profile for each of The Capital Spectator’s GDP forecast methodologies:

R-4: This estimate is based on a multiple regression in R of historical GDP data vs. quarterly changes for four key economic indicators: real personal consumption expenditures (or real retail sales for the current month until the PCE report is published), real personal income less government transfers, industrial production, and private non-farm payrolls. The model estimates the statistical relationships from the early 1970s to the present. The estimates are revised as new data is published.

R-10: This model also uses a multiple regression framework based on numbers dating to the early 1970s and updates the estimates as new data arrives. The methodology is identical to the 4-factor model above, except that R-10 uses additional factors—10 in all—to forecast GDP. In addition to the data quartet in the 4-factor model, the 10-factor forecast also incorporates the following six series: ISM Manufacturing PMI Composite Index, housing starts, initial jobless claims, the stock market (Wilshire 5000), crude oil prices (spot price for West Texas Intermediate), and the Treasury yield curve spread (10-year Note less 3-month T-bill).

ARIMA GDP: The econometric engine for this forecast is known as an autoregressive integrated moving average. This ARIMA model uses GDP’s history, dating from the early 1970s to the present, for anticipating the target quarter’s change. As the historical GDP data is revised, so too is the forecast, which is calculated in R via the “forecast” package, which optimizes the parameters based on the data set’s historical record.

ARIMA R-4: This model combines ARIMA estimates with regression analysis to project GDP data. The ARIMA R-4 model analyzes four historical data sets: real personal consumption expenditures, real personal income less government transfers, industrial production, and private non-farm payrolls. This model uses the historical relationships between those indicators and GDP for projections by filling in the missing data points in the current quarter with ARIMA estimates. As the indicators are updated, actual data replaces the ARIMA estimates and the forecast is recalculated.

VAR 4: This vector autoregression model uses four data series in search of interdependent relationships for estimating GDP. The historical data sets in the R-4 and ARIMA R-4 models noted above are also used in VAR-4, albeit with a different econometric engine. As new data is published, so too is the VAR-4 forecast. The data sets range from the early 1970s to the present, using the “vars” package in R to crunch the numbers.

ARIMA R-NIPA: The model uses an autoregressive integrated moving average to estimate future values of GDP based on the datasets of four primary categories of the national income and product accounts (NIPA): personal consumption expenditures, gross private domestic investment, net exports of goods and services, and government consumption expenditures and gross investment. The model uses historical data from the early 1970s to the present for anticipating the target quarter’s change. As the historical numbers are revised, so too is the estimate, which is calculated in R via the “forecast” package, which optimizes the parameters based on the data set’s historical record.

Pingback: 02/26/16 – Friday’s Interest-ing Reads | Compound Interest-ing!

Pingback: Weighing The Week Ahead: Can US Economic Strength Support Stocks? – Nasdaq – Investing Signal

Pingback: Weighing The Week Ahead: Can US Economic Strength Support Stocks? – Nasdaq – Short Term Wealth

Pingback: Weighing The Week Ahead: Can U.S. Economic Strength Support Stocks? | InvestingLab.com

Pingback: Stronger U.S. Economy Could Support Rebound in Stocks