Financial stress in the US has been low in recent weeks, according to four benchmarks published by Federal Reserve banks. The relative calm comes in the wake of the first increase in the Fed funds rate in nearly a decade, a widening of the high-yield spread and increased anxiety about the outlook for economic growth. Despite those changes, several metrics that are designed to quantify the overall level of financial stress point to a generally serene state of affairs for the nation’s financial system.

The St. Louis Fed’s FRED database collects the data on four indexes that quantify stress in the financial system across a range of factors. Each benchmark uses a different methodology and dataset and so reviewing all of the indexes offers a relatively robust and diversified risk profile. The following is a summary of where we stand at the moment, based on numbers collected this morning (Dec. 22).

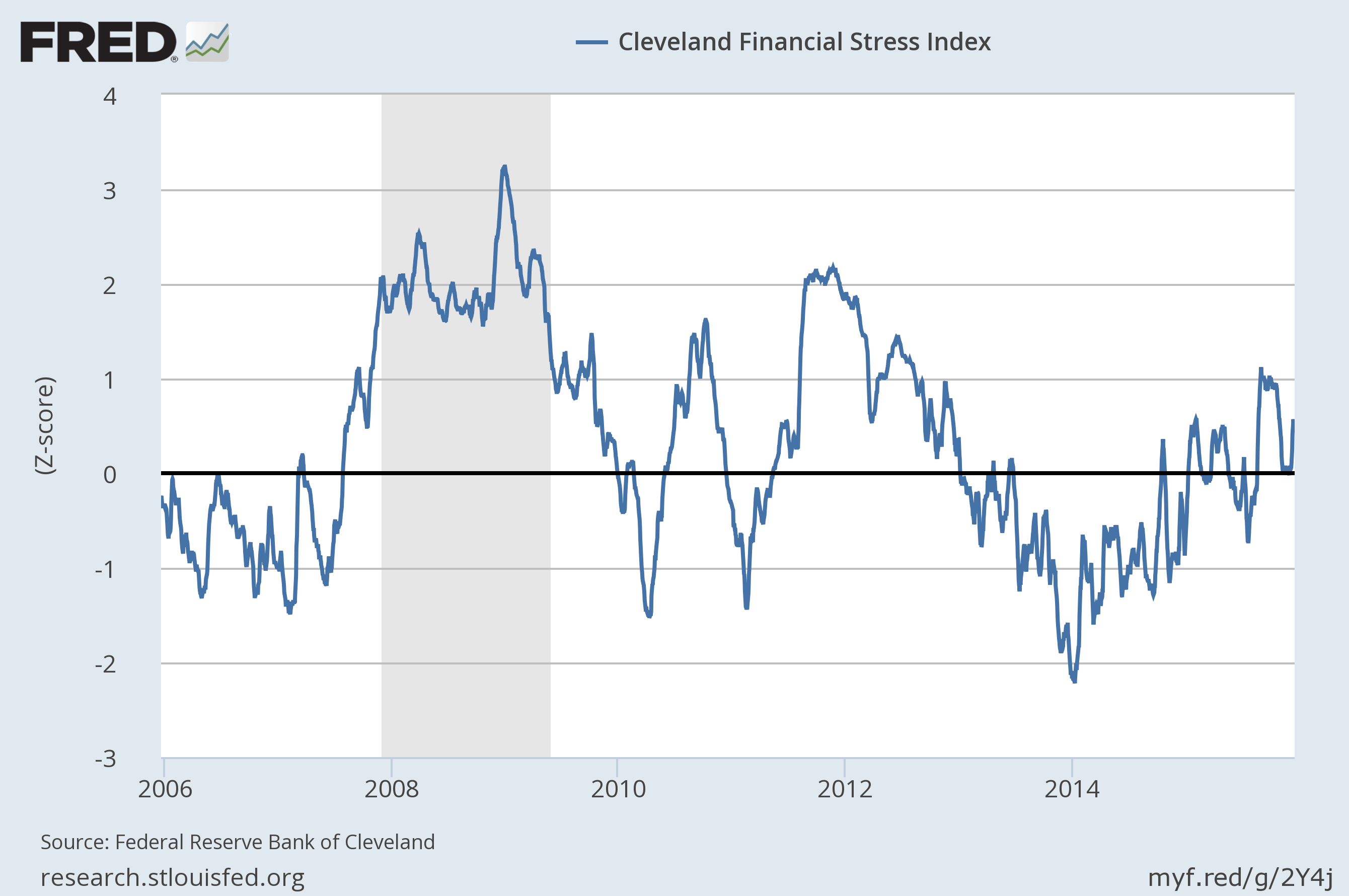

Cleveland Fed US Financial Stress Index

Published daily by the Federal Reserve Bank of Cleveland, this benchmark is currently reflecting “normal” levels of financial stress. The +0.44 reading for Dec. 18 has declined from recent highs of roughly +1.0 in September and October. But only values at or above +1.82 are considered a signal of “significant” stress.

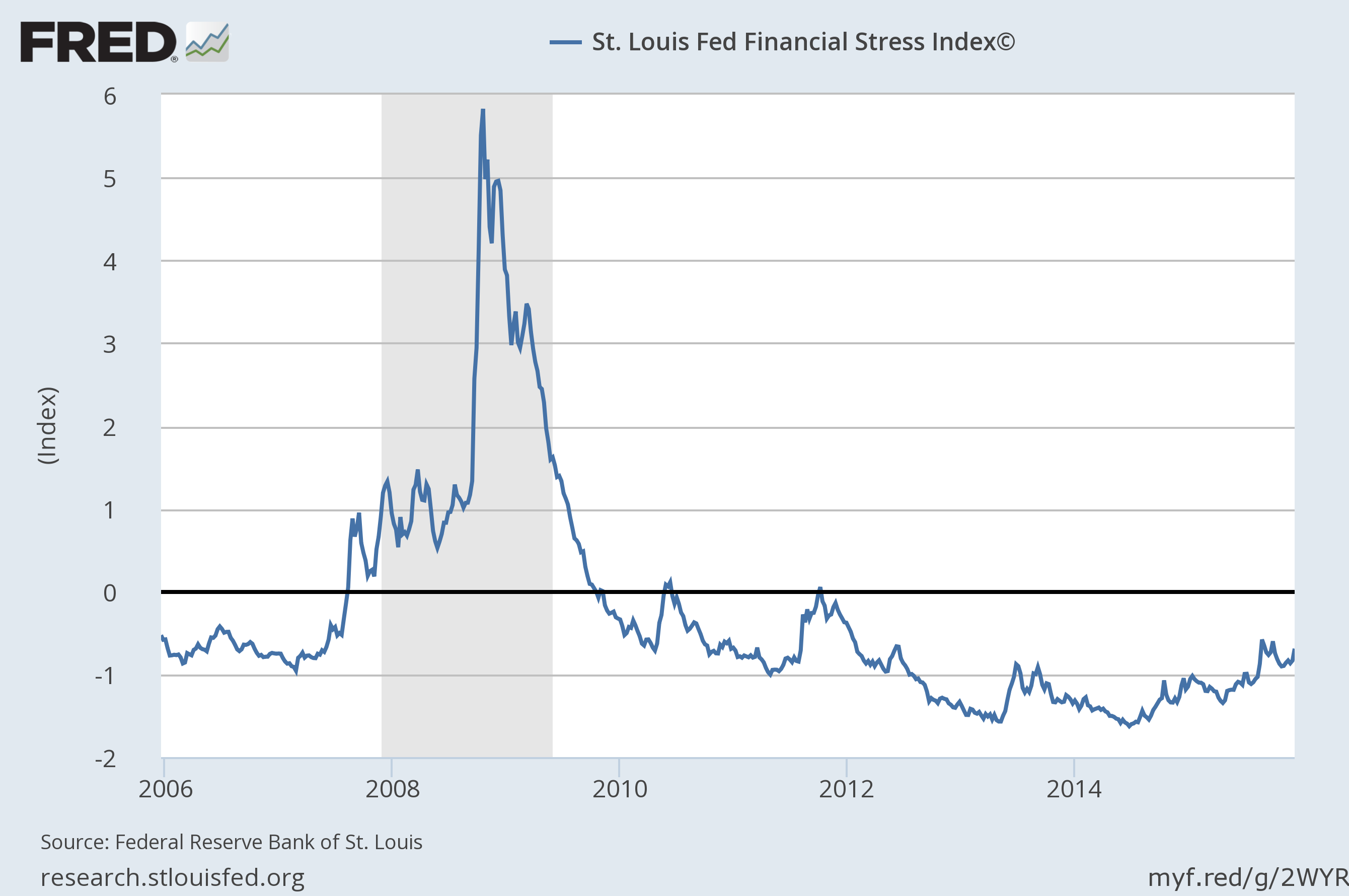

St. Louis Fed US Financial Stress Index

This weekly measure of financial stress has ticked higher in recent weeks, reaching -0.69 for the week through Dec. 11. But that’s modestly below the recent peaks and is reflective of low risk. According to the St. Louis Fed, “values below zero suggest below-average financial market stress.”

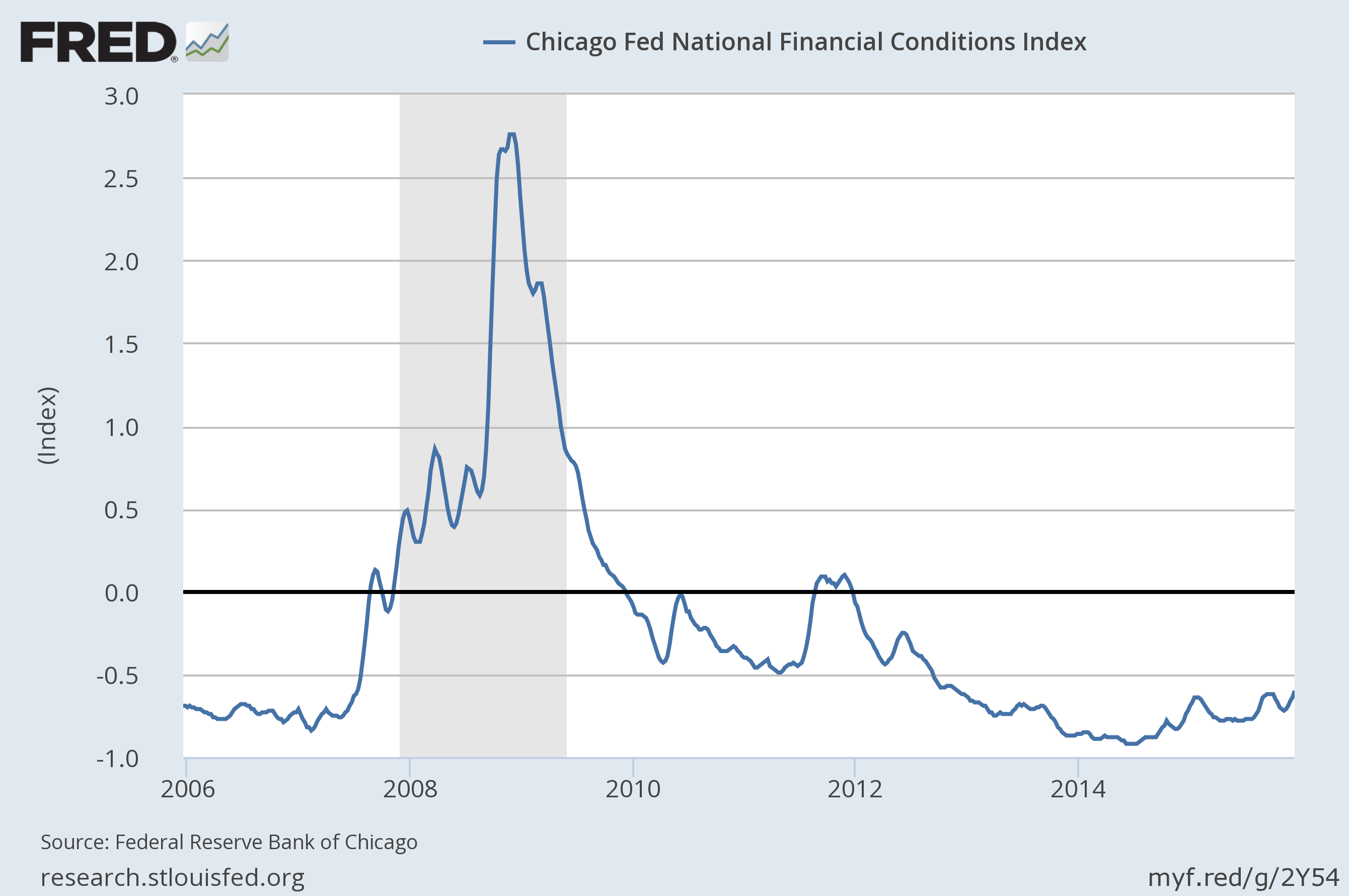

Chicago Fed National Financial Conditions Index

In contrast with the other stress benchmarks, the Chicago Fed’s weekly index of US financial conditions has increased to a two-year high, reaching -0.60 for the week through Dec. 11. But the current level still reflects “loose” conditions, as per readings below zero. Only values above zero indicate financial conditions that are tighter than average.

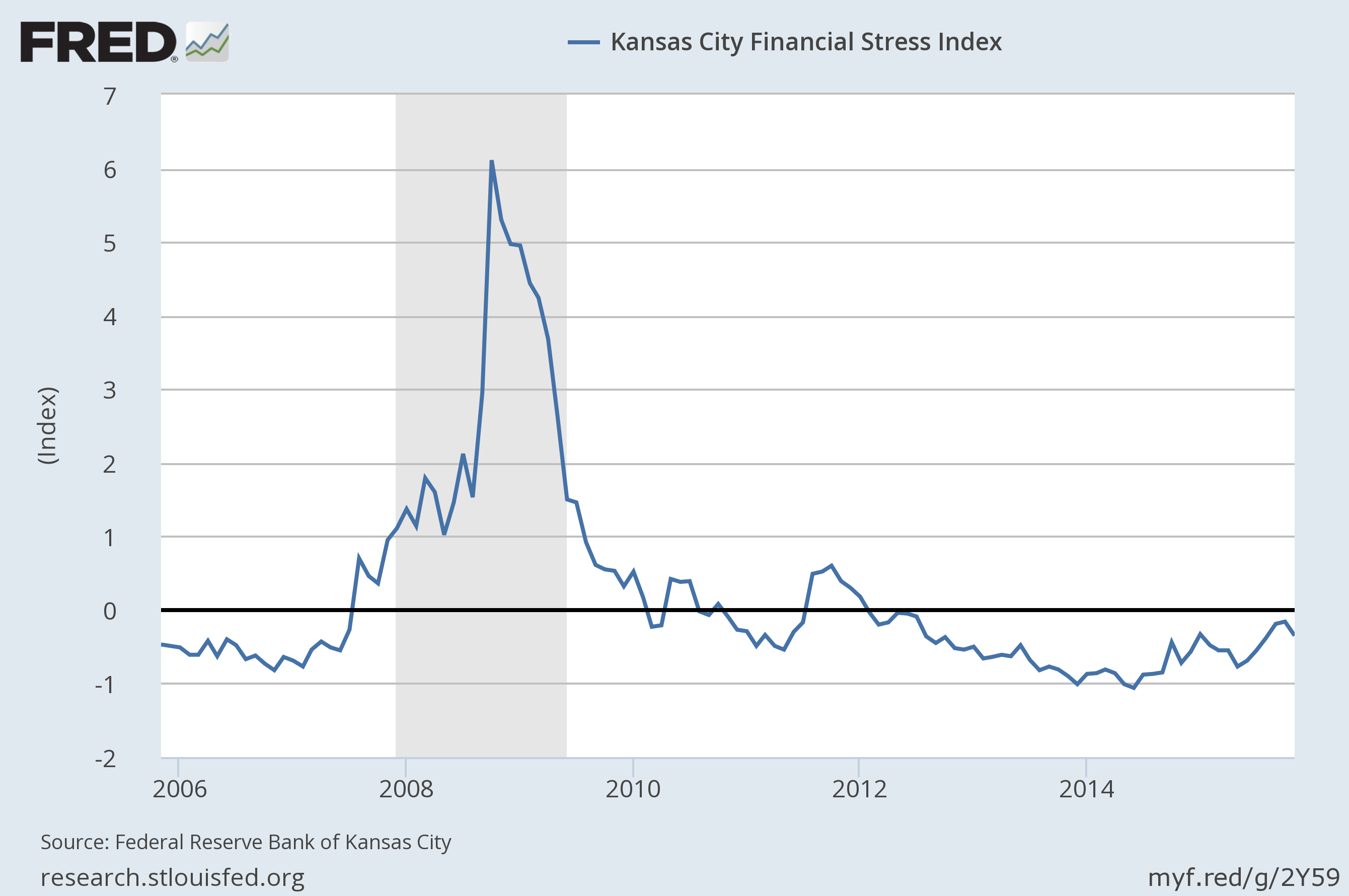

Kansas City Fed US Financial Stress Index

This monthly benchmark of financial stress dipped in November, pulling back from a 3-year high in October 2015. Compared with the last several business cycles, however, the current reading remains well below levels that have previously signaled high risk.

Pingback: Financial Stress Remains Low in US