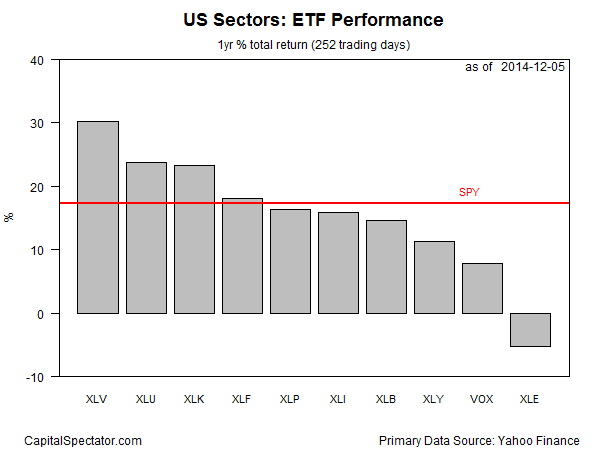

The great divide between health care and energy in US equities rolls on. Health care shares continue to dominate the recent rally in the US stock market while energy firms remain conspicuous laggards, based on one-year returns. In fact, energy is the only sector currently posting a loss for the trailing 252-trading-day period, according to a representative set of ETFs through Friday (Dec. 5). Positive momentum certainly favors the health sector lately, and it wouldn’t be surprising to see it persist in the near term. But it’s also reasonable to wonder if recent events are laying the foundation for a profitable reversion-to-the-mean trade in the energy patch at some point.

As for the here and now, the Health Care Select Sector SPDR (XLV) is up a bit more than 30% through Friday’s close on a total return basis. XLV’s bull run is nearly double the gain for the US stock market overall, based on the SPDR S&P 500 (SPY), which is ahead by roughly 17% over the past 252 trading days (one year). Meantime, energy — the worst-performing equity sector — is off nearly 7% over that span.

The second-best equity performer is the Utilities Select Sector SPDR (XLU), which is ahead by nearly 24% over the past year. Meantime, the telecom sector is the second-worst performer, albeit by way of a relatively mild rise. Vanguard Telecom Services (VOX) is up around 7% on a total-return basis over the past 12 months.

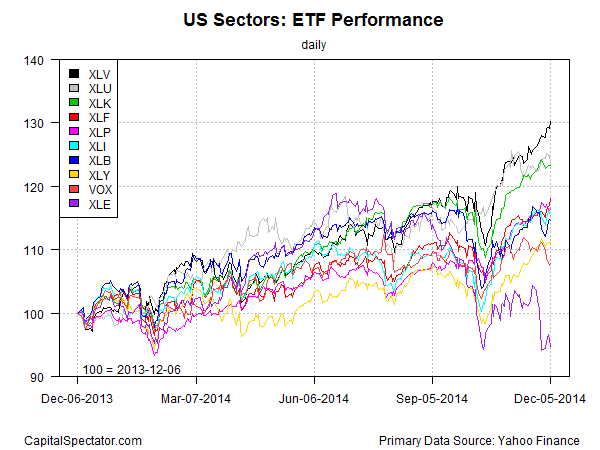

Here’s how the trailing one-year performance histories stack up when we index all the sector ETFs to 100 as of Dec. 6, 2013. Note the acceleration in health care’s rally lately (black line at top). Meantime, energy’s performance has given back all of its modest recovery in recent weeks (purple line at bottom).

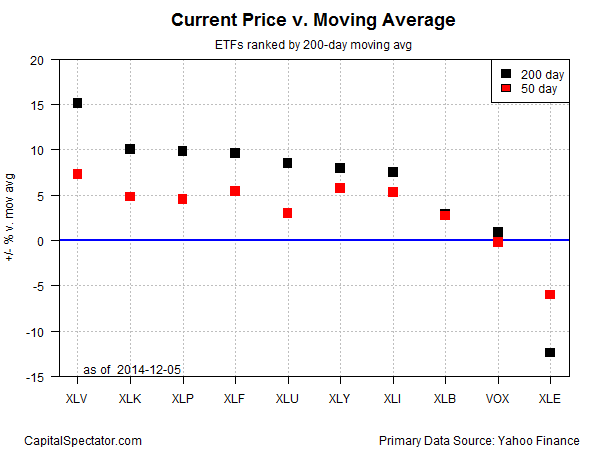

Finally, here’s a comparison of recent momentum for the sector ETFs via current prices relative to trailing 50- and 200-day moving averages, as shown in the next chart below. For example, Health Care Select Sector SPDR (XLV) is 15.1% above its 200-day moving average (black square in upper left-hand corner). At the opposite end of the spectrum in the lower right-hand corner is Energy Select Sector SPDR ETF (XLE), which closed on Dec. 5 at more than 12% below its 200-day moving average.

Here’s a list of the sector ETFs cited above, with links to summary pages at Morningstar.com for additional research:

Consumer Discretionary (XLY)

Consumer Staples (XLP)

Energy (XLE)

Financial (XLF)

Healthcare (XLV)

Industrial (XLI)

Materials (XLB)

Technology (XLK)

Utilities (XLU)

Telecom (VOX)

Pingback: Energy Sector Only Sector Posting a Loss