Despite rising headwinds for the global economy, US output remains set to rebound in the second quarter, based on recent estimates from several sources.

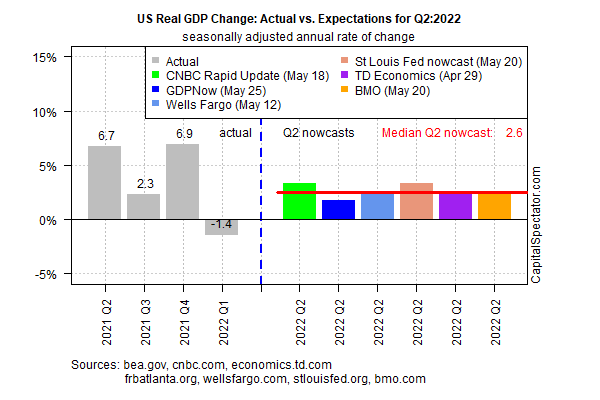

Economic growth is expected to recover with a 2.6% increase in GDP (seasonally adjusted annual rate) for the April-through-June period via the median of several Q2 nowcasts compiled by CapitalSpectator.com. The growth rate is unchanged from the previous estimate published last week and marks a robust bounce from the 1.4% contraction reported for Q1.

The projected Q2 rebound aligns with a new forecast released yesterday by the nonpartisan Congressional Budget Office, which paints a relatively upbeat outlook for the US economy. “In CBO’s projections, the current economic expansion continues, and economic output grows rapidly over the next year. Consumer spending increases, driven by strong gains in spending on services.”

Despite the apparent resilience for the US economy, headwinds are building for global economic activity, warned the head of the World Bank on Wednesday. Speaking at a US business conference, David Malpass says it difficult to “see how we avoid a recession.” He cites several factors, including rising prices for food and fertilizer due to Russia’s invasion of Ukraine and a series of coronavirus lockdowns in China.

In fact, China’s leaders are increasingly worried about the country’s outlook and convened an emergency meeting yesterday to address decelerating growth. The goal, state media reports, is to promote new measures to stabilize the economy.

For the US, recent economic data suggests that recession risk for the immediate future is still low. Nonetheless, some economists are forecasting rising odds of a downturn for 2023.

“A recession is pretty likely” next year, former Federal Reserve vice chair Alan Blinder tells CNBC. “I don’t mean 89% probability, but maybe 50 to 60% probability,” he said, although any downturn will be mild, he advises.

Gus Faucher, chief economist at PNC Financial Services Group, also thinks the US will sidestep a recession this year, but the risks rise for 2023. “The likelihood of recession this year is pretty low,” he predicts, but “it gets dicier in 2023 and 2024.”

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report