The third-quarter GDP report surprised most economists with a blow-out 4.9% gain. Is a downside reversal brewing for Q4?

Early estimates for the final months of 2023 point to a substantially softer pace of economic activity. It’s premature to say for sure if the deceleration will mark a turning point that quickly leads to recession in the new year or just a slower expansion, but the early signals suggest that the expansion will survive through the end of the year.

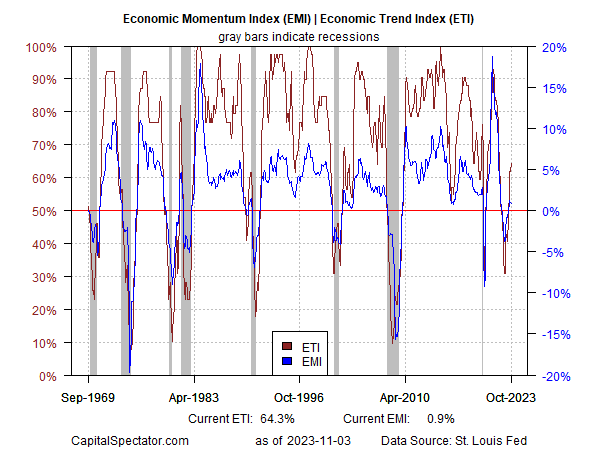

A productive way to estimate the ebb and flow of US macro risk in real time is monitoring the incoming data for key indicators that provide a summary of the US economic activity. On that basis the results are aggregated in two proprietary business-cycle indicators (ETI and EMI) that are updated weekly in The US Business Cycle Risk Report. Here’s a quick summary from the current edition.

Let’s start with the still-relevant fact that ETI and EMI continue to hold on to the recent rebound and remain well above their respective tipping points that mark the start of NBER-defined recessions. The current reading through October reflects partial data, but the numbers published to date strongly suggest that the expansion remains intact at the start of Q4.

Using an econometric technique to project ETI and EMI through December show a clear bias in favor of expecting growth through December.

The question is whether the incoming numbers for the underlying components will post downside surprises that show the economy is decelerating much more than the ETI/EMI projections imply? That’s a low risk, based on the econometric estimates, which have a reliable history of estimating near-term conditions.

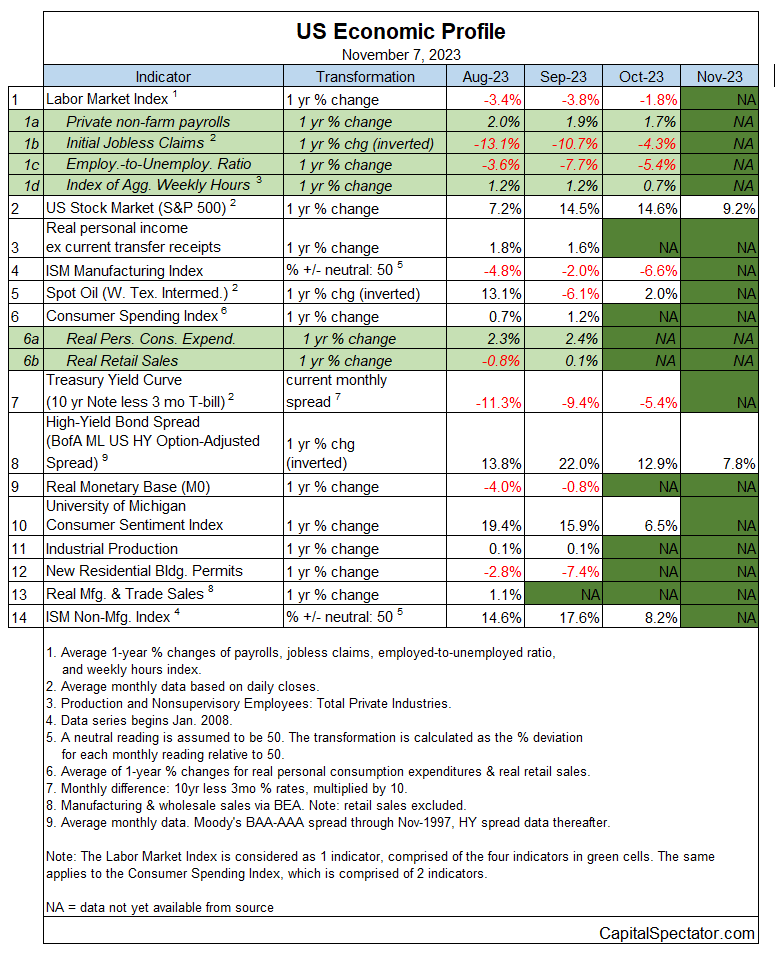

The reliability of the forecast will be tested in the upcoming reports for the missing data points in the following indicators that are used to calculate ETI and EMI.

For now, the main takeaway is that the expected slowdown for US economic activity for Q4 will be conspicuous (relative to Q3) but moderate. A recession could be brewing, but the current data suggests it won’t start in Q4.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report