The global economy is under pressure these days, suffering from a troubling mix of heightened geopolitical risk and wobbly macro reports. Despite the challenging environment, the US economy still looks resilient, based on the current numbers through November. Tracking a diversified set of indicators shows that macro momentum was solidly positive through last month. But at a time when the economic trend for the US appears to be strengthening, new threats are on the horizon. In addition to the familiar and long-simmering challenges facing Europe and Japan, a crisis may be brewing in emerging markets in the wake of sharply lower oil prices. As a result, blowback risk is rising for the developed world. The US isn’t immune to the turbulence, but the downside risks for the near term are limited due to the country’s positive macro momentum of late.

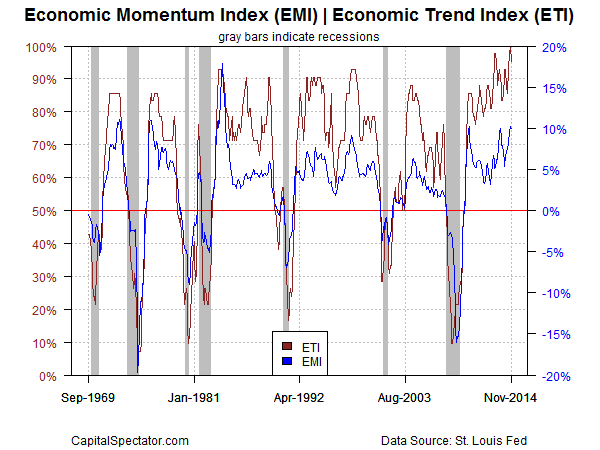

Using a methodology outlined in Nowcasting The Business Cycle: A Practical Guide For Spotting Business Cycle Peaks, economic and financial trends suggest that recession risk for the US remains low as of November. The Economic Trend and Momentum indices (ETI and EMI, respectively) are still at levels that equate with expansion. The current profile of published indicators through last month (12 of 14 data sets) for ETI and EMI reflect solidly positive trends.

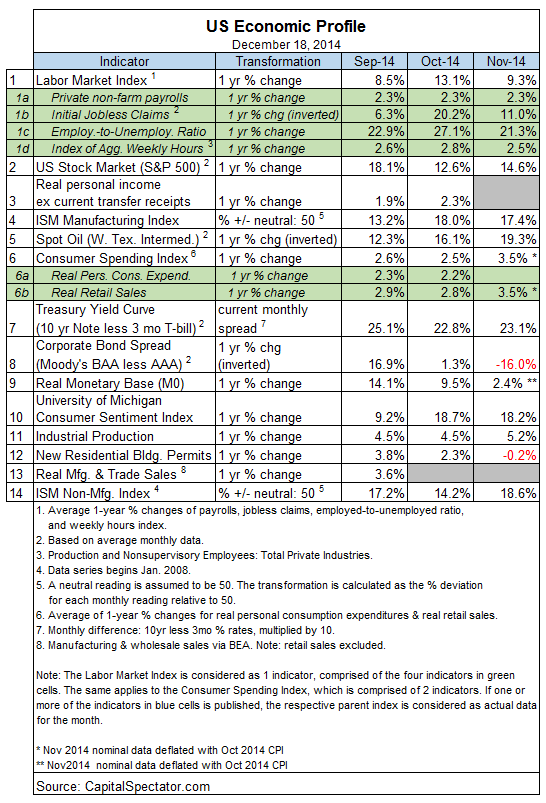

Here’s a summary of recent activity for the components in ETI and EMI:

Aggregating the data into business cycle indexes continues to show positive trends. The latest numbers for ETI and EMI indicate that both benchmarks are well above their respective danger zones: 50% for ETI and 0% for EMI. When the indexes fall below those tipping points, we’ll have clear warning signs that recession risk is elevated. Based on the latest updates, there’s still a sizable margin of safety between current values for November and the danger zones, as shown in the chart below. (See note below for ETI/EMI design rules.)

Translating ETI’s historical values into recession-risk probabilities via a probit model also suggests that business cycle risk remains low for the US. Analyzing the data with this methodology implies that the odds are virtually nil that the National Bureau of Economic Research (NBER) — the official arbiter of US business cycle dates — will declare last month as the start of a new recession.

Let’s also consider how ETI’s values may evolve as new data is published. One way to estimate expected values for this index is with an econometric technique known as an autoregressive integrated moving average (ARIMA) model, based on calculations via the “forecast” package for R, a statistical software environment. The ARIMA model calculates the missing data points for each indicator, for each month through January 2015. (September 2014 is currently the latest month with a complete set of published data). Based on today’s projections, ETI is expected to remain well above its danger zone in the near term.

Forecasts are always suspect, of course, but recent projections of ETI for the near-term future have proven to be relatively reliable guesstimates vs. the full set of published numbers that followed. That’s not surprising, given the broadly diversified nature of ETI. Predicting individual components, by contrast, is prone to far more uncertainty in the short run. As such, the latest projections (the four black dots on the right in the chart above) offer support for cautious optimism. The chart above also includes the range of vintage ETI projections published on these pages in previous months (blue bars), which you can compare with the complete monthly sets of actual data that followed, based on current numbers (red dots). The assumption here is that while any one forecast for a given indicator is likely to be wrong, the errors may cancel out to some degree by aggregating a broad set of predictions. The historical record for this forecast methodology suggests that’s a reasonable assumption for looking ahead to the next few months.

For additional perspective on judging the value of the forecasts via the historical record, here are the previous updates for the last three months:

20 Nov 2014

20 Oct 2014

19 Sep 2014

Note: ETI is a diffusion index (i.e., an index that tracks the proportion of components with positive values) for the 14 leading/coincident indicators listed in the table above. ETI values reflect the 3-month moving average based the transformation rules defined. EMI measures the same set of indicators/transformation rules based on the 3-month average of the median percentage change for the 14 indicators.

Pingback: Economic Profile for U.S. Appears To Be Positive