Deutsche Bank’s chief international economist advises that the US isn’t tipping into a recession. “There is a big disconnect between the current narrative in both equity and rates markets and the actual economic data,” he says via Bloomberg. “This economy is stronger than its reputation and for some reason many investors want to hold onto the 2009 story of ‘the economy is not good’ “.

That’s been the narrative all along for The Capital Spectator’s proprietary business cycle indexes. Macro risk has risen lately, according to a markets-based perspective (as discussed earlier this month), but the broad trend for the US remains positive, based on published figures to date for a diversified set of economic and financial indicators. Although the US macro trend has decelerated over the last few months–a slowdown that’s been projected on these pages for months (see here, for instance)–the available numbers in the aggregate continue to reflect a growth bias.

That said, it’s clear that the positive bias has weakened. In fact, next week’s “advance” estimate of third-quarter GDP is on track to suffer a sharp slowdown. The Atlanta Fed’s revised nowcast (as of Oct. 20) for Q3 GDP is a sluggish 0.9%–a hefty decline from Q2’s robust 3.9% increase (seasonally adjusted annual rate). The Wall Street Journal’s current survey of economists sees a stronger GDP gain for Q3—2.0%, based on the average estimate. But most forecasts are in agreement that the pace of growth has decelerated in recent months.

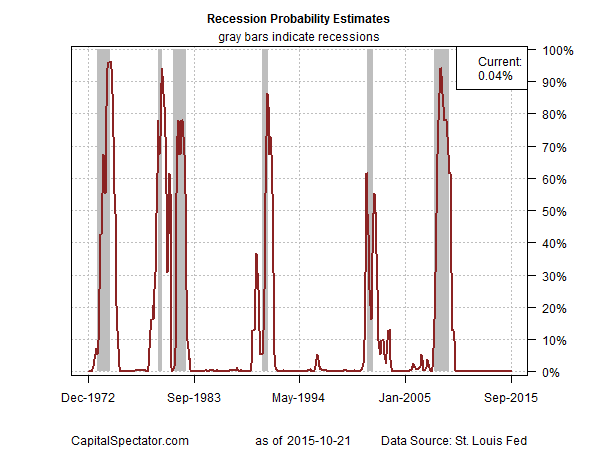

For the moment, however, making the leap from a lesser rate of growth to an NBER-defined recession for the US remains an act of speculation—and one with minimal support in the numbers published to date. Recession risk in the US remained low through last month, based on a broad set of economic and financial indicators through September 2015. Near-term projections of The Capital Spectator’s proprietary business cycle indexes reflect ongoing deceleration, but there’s still no sign that the macro trend overall has turned negative in a clear an unambiguous degree. Cherry-picking a few indicators to promote a particular agenda may suggest otherwise, but the overall state of macro in the US hasn’t rolled over, at least not yet.

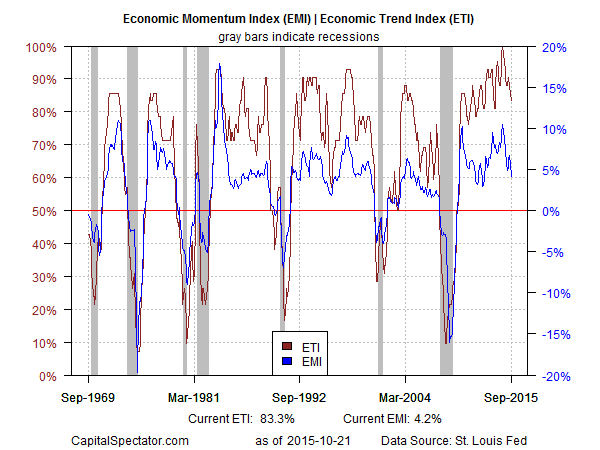

Using a methodology outlined in Nowcasting The Business Cycle: A Practical Guide For Spotting Business Cycle Peaks, an aggregate of economic and financial trend behavior shows that business-cycle risk remained low through last month. The Economic Trend and Momentum indices (ETI and EMI, respectively) are still at levels that equate with expansion. The current profile of published indicators through last month (12 of 14 data sets) for ETI and EMI reflect a positive trend overall. The three exceptions through September: the corporate bond spread, the real monetary base, and the US stock market trend. If and when the red ink spreads to other indicators, the outlook would turn substantially darker. But for the moment, it’s still debatable if the worst is over or if deeper trouble awaits in the months ahead.

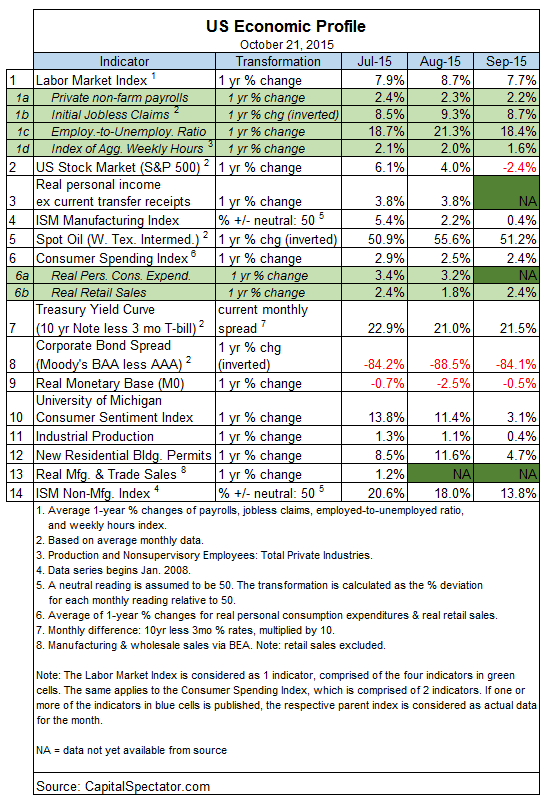

Here’s a summary of recent activity for the components in ETI and EMI and the various calculations that are used to calculate the trend benchmarks:

Aggregating the data into business cycle indexes reflects positive trends overall. The latest numbers for ETI and EMI indicate that both benchmarks are well above their respective danger zones: 50% for ETI and 0% for EMI. When the indexes fall below those tipping points, we’ll have clear warning signs that recession risk is elevated. Based on the latest updates for Septmeber — ETI is 83.3% and EMI is 4.2% — there’s still a wide margin of safety between current values and the danger zones, as shown in the chart below. (See note at the end of this post for ETI/EMI design rules.)

Translating ETI’s historical values into recession-risk probabilities via a probit model also points to low business cycle risk for the US. Analyzing the data with this methodology implies that the odds are virtually nil that the National Bureau of Economic Research (NBER) — the official arbiter of US business cycle dates— will declare last month as the start of a new recession.

For another perspective, consider how ETI may evolve as new data is published. One way to project future values for this index is with an econometric technique known as an autoregressive integrated moving average (ARIMA) model, based on calculations via the “forecast” package for R, a statistical software environment. The ARIMA model calculates the missing data points for each indicator, for each month in this case through November 2015. (Note that July 2015 is currently the latest month with a complete set of published data.) Based on today’s projections, ETI is expected to remain well above its danger zone for the near term. (Keep in mind that frequent business cycle updates are available through each month with The US Business Cycle Risk Report.)

Forecasts are always suspect, of course, but recent projections of ETI for the near-term future have proven to be relatively reliable guesstimates vs. the full set of published numbers that followed. That’s not surprising, given the broadly diversified nature of ETI. Predicting individual components, by contrast, is prone to far more uncertainty in the short run. The latest projections (the four black dots on the right in the chart above) suggest that the economy will continue to expand. The chart above also includes the range of vintage ETI projections published on these pages in previous months (blue bars), which you can compare with the actual data that followed, based on current numbers (red dots). The assumption here is that while any one forecast for a given indicator will likely miss the mark, the errors may cancel out to some degree by aggregating a broad set of predictions. That’s a reasonable assumption via the historical record for the ETI forecasts.

For additional perspective on judging the track record of the forecasts, here are the previous updates for the last three months:

18 Sep 2015

19 Aug 2015

20 Jul 2015

Note: ETI is a diffusion index (i.e., an index that tracks the proportion of components with positive values) for the 14 leading/coincident indicators listed in the table above. ETI values reflect the 3-month average of the transformation rules defined in the table. EMI measures the same set of indicators/transformation rules based on the 3-month average of the median monthly percentage change for the 14 indicators. For purposes of filling in the missing data points in recent history and projecting ETI and EMI values, the missing data points are estimated with an ARIMA model.

What if you were to incorporate a time variable into your model to try to evaluate the probability of a recession given a particular economic profile at each time period from the ending of the last recession? Sorry if you’ve already explained this in an article. Thanks. Craig

Craig,

To an extent I already do this, although it sounds like you have a particular model in mind. Perhaps you can share additional details. Meantime, I run the analytics daily, and provide more frequent updates in The US Business Cycle Risk Report for subscribers–see a sample here:

http://www.capitalspectator.com/premium-research/

The reasoning, as you suggest, is that the incoming numbers keep changing and so real-time analysis can be valuable, particularly in the current climate, when the macro trend has been weaker.

–JP