Bloomberg reports that a rate hike at the Federal Reserve’s June 13-14 policy meeting is a “virtual certainty”, based on Fed funds futures. That’s a clue for thinking that the recent flattening of the Treasury yield curve is on track to become even flatter.

Consider the 10-year/3-month spread, a widely followed benchmark for monitoring the Treasury curve. On Wednesday (May 30), this spread dipped to 1.28 percentage points, an eight-month low, based on daily data via Treasury.gov. The 10-year/2-year spread has also decreased in recent months, sliding to 0.93 percentage points – the lowest since last October.

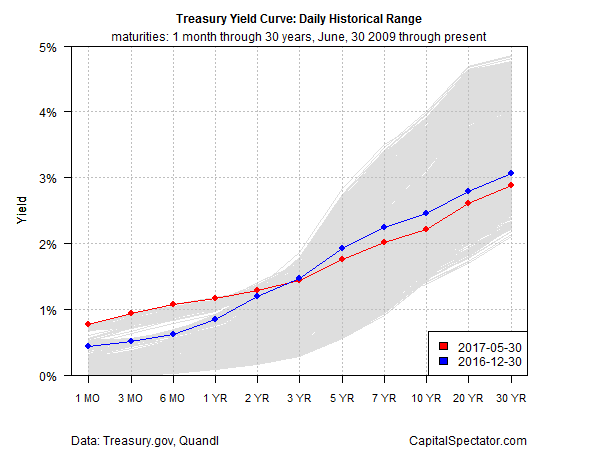

For another perspective, note the change in the full yield curve this year. The red line shows the current yields as of yesterday (May 30) vs. the yields at last year’s close (blue line). The main takeaway: a clear flattening trend has been unfolding so far in 2017.

Another installment of tighter monetary policy implies that longer-dated Treasuries would be the target of selling, which equates with higher yields. But the crowd so far this year has ripped up the script. The benchmark 10-year yield dipped to 2.21% yesterday, close to the lowest level for the year to date.

What’s the rationale for buying Treasuries at the longer end of the curve at a time of high expectations for another rate hike? Yesterday’s weaker-than-expected inflation news is a factor. The annual pace of the personal consumption expenditures (PCE) price index — a benchmark that’s considered to be the Fed’s preferred measure of inflation – fell to 1.7% in April from 1.9% in the previous month. Core PCE (excluding food and energy) also eased, dipping to a 1.5% year-over-year rate last month – a 16-month low. In other words, the central bank’s 2.0% inflation target looks a bit more elusive at the moment.

“The market is realizing that this underlying inflation that the Fed is sort of looking at to hit targets, we’re not hitting those and it looks like we’re topping out,” says Justin Hoogendoorn, head of fixed-income strategy at Piper Jaffray.

Yet Fed Governor Lael Brainard is still recommending more rate hikes, as she advised yesterday in a speech at the New York Association for Business Economics. But she added that “if the soft inflation data persist, that would be concerning and, ultimately, could lead me to reassess the appropriate path of policy.”

For now, however, Brainard is inclined to talk like a hawk. “On balance, when assessing economic activity and its likely evolution, it would be reasonable to conclude that further removal of accommodation will likely be appropriate soon,” she explained.

Mr. Market, however, appears to be pricing in a different game plan.

Pingback: Rate Hike By Federal Reserve Coming - TradingGods.net

Pingback: What I am reading today (31 May 2017) – FinSummary

Pingback: Treasury Yield Curve Continues To Flatten | SAMUELSSONS RAPPORT