The economic news remains mixed for the US, but the Treasury market continues to anticipate that the Federal Reserve’s first interest rate hike since 2006 is near. That’s the implied message in the upward momentum in Treasury yields.

Although the benchmark 10-year yield has pulled back from its recent high of 2.50% on June 10, the rate has been inching higher in recent sessions and settled at 2.42% yesterday (June 23), according to data from Treasury.gov. The rate-sensitive 2-year yield is also sticking close to its recent high.

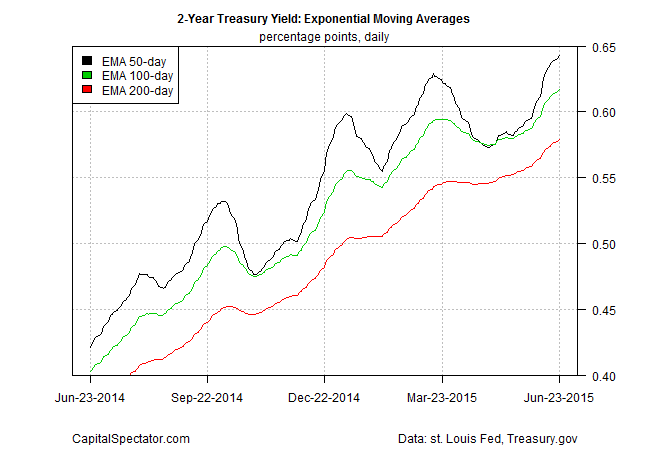

The upward trend is clearer when we look at exponential moving averages (EMA) for yields, a filter that cuts out the short-term noise. The 2-year yield, considered the most sensitive spot on the yield curve for rate expectations, continues to trend higher with a fair degree of strength.

The 10-year yield’s upward momentum is still precarious by comparison, although for the moment the recent transition to a rising bias remains intact.

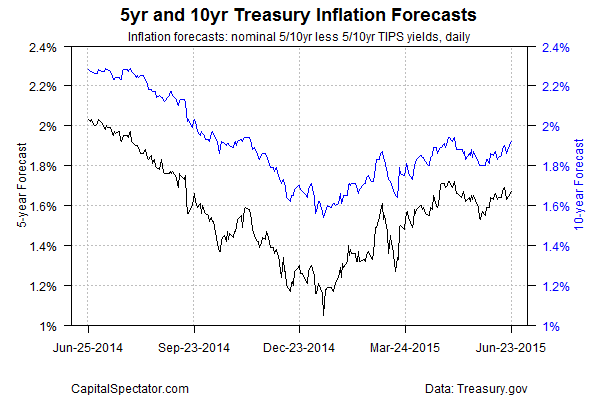

Meanwhile, the Treasury market is still anticipating that inflation will continue to firm in the foreseeable future, based on the implied forecast via the yield spread on the nominal 10-year less its inflation-indexed counterpart. Note that the 10-year spread is still trending higher, touching 1.92% yesterday (June 23)—close to the recent high of 1.94% and within shouting distance of the Fed’s 2% inflation target.

The labor market remains the leading source of optimism for thinking that the US economy will deliver stronger growth in the months ahead. The solid rise in payrolls in May, combined with the bullish signal via jobless claims, certainly paint an upbeat profile. The manufacturing sector is softer these days, although reviewing the macro trend across a broad spectrum of indicators suggests that modest growth still describes the big picture for the US through last month. This week’s update of the Chicago Fed National Activity Index, for instance, reflects an economic expansion that’s running just below the historical-trend rate through last month.

The question is how the June data will compare? An early clue arrived in yesterday’s survey data for manufacturing via Markit’s PMI numbers. The overall trend in this sector is still positive but showing signs of deceleration. The headline index reflected the slowest growth since Oct. 2013. On the other hand, the data for new orders and payrolls ticked higher in June, suggesting that moderate growth is still a reasonable forecast.

For now, the Treasury market is inclined to agree.

Pingback: Treasury Market Expecting Interest Rate Hike