The US stock market continued to climb out of a hole yesterday. The S&P 500 closed at its highest level so far this year. Yesterday’s rise comes a day after the Federal Reserve decided to hold off on rate hikes, citing increased macro risks–here and abroad. But if equities are reacting positively to revived expectations for keeping interest rates lower for longer, is the commensurate rise in the Treasury market’s inflation forecast a potential spoiler for the newly minted party in the stock market?

The Treasury market’s 10-year inflation estimate—based on the 10-year nominal yield less its inflation-indexed counterpart—is holding near a three-month high of 1.57% (as of Mar. 17) via daily data from Treasury.gov. The implied inflation forecast via the 5-year maturities is even firmer, ticking up to 1.46% yesterday—the highest since last summer.

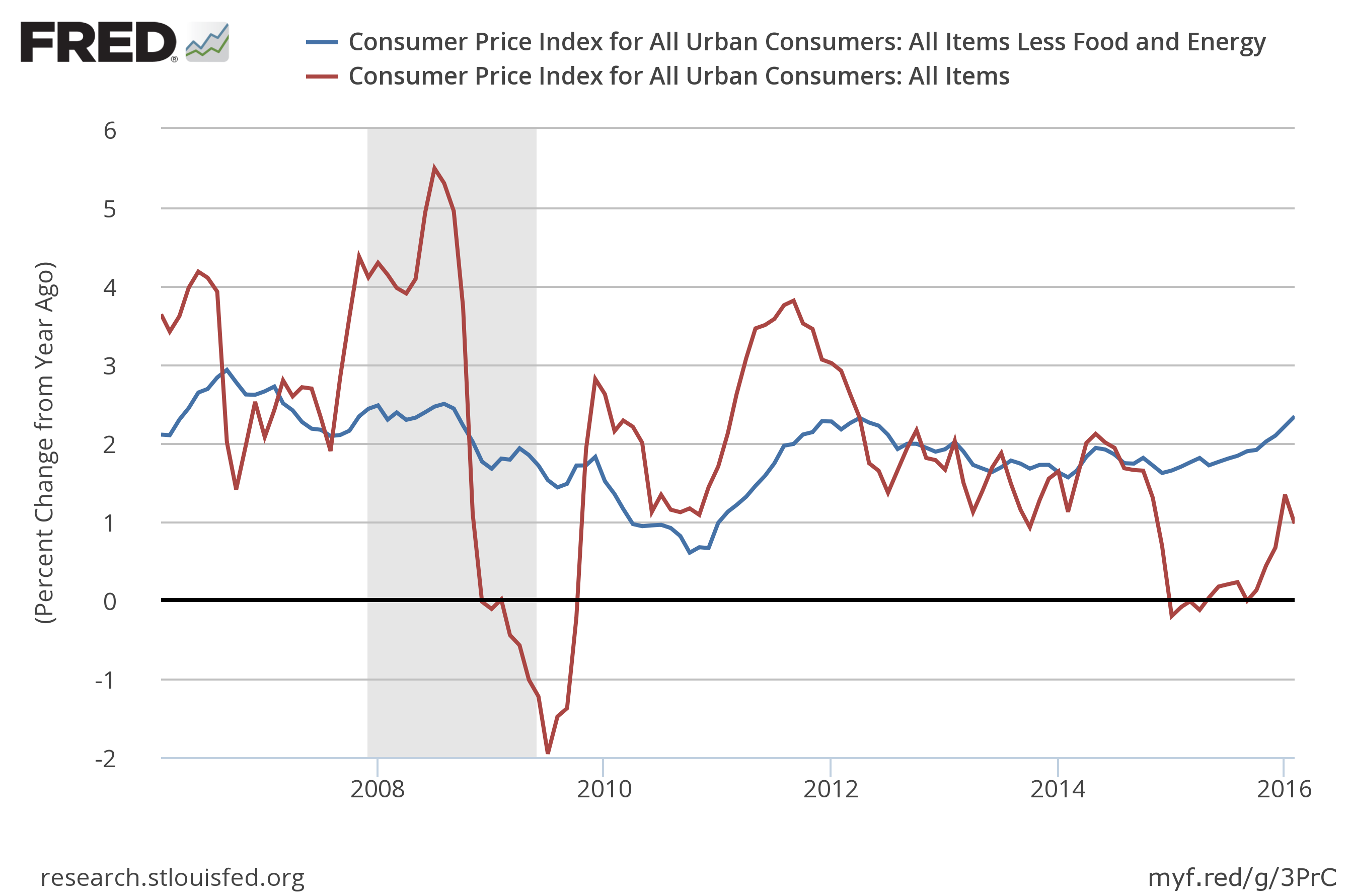

It’s no surprise that the market’s pricing in higher inflation expectations… again. Earlier this week the government reported that core consumer inflation—prices excluding energy and food—inched up to a 2.31% annual pace in February, marking the highest increase in nearly eight years (blue line in chart below). Headline inflation is still weak, running at around 1% on a year-over-year basis (red line). But if core CPI’s track record as a relatively reliable predictor of headline inflation holds up, pricing pressures are set to trend even higher in the months ahead.

“There’s absolutely no denying that there are inflationary pressures,” Tom Porcelli, chief U.S. economist at RBC Capital Markets, told Bloomberg on Wednesday—the day before the central bank’s monetary announcement. “The Fed can no longer be dismissive on inflation. They’re going to have to raise their inflation forecast.”

Perhaps, but the outlook for inflation in Thursday’s updated macro outlook from the Fed revealed a slightly lower forecast for personal consumption expenditures (PCE) inflation on a headline basis for this year and in 2017. For instance, the median forecast for headline PCE inflation is on track to rise 1.2% in 2016, down from the December’s 1.6% estimate.

Fed Chair Janet Yellen, speaking at Thursday’s press conference, suggested that the recent rise in inflation pressures may be transitory. “Core inflation (which excludes energy and food prices) has also picked up, although it remains to be seen if this firming will be sustained,” she said, according to the transcript. “In particular, the earlier declines in energy prices and appreciation of the dollar could well continue to weigh on overall consumer prices.”

The Treasury market, by contrast, is raising its implied inflation outlook. What’s more, the stock market is fine with that view. As you can see in the chart below, the S&P 500’s recent rally has been tightly correlated with the Treasury market’s rising inflation forecast. It’s been a roller coaster for the year overall, with equities tumbling when inflation expectations collapsed to seven-year lows at one point last month. But the sharp reversal in recent weeks in expected pricing pressure has been accompanied by a hefty rise in the S&P 500 off the mid-February lows.

The question is how long will higher inflation expectations inspire the equity bulls? At some point, higher inflation will force the Fed’s hand and unleash a new round of rate hikes. Assuming, of course, that economic growth holds up. Otherwise, we’re talking about stagflation—higher inflation without a commensurate increase in output. Putting that possibility aside for now, let’s assume that modest growth endures and inflation creeps higher. At what point will equity optimists rethink the case for raising stock prices in line with firming inflation?

There’s probably still room to run on that front, courtesy of the still-low inflation data. But core CPI has been running above the Fed’s 2% target for three months and there appears to be a modest but persistent upside tailwind blowing. Is this another head fake—or an early sign of regime change?

No one knows the answer at this point, but if inflation continues to surprise on the upside there may be a new round of volatility lurking in the near-term future. As Northern Trust economist Carl Tannenbaum noted earlier this week, “if we got to a point where the Fed had to raise [rates] quickly, it could be very destabilizing.”

It appears equity markets like moderate inflation. Too low usually means the economy is slow, while too high usually means the Fed will tighten. That’s why an uptick from very low levels leads equities higher and too much leads them lower.

There are also issues relating to businesses ability to pass along higher costs and the effect discount rates have on equity prices, which complicate things, but the basic story usually holds

Pingback: Stock Market Goes Up on Thursday