Earning a respectable investment is hard. Holding it on to it is even harder, according to a variety of studies over the years that have analyzed the portfolios that investor build and own. The news is at once disturbing and baffling. Disturbing because a large population of individuals have earned painfully low returns over long stretches of time; baffling because the solution to climbing out of the performance hole is ridiculously easy… in theory.

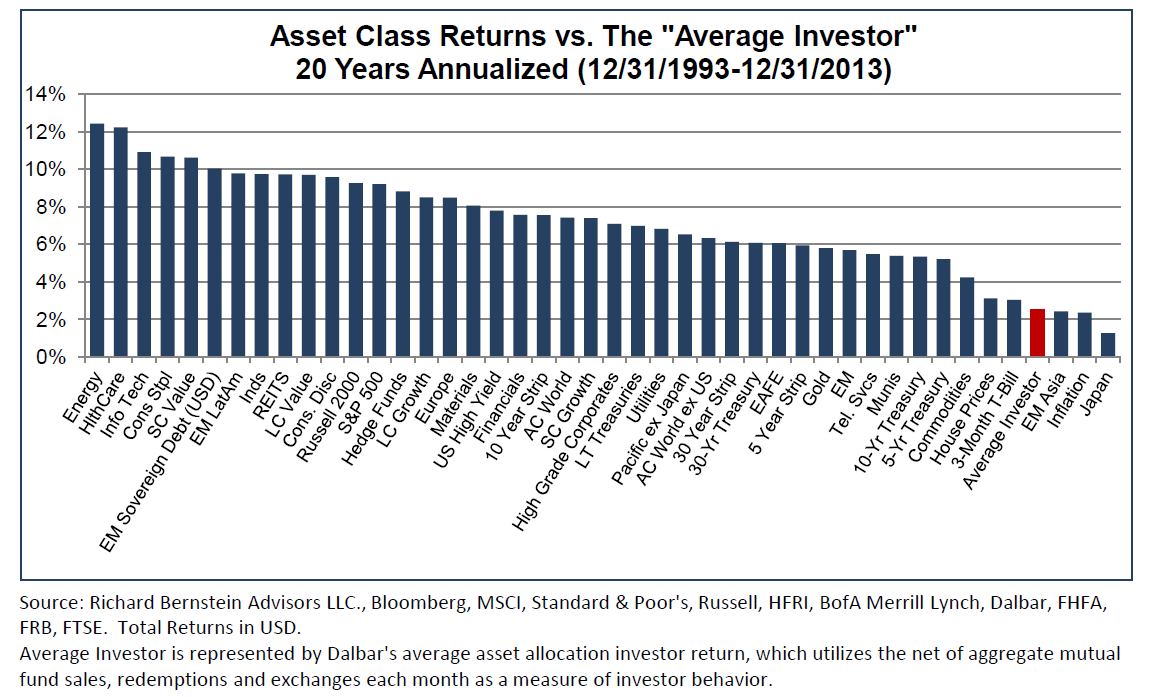

But first let’s consider the problem: disappointing results… shockingly so, according to Richard Bernstein Advisors (RBA). Measuring performance over the trailing 20-year period through the end of 2013, RBA reports that the “average investor” underperformed cash (3-month T-bill). As the chart below suggests, this isn’t about a lack of opportunity—most of the returns across a spectrum of asset classes delivered higher returns, in many cases by a wide margin.

Barry Ritholtz rightly observes that “people are obviously doing something wrong, very wrong, with their investment dollars.” Unfortunately, this is an old problem. Morningstar’s estimate of investor return, which “measures how the average investor fared in a fund over a period of time”, routinely quantifies what the chart above summarizes: individuals are making poor choices in matters of portfolio design and/or management. The price tag , by Morningstar’s reckoning, is that “investors are losing about 2.5% per year to poor market-timing decisions” (as detailed in the next chart).

One solution is to hold a portfolio that’s professionally managed and specifically designed to capture a cross section of risk premia through time. A solid example is the Vanguard STAR fund (VGSTX), a multi-asset class fund of funds that’s earned an annualized total return of roughly 9.8% since inception (1985). With a low expense ratio (0.34%) and respectable risk-adjusted results (the trailing 15-year Sharpe ratio is a decent 0.51), this managed asset allocation fund is a reminder that earning a sizable risk premium doesn’t have to be complicated or pricey.

The STAR fund doesn’t have a monopoly on encouraging results. There are a number of multi-asset class funds that also compare favorably over a decade or more. You could just as easily hire a financial advisor to do the heavy lifting. For most folks, such advice is almost certainly the key to breaking free of the average-investor curse. The reasoning is less about the markets per se vs. the demons within.

A new study (“Deciding for Others Reduces Loss Aversion”) that analyzes the problem makes a strong case for outsourcing some or all of your portfolio management decisions. “We find that deciding for others reduces loss aversion,” two economists advise. The key issue, not surprisingly, is all risk.

When choosing between risky prospects for which losses are ruled out by design, subjects make the same choices for themselves as for others. In contrast, when losses are possible, we find that the two types of choices differ. In particular, we find that subjects who make choices for themselves take less risk than those who decide for others when losses loom. This finding is consistent with an interpretation of loss aversion as a bias in decision making driven by emotions and that these emotions are reduced when making decisions for others.

It’s old news that behavioral complications (loss aversion being just one of many) have a habit of derailing the best laid plans of investors. Avoiding the worst-case scenario isn’t terribly complicated, but it does require some disciplined thinking. It’s easier to farm out the work to others (assuming a competent advisor or fund).

For those who prefer to do it themselves, the hurdle is higher but not dramatically so, at least not in theory. The foundation is developing a deep understanding of market history and drawing up an informed strategy that has a reasonably good chance of success. The problem, I suspect, for many do-it-yourselfers is that they spend too little time crunching the numbers. Backtesting is a dirty word in some circles, but it’s enormously valuable if only to avoid the all-too-common problem of investing based on intuition and emotion without studying how the strategy would have performed in years past.

Quite a lot of problems can easily be avoided if investors follow a simple rule: backtest the strategy before funding it with real money. It’s enormously important to have a sense of how a strategy performed in history—in terms of risk as well as performance. Why? Because quite a lot of what passes for enlightened investing has a hard time passing the smell test once you get into the details.

We shouldn’t be slaves to history. But as a first step for separating the strategic wheat from the chaff backtesting is essential. It’s also a powerful for tool for enlightenment. If you translate “good ideas” into code and study the results, a common theme emerges: it’s tough to beat the market, either within asset classes or in a multi-asset class framework, especially after adjusting for risk, market frictions and taxes.

Even matching the market (or a reasonable asset allocation benchmark) has been out of reach for many (most?) investors. The diagnosis applies to institutional investors as well. Perhaps this is simply the natural order. Indeed, a key reason why a minority of investors (institutional or otherwise) can earn stellar returns is because mediocrity or worse otherwise dominates.

Moving from the crowd to the minority isn’t rocket science, but it requires something that’s much tougher for the average investor to grasp: business as usual is a losing proposition.

Pingback: 01/29/2015 - Thursday Reading - Compound Interest Rocks!Compound Interest Rocks!