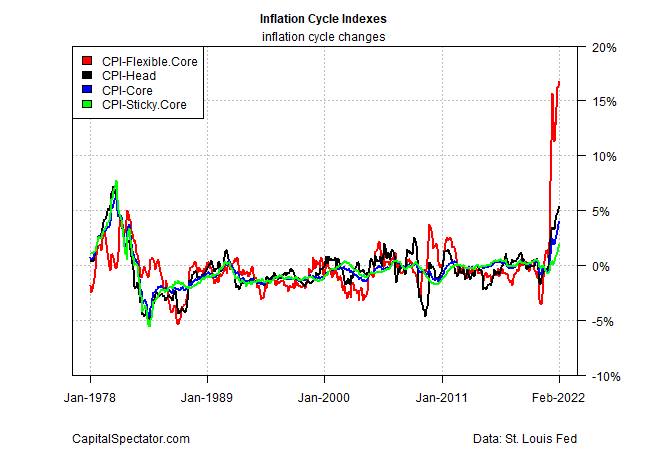

We already know that the recent inflation surge is still accelerating, and that it’s likely to heat up further in the months ahead as effects from the Ukraine war begin to factor into the data. One question that comes up is whether some or most of this pricing pressure is noise or signal? For some perspective, let’s estimate the inflation “cycle,” based on a simple estimate that attempts to capture the longer-term ebb and flow of inflation.

The idea here is to minimize recent data and emphasize the so-called cycle. A recent paper from Research Affiliates proposes one methodology: taking the current inflation rate and subtracting a “smooth” 10-year average, based on an exponential moving average. The goal is to reduce some of the noise in search of the cyclical component signal.

In this simple review I expanded the cyclical application to four measures of US consumer prices for a bit more context:

- Headline CPI

- Core CPI (less food and energy)

- Sticky CPI, which measures goods and services that change price relatively infrequently.

- Flexible CPI, which measures goods and services that change price relatively frequently.

The main takeaway: the inflation cycle is the hottest in more than forty years. Indeed, all four measures indicate that pricing pressure cycle has accelerated well above what’s been seen in recent decades.

In other words, the recent inflation surge appears to be driven by an unusually strong cyclical component. Cyclical inflation doesn’t last forever, but it can linger. In the previously strong cyclical upswing in the late-1970s it took several years before the cycle peaked. It’s unclear if that applies this time, but it’s too early to rule it out.

It’s a timely topic, of course, ahead of tomorrow’s policy statement (Wed., Mar. 16) from the Federal Reserve. Markets are keenly waiting to learn how Fed Chair Jerome Powell will react to recent inflation run. The consensus forecast, not surprisingly, expects an interest rate hike, the first of many, analysts predict.

Meanwhile, comparisons with the early 1980s are top of mind. Forty years ago, when Paul Volcker ran the Fed, he applied a potent hawkish policy regime of sharp rate hikes to break inflation, a policy shift that was a factor in triggering an economic recession.

“I knew Paul Volcker,” Powell said during in his latest congressional testimony. “I think he was one of the great public servants of the era — the greatest economic public servant of the era.”

Markets are now waiting to learn if Powell will also act like Volcker and, if he does, will economic business-cycle history repeat, rhyme or set a new precedent in some way? The answer will take months, but it starts with tomorrow’s Fed announcement.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report