Portfolio design and management tends to fare best when the rules and structure are relatively simple. But there are limits and so deciding on the degree of simplicity can be a gray area, depending on your definition of “simple” and “complicated,” along with expectations and investment goals. The debate on how far to go with simplicity inspires a fresh look at what I call the hierarchy of decisions in the process of building and managing portfolios through time.

Let’s start with the basics, namely: portfolio structure and rebalancing. These two components are the main components of nearly every strategy. Simply put, what will you own and how often will you adjust the portfolio in one way or another relative to its previous state?

Everything flows from these questions. There are other aspects, of course, but asset allocation and rebalancing are critical variables and it’s hard if not impossible to succeed in investing over any length of time without intelligently dealing with these decisions. Together or separately they often determine the lion’s share of investment results through time.

The question before the house is how simplicity and complexity interact with asset allocation and rebalancing? To explore the answers in a series of posts, it’s useful to begin at the beginning with the simplest possible portfolio: holding one security indefinitely.

In this setup, there’s just one decision: Which security to buy? Imagine that we choose an S&P 500 Index fund – SPDR S&P 500 (SPY), for instance. In that case, we buy and hold SPY on an infinite-horizon basis and we’re done. It doesn’t get any simpler than that. (For purposes of our discussion, we’ll assume that there are no future investments.)

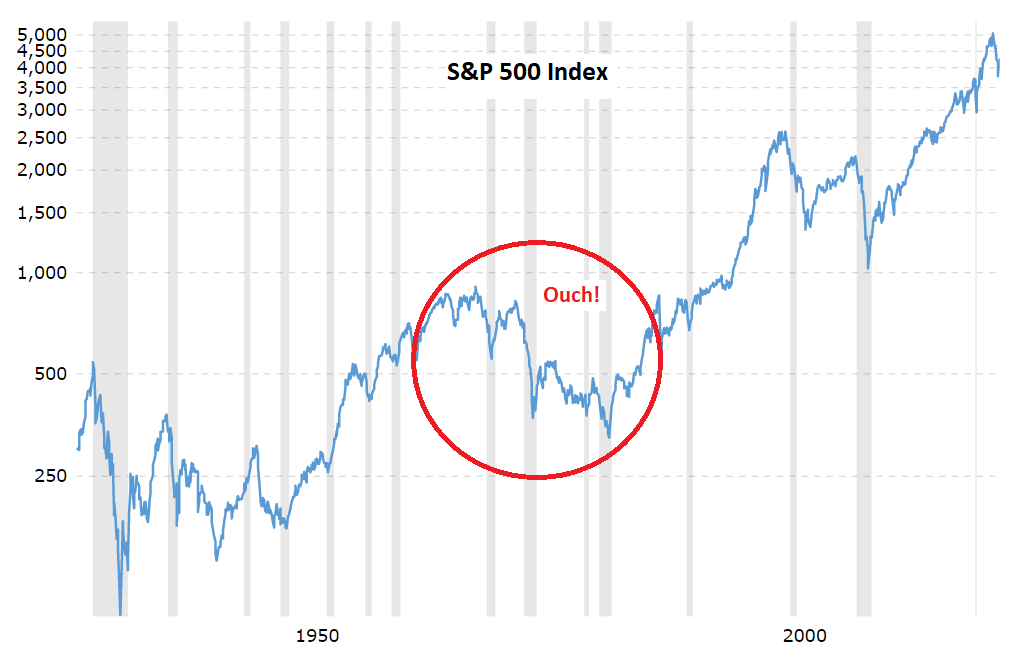

Holding one security and letting it ride is minimalism in the extreme. If the goal is solely about making portfolio design and management simple, our mission is accomplished. As it happens, this choice has fared quite well. Investing in SPDR S&P 500 (SPY) at the start of 1993 has reaped a nearly 1,600% return! Maximum simplicity, it appears, is a blow-out winner.

But appearances can be deceiving, and that surely applies here. History may rhyme, but it doesn’t necessarily repeat, at least not always on a timetable that’s convenient for your investing goals. Mindlessly pursuing simplicity to the extreme in portfolio design is probably a recipe for trouble at some point. After all, you’re betting the farm on one decision. If it’s wrong, you’re cooked.

Skeptics might counter that a one-decision, buy-and-hold portfolio tends to work wonders with US stocks. History, after all, speaks clearly on this point. True, but there are several caveats to consider, starting with the empirical fact that even US equities can remain in a trading range for long periods of time. There are also examples of the S&P 500 losing money over a 20-year period: 1965-1985.

Uncertainty about the future, in other words, should keep as wary about one-decision portfolio strategies. That’s another way of saying that we need asset allocation and rebalancing. Not because they’re going to make investing easy or automatically deliver stellar returns for all time periods ex ante. Poor decisions with asset allocation and rebalancing can still be quite painful. But our first line of defense against market uncertainty and things that go bump in the night requires moving beyond the simplest portfolio – even one that’s delivered magnificent results over the long-term in the past.

The bottom line: simplicity alone is imprudent. Why? Because it doesn’t factor in the critical aspect of risk management, which is always and forever essential in portfolio design. In other words, we need a bit of complexity. The art of portfolio design is deciding on the degree and structure of that complexity.

In sum, how should we intelligently move beyond a simple one-decision/one-security portfolio? Exploring the process of decision-making is the agenda ahead for the upcoming installments in this series. Meantime, this essay’s main takeaway can be reduced to the Einstein quote, which is probably apocryphal: “Everything should be made as simple as possible, but no simpler.”

The quote may be misattributed, but reportedly it’s an attempt to summarize a line from a 1933 lecture by Einstein: “It can scarcely be denied that the supreme goal of all theory is to make the irreducible basic elements as simple and as few as possible without having to surrender the adequate representation of a single datum of experience.”

That leaves us with the key question: How to utilize asset allocation and rebalancing to maximize return and minimize risk? There are no flawless answers and there are many pitfalls. But there are also some obvious paths to consider, which we’ll explore in the next step in evaluating the hierarchy of portfolio decisions.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno