Yesterday’s update of the Federal Reserve’s quarterly economic forecast is a minor triumph for optimism. The central bank still expects that US GDP in 2015 will increase in the range of 2.6% to 3.0%, unchanged from its previous estimate in September. That’s a mild expansion, but it’s a step up from the Fed’s 2.3%-to-2.4% GDP outlook for this year. In a word, progress. Forecasting year-ahead GDP is subject to any number of risks, of course, and so it’s best to take the Fed’s prediction with a grain of salt. Yet it’s clear that the bank’s policymakers are becoming more confident that the US economic expansion will strengthen a bit in the year ahead. Events abroad may intervene and render the current outlook null and void, but based on what we know today the US macro trend is on track to start the new year with a moderately improving tailwind.

Reflecting the optimism, Fed chair Janet Yellen said in yesterday’s press conference that the market’s recent expectations for a mid-2015 rate hike remain valid. The end is near for the near-zero policy for the Fed funds rate. Some analysts have been speculating lately that the central bank would delay the rate hike due to increased geopolitical risks and a wobbly global economy ex-US. But Yellen effectively told the crowd that the game plan is still intact for the first rate hike in six months, give or take .

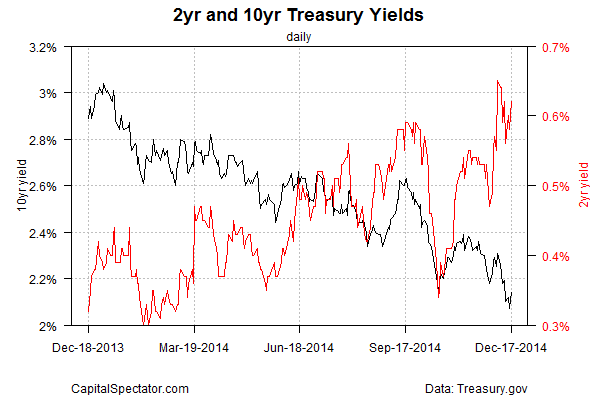

The market reacted accordingly. The yield on the 2-year Treasury — widely viewed as the most sensitive spot on the yield curve with regards to rate expectations – rose moderately to 0.62% yesterday, which is close to a three-year high. The 10-year yield also rose, suggesting that the year-long slide for this influential benchmark rate may have bottomed out.

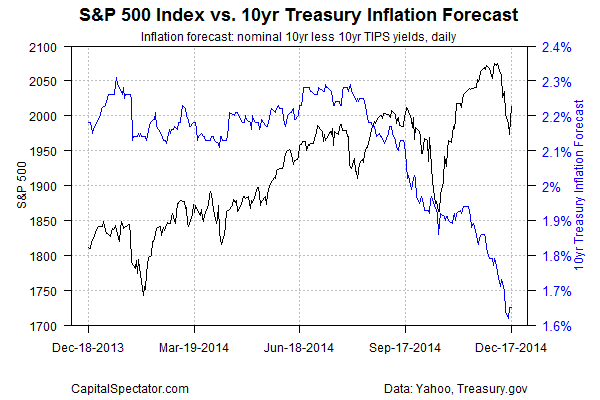

Nonetheless, it’s premature to assume that the Fed’s plans for tightening in mid-2015 are written in stone. Reflecting the still-cautious outlook, the market’s implied inflation forecast, based on the nominal 10-year yield less the yield for the 10-year TIPS, remained unchanged yesterday at 1.65%, which is near a four-year low. It’s reasonable to argue that the Treasury’s market’s expectation for low/declining inflation is primarily driven by offshore concerns. Nonetheless, the US isn’t completely immune to the disinflation/deflation bias that’s stalking the global economy, a hazard that’s especially conspicuous in the Eurozone and Japan.

The comparatively upbeat trend in the US provides a substantial defense, but much depends on how hard the D-risk winds will blow in the months ahead. “These are uncertain times again and there is a risk of another global downturn,” Stephen Webster, chief European economist at 4CAST, noted earlier this week.

True, although the recent improvement in estimates for Eurozone GDP offers a glimmer of hope. Now-casting.com’s latest forecast (Dec. 12) sees a 0.1% rise in Q4 GDP for the countries that share the euro. That’s still a slim gain, but the revisions in recent weeks have been inching higher and so the current estimate compares favorably with the late-October/early November projections for a mild contraction in Q4. This week’s December update of business survey data from Markit Economics also finds a bit of progress in Europe’s economic trend as the year comes to a close.

Another tentative sign that the worst for Europe’s macro troubles may have passed: business confidence in Germany seems to be reviving after tumbling in previous months, according to today’s December update of the Ifo Business Climate Index. “Dropping oil prices and a falling euro exchange rate are seasonal gifts to the German economy,” Hans-Werner Sinn, president of the Munich-based Ifo Institute, said in a news release. The Ifo report follows a similarly upbeat improvement in the mood for Europe’s biggest economy via Tuesday’s update of the ZEW Indicator of Economic Sentiment. “Confidence in the German economy seems to be slowly returning among the financial market experts surveyed by ZEW,” the Center for European Economic Research said earlier this week.

It’s premature to argue that Europe has turned a corner, but it’s getting easier to assume that maybe, just maybe, the Continent’s economic deterioration isn’t getting any worse. The threat of stagnation remains a real and present danger for the Eurozone. But if the trend is stabilizing, the change will boost the odds slightly that the US can keep its expansion rolling forward in the new year.

Pingback: U.S. Macro Trend on Track for Moderate Growth