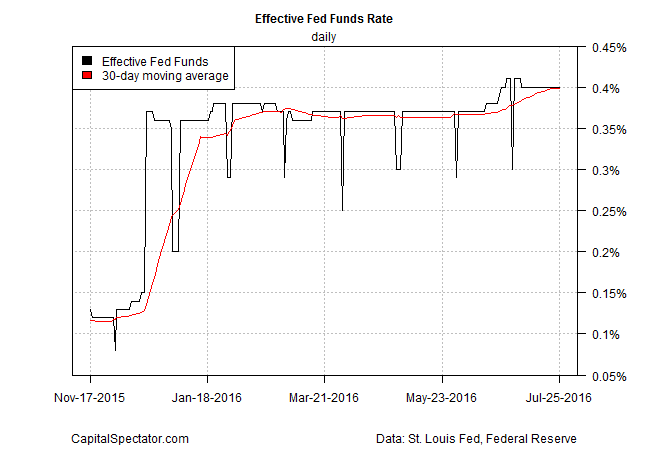

The Federal Reserve is expected to forgo a rate hike in today’s FOMC policy announcement and keep the target Fed funds at a 0.25%-to-0.50% range. But the recent increase in the effective Fed funds rate (EFF) suggests that a hawkish bias is bubbling.

EFF’s day-to-day changes can be volatile, but the 30-day average does a reasonable job of capturing the trend, which is inching higher again. In fact, EFF’s 30-day average has increased to just a whisker below 0.40% in recent days. From the perspective of the post-2008 era, it’s tempting to argue that nothing’s changed. Indeed, you still need a microscope to see the difference between the current EFF vs. the level before the Fed raised rates last December. But at a time when interest rates generally are at or near record lows, even subtle changes carry import in the search for evidence of regime change. With that in mind, consider that the 30-day average EFF has crawled up in recent days to the highest mark since late-2008–conspicuously above the range that’s prevailed previously this year.

Is the upward bias in EFF’s 30-day average of late a sign that that the Fed is again laying the ground for a rate hike? Let’s consider some other indicators for perspective, starting with the year-over-year percentage change in the real (inflation-adjusted) monetary base via data from the St. Louis Fed. Note that the annual pace has been negative in recent months, suggesting that Fed policy has been comparatively tight on this front for much of the year so far. In other words, the central bank has been squeezing policy for the first time since 2012, according to this metric. That alone doesn’t insure that a rate hike is fate, but it suggests that a hawkish change is a bit more likely.

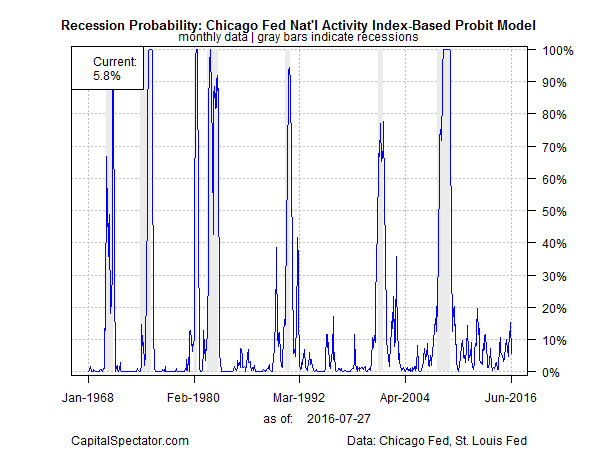

Meanwhile, the broad trend in the economy, despite wobbles earlier in the year, still looks poised for moderate growth. Consider the 3-month average of the Chicago Fed National Activity Index. Using last week’s June update as a guide, recession risk is low. It’s debatable if the forward momentum is strong enough to warrant another round of policy tightening, but there’s minimal support in the data for arguing that a rate hike is premature because the economy’s sliding over to the dark side of the business cycle.

This Friday’s “advance” second-quarter GDP report is expected to provide more evidence that the sharp deceleration in growth in early 2016 was an aberration. As I discussed yesterday, a stronger growth rate is widely expected among analysts for Q2—2%-plus vs. the weak 1.1% gain in Q1.

Inflation is a mixed bag at the moment, although the last round of updates hints at a firmer trend. Although the headline consumer price index’s 1.0% year-over-year rise is still weak, “recent inflation reports suggest the Fed is on track to meeting its 2 percent target,” advises Tim Duy, an economist at the University of Oregon.

The Fed’s preferred measure of inflation registered about 2 percent or greater on an annualized basis in four of the last five readings. At this rate, it is reasonable to expect year-over-year core inflation to hit the target 2 percent by the end of 2016.

Does all this add up to an overwhelming case for the Fed to pull the trigger today? Probably not, or so the crowd is telling us. Fed funds futures are pricing in a 98% probability of no change in policy in today’s announcement, based on CME data as of July 26.

But as Alan Ruskin, a macro strategist at Deutsche Bank, observes: “The Fed could not have wished for a more benign financial market, international event and data backdrop than they have right now. It begs the question, in a volatile world will ‘the ducks’ ever align so perfectly for a tightening again?”

Pingback: Rate Hike Not Likely Today - TradingGods.net