Fed Vice Chairman Stanley Fischer over the weekend laid out the rationale for raising US interest rates in the near future, perhaps as early as next month. His reasoning boils down to two main arguments. One, “the economy has continued to recover and the labor market is approaching our maximum employment objective.” Meanwhile, inflation is still low—“persistently below” the Fed’s 2% target, he recognized in a speech on Saturday. But that won’t last, he explained, advising that “there is good reason to believe that inflation will move higher as the forces holding down inflation dissipate further.”

Encouraging numbers on the economy generally and the labor market in particular of late arguably support the case for tighter monetary policy. But inflation isn’t playing along, at least not so far. But to think like a central banker, it’s essential to limit one’s view of the world by looking into the rear-view mirror, Fischer reasoned. As such, his expectation that pricing pressures will soon strengthen is critical for making the case for a rate hike. Why not wait until the evidence is overwhelmingly clear? Because, he explained,

monetary policy influences real activity with a substantial lag [and so] we should not wait until inflation is back to 2 percent to begin tightening. Should we judge at some point in time that the economy is threatening to overheat, we will have to move appropriately rapidly to deal with that threat. The same is true should the economy unexpectedly weaken.

In any case, Fischer was careful to point out that the timing of the first rate hike since 2006 remains an open question. The next and perhaps last major data point that could influence if the Fed will start squeezing rates at its Sep. 16-17 policy meeting is this Friday’s employment report.

The average monthly rise of 235,000 for nonfarm payrolls through July is “well above the amount needed to continue the strengthening of the labor market,” Fischer said in his Saturday speech. Based on Econoday.com’s consensus forecast, the headline data for the August payrolls is on track to increase by 223,000, which is also the implied three-month average through this month. In other words, not much is expected to change on the employment front, which means that Fischer’s evaluation that labor market conditions are improving will likely remain intact, or so it seems.

In that case, the key unknown is inflation. The next major release on this front is the August report on consumer prices, scheduled for the morning of Sep. 16—the first day of the Fed’s two-day policy meeting.

It’s unclear at this stage if the August Consumer Price Index (CPI) data will support Fischer’s outlook for a firming in pricing pressure. As for the published numbers through July, there’s a hint that headline CPI’s annual rate is inching higher after a run of flat to mildly negative year-over-year comparisons in recent months. Even so, the 0.2% annual rise in headline CPI through July is hardly supportive of tighter monetary policy.

On the other hand, core CPI (less energy and food) is considerably higher, rising 1.8% for the 12 months through July. That’s close to the highest rate in recent years. It’s also worth noting that the core rate of just below 2% has been stable in recent months, holding fast to a 1.7%-to-1.8% range since March.

Core inflation is widely considered by economists to be a more reliable estimate of where inflation is headed. Headline inflation, by contrast, tends to be minimized in central banking as a forward-looking measure, largely because it includes the volatile energy component, a variable over which the Fed has little if any influence. No wonder, then, that Fischer minimized the relevance of energy’s disinflationary trend of late.

The past year’s energy price declines ought to be largely a one-off event. That is, while futures markets suggest that the level of oil prices is expected to remain well below levels seen last summer, markets do not expect oil prices to fall further, so their influence in holding down inflation should be temporary.

The bottom line, Fischer emphasized:

Given the apparent stability of inflation expectations, there is good reason to believe that inflation will move higher as the forces holding down inflation dissipate further.

Rest assured that the crowd will be looking for the supporting evidence (or the lack thereof) in the Sep. 16 inflation update. Meantime, the Treasury market’s implied inflation forecast is at least moving in a direction that supports Fischer’s outlook for firmer pricing. The 10-year inflation estimate (based on the yield spread for the nominal 10-year Note less its inflation-indexed counterpart) has been ticking higher in recent sessions, rising to 1.60% on Friday, based on Treasury.gov’s daily data. Of course, the incremental bounce follows the slide that pushed the inflation forecast to a five-year low of 1.49% on Aug. 24. The fact that Mr. Market’s inflation forecast has rebounded a bit is, at this point, a thin reed for arguing that there’s widespread agreement that pricing pressures are reviving.

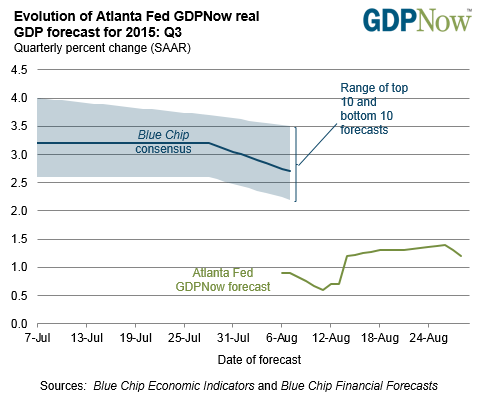

In short, Fischer’s thesis that inflation will provide stronger support for hiking rates is a work in progress. But it doesn’t help Fischer’s narrative to see that the Atlanta Fed’s GDPNow estimate for third-quarter growth slipped to 1.2% in Friday’s update—sharply below Q2 GDP’s 3.7% rise.

If economic growth is decelerating, stronger inflation may be unwelcome news. In other words, be careful what you wish for, Mr. Fischer.

Stronger pricing pressure will be productive if–if–economic growth is bubbling along at 3%-plus. But higher inflation while GDP’s pace is decelerating towards 1% implies a different monetary story than the tale that Fischer’s been telling.

But let’s not rush to judgment just yet. It’s too soon to be taking Q3 GDP estimates as the last word on what’s coming. There’s still a long road of data ahead between today and Oct. 29, when the government publishes its first official GDP estimate for the third quarter.

Meanwhile, this much is clear: based on the data available today, the case for hiking rates still looks wobbly. Fischer, to his credit, didn’t commit himself one way or the other. That doesn’t mean the Fed won’t pull the trigger next month. But to the extent that the central bank is looking for convincing data to support tighter policy in mid-September, the stakes are high for seeing hefty upside surprises in the next round of economic reports.