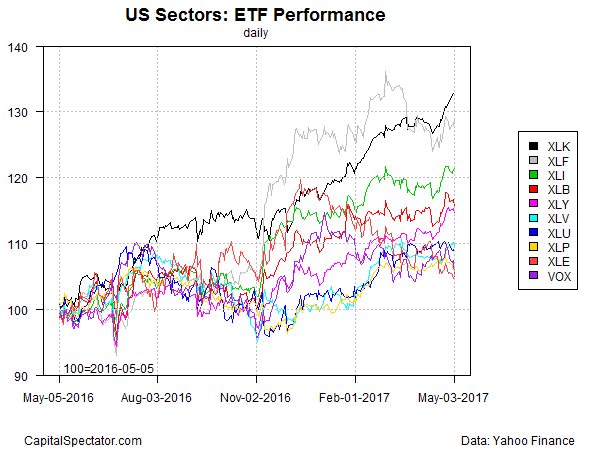

Technology shares have taken the lead over stumbling financials in the one-year-return column, based on a set of proxy ETFs as of yesterday (May 3, 2017). Although financials are still sitting on a solid one-year gain, tech’s annual rise has moved decisively into first place among the major US equity sectors in recent days.

The ascendance of technology shares to the top spot for year-over-year performance marks the first time since last autumn that this corner of the market is leading in the sector horse race. Technology Select Sector SPDR (XLK) is currently posting a 32.6% total return for the trailing one-year window (252 trading days), comfortably above the 29.0% one-year gain for Financial Select Sector SPDR (XLF).

The broad market continues to post strong results for the past year as well, although well below the tech’s gain. SPDR S&P 500 (SPY) is ahead by 18.1% over the past 12 months. Although that pales next tech’s rise, SPY’s one-year return is more than double the stock market’s long-term performance.

The recent leadership change in favor of tech can be seen in the chart below as XLK (black line at top) overcomes XLF (gray line).

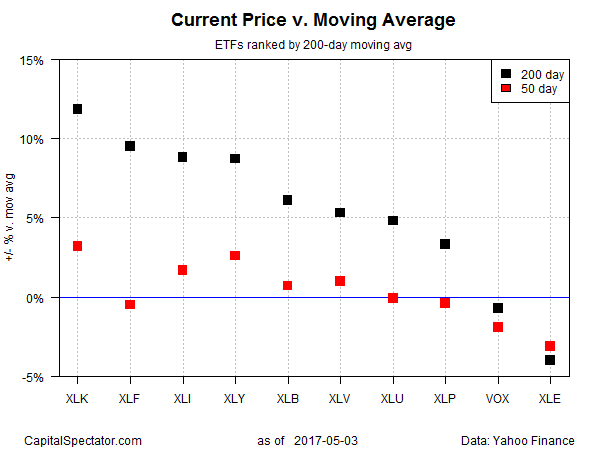

Tech’s top-ranking performance is also visible from the vantage of moving averages. For instance, XLK’s price is currently posting the highest premium over its 50- and 200-day moving averages compared with the rest of the field. (Note that an early clue of the leadership shift in favor of tech was bubbling last month, when XLF’s momentum showed signs of fading vis-a-vis moving averages.)

For additional research on the sector ETFs cited above, here are links to the summary pages at Morningstar.com:

Consumer Discretionary (XLY)

Consumer Staples (XLP)

Energy (XLE)

Financial (XLF)

Healthcare (XLV)

Industrial (XLI)

Materials (XLB)

Technology (XLK)

Utilities (XLU)

Telecom (VOX)

Pingback: Technology Shares Take the Lead Over Financials - TradingGods.net