There are many reasons to question a bullish outlook at the start of the year, but the gravity-defying trend remains intact overall, based on a set of ETF pairs that track global asset allocation strategies through Friday’s close (Jan. 3). The analysis turns mixed, however, when analyzing markets on a more granular level.

From a global top-down perspective, the bullish trend still looks solid. Following a modest correction last summer, the ratio for an aggressive mix of global assets (AOA) vs. a conservative counterpart (AOK) continues to trend higher.

The risk appetite for US equities continues to rebound after the summer’s sharp correction, based on the ratio for a broad equities ETF (SPY) vs. a low-volatility portfolio of stocks (USMV).

The caveat: the bullish momentum for equities is increasingly reliant on US shares — stocks ex-US, by comparison, are faltering. Consider, for instance, the bull run in US shares (VTI) relative to stocks in developed markets ex-US (VEA). In recent weeks, the American premium for equities has surged, a trend that’s become extreme lately, as shown by the VTI:VEA ratio.

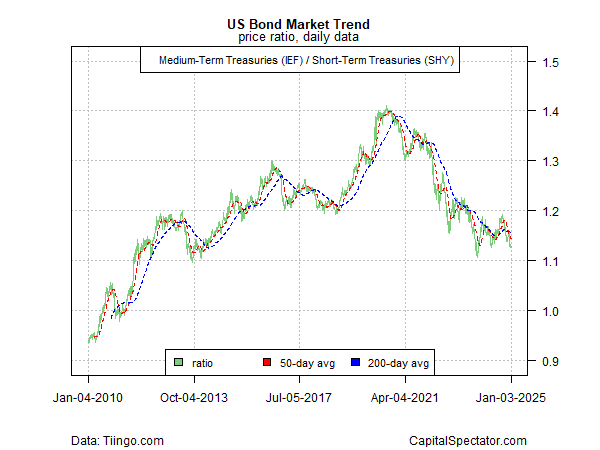

For US bonds, a risk-off trend persists, based on the ratio for medium-term Treasuries (IEF) vs. short-term maturities (SHY). Despite several attempts to recover in recent years, the downside bias has resumed.

The sharp divergence in US stocks (SPY) vs. US bonds overall (BND) tells a similar story: risk-on for equities dominates as fixed-income beta slumps.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno