The appetite for US equity risk has wobbled in recent months, but on the first trading day after Trump’s election victory the bullish signaling revived on several fronts, based on numerous sets of ETF pairs through Wednesday’s close (Nov. 6). The main exception: bonds, which are wilting anew.

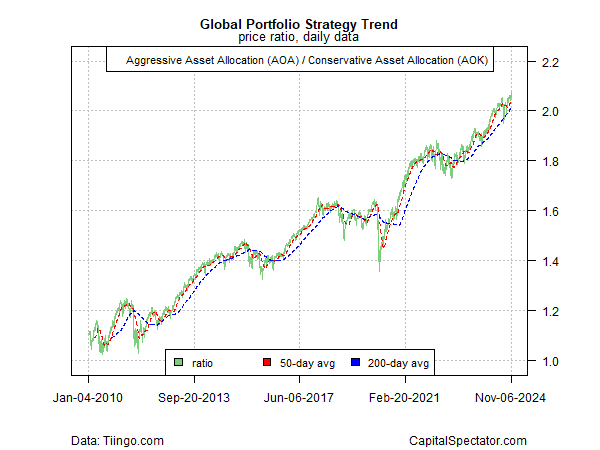

A sentiment proxy for global asset allocation jumped to a record high yesterday. Following weak periods in August and September, the ratio for an aggressive mix of global assets (AOA) vs. a conservative counterpart (AOK) jumped to a new peak, driven by a surge in US stocks. A possible warning: equities ex-US didn’t participate in yesterday’s rally.

The risk appetite for US equities, however, rebounded sharply, based on the ratio for a broad equities ETF (SPY) vs. a low-volatility portfolio of stocks (USMV). Note, however, that this proxy remains below its July peak and so it’s not yet clear if the revival in bullish sentiment is on a sustainable path.

Note, too, that the ratio for semi stocks (SMH) vs. the broad equities US market (SPY) remains in a trading range, which suggests a cautious stance. Semi stocks are a used as a proxy for the business cycle and so the failure for this group to participate in the rally indicates a reason to wonder if the bullish mood for stocks generally can persist.

On the other hand, the ratio for safe-haven utilities (XLU) vs. the broad stock market (SPY) fell sharply on Wednesday – a sign that the appetite for risk remains robust.

The bond market, by contrast, continues to suffer. The ratio for medium-term Treasuries (IEF) vs. short-term maturities (SHY) fell sharply yesterday, dropping to a five-month low. Sentiment has shifted to a risk-off position since September in favor of shorter maturities — a trend that accelerated on Wednesday.

Reviewing a simple US stocks (SPY)/US bonds (BND) ratio continues to show a clear bias in favor of equities. This proxy ripped higher yesterday, rising to a new record high. The message is clear: market sentiment favors stocks over bonds by a hefty degree.