Energy stocks are having a good year, or so it seems by using the usual suspects as a benchmark. Traditional names – Exxon Mobil and Chevron, for example – have posted sharp rallies after suffering in 2020. The wider world for so-called alternative energy, by contrast, is a mixed bag in 2021.

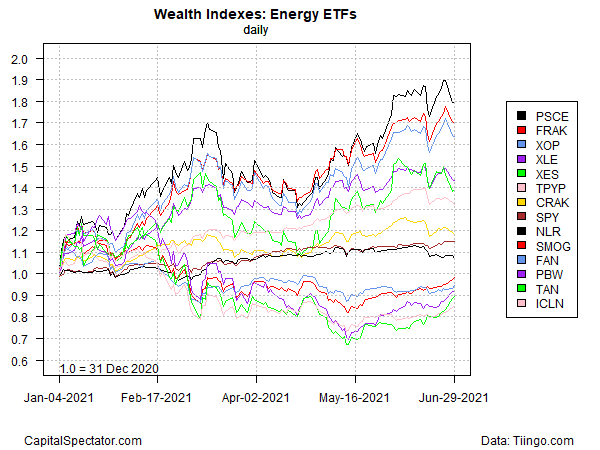

A broad measure of energy shares are posting a wide range of year-to-date performances, based on a set of exchange traded funds tracking several slices of the alternative energy world. (“Alternative” here is defined as companies outside the realm of major oil and gas firms.) On the plus side, Invesco S&P Small Cap Energy (PSCE) is surging. The fund, which holds mostly shares of smaller companies engaged in traditional energy activities, is up nearly 80% year to date through yesterday’s close (June 29).

In second- and third-place: VanEck Vectors Unconventional Oil & Gas (FRAK) and SPDR S&P Oil & Gas Exploration & Production (XOP), respectively.

The top-three have outperformed the energy benchmark — Energy Select Sector SPDR (XLE) – by wide margins so far in 2021. XLE’s holdings are dominated by Exxon, Chevron, ConocoPhillips and other large energy companies. The outperformance is no trivial matter when you consider that XLE, year-to-date, is up a strong 43.3%.

Overall, most energy stocks are posting gains – the main exceptions are found in clean energy industries.

The worst performer on our list: iShares Global Clean Energy (ICLN). After a powerful rally in 2020, ICLN has been retreating this year and is currently down a bit more than 15% in 2021 through yesterday’s close.

Year-to-date losses are found in four other energy funds on our list – ETFs tracking companies focused on solar (TAN), US clean energy (PBW), wind energy (FAN), and renewable energy/low-carbon stocks (SMOG).

Although some corners of green energy stocks are suffering this year, investors still appear willing to bet aggressively on these industries, based on fund flows. The Wall Street Journal this week reports that “Clean Energy ETFs Take a Hit, but Money Keeps Flowing In.”

Here’s a complete listing of the ETFs and tickers cited in the chart above, followed by a table of return correlations of the funds.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno