US real estate investment trusts (REITs) scored a strong gain last week, posting the biggest return among the major asset classes, based on a set of exchange-traded products. Meantime, broadly defined commodities suffered the biggest loss for the shortened trading week through Feb. 24.

Vanguard REIT (VNQ) led the field with a weekly advance of nearly 2.0%. The fund closed on Friday at its highest price since Sep. 30.

The iPath Bloomberg Commodity (DJP) eased for the second week in a row, falling 0.8%. The ETN settled at its lowest weekly close in six weeks.

Prices overall continued to rise last week, based on an ETF-based version of the Global Markets Index (GMI.F). This investable, unmanaged benchmark that holds all the major asset classes in market-value weights increased 0.4% — the fifth straight weekly advance for the index.

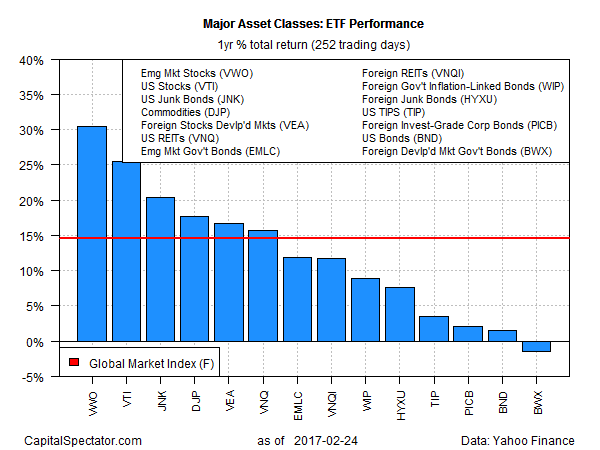

In the one-year column, emerging-market stocks continue to hold the top spot. Vanguard FTSE Emerging Markets (VWO) is up 30.7% on a total-return basis through Feb. 24.

The only loser for the trailing one-year window: foreign government bonds in developed markets (in unhedged US dollar terms). SPDR Bloomberg Barclays International Treasury Bond (BWX) is down 1.5% for the year through Friday.

Meanwhile, GMI.F’s one-year trend remains comfortably in the black, posting a solid 14.6% total return through Feb. 24.